Analyze Order Flow Analyzer, Volume Profile, Time and Sales and Orders with VolSys

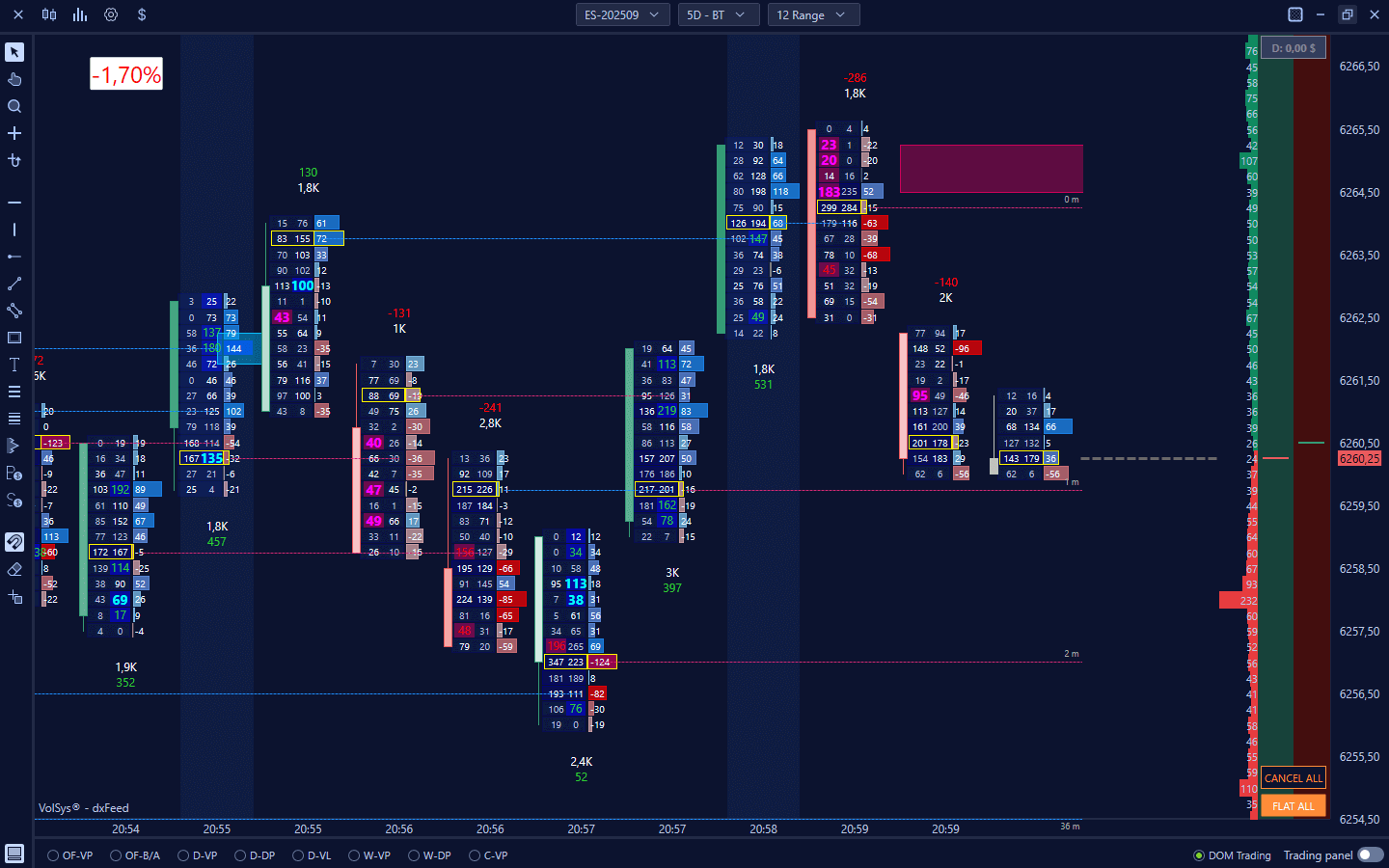

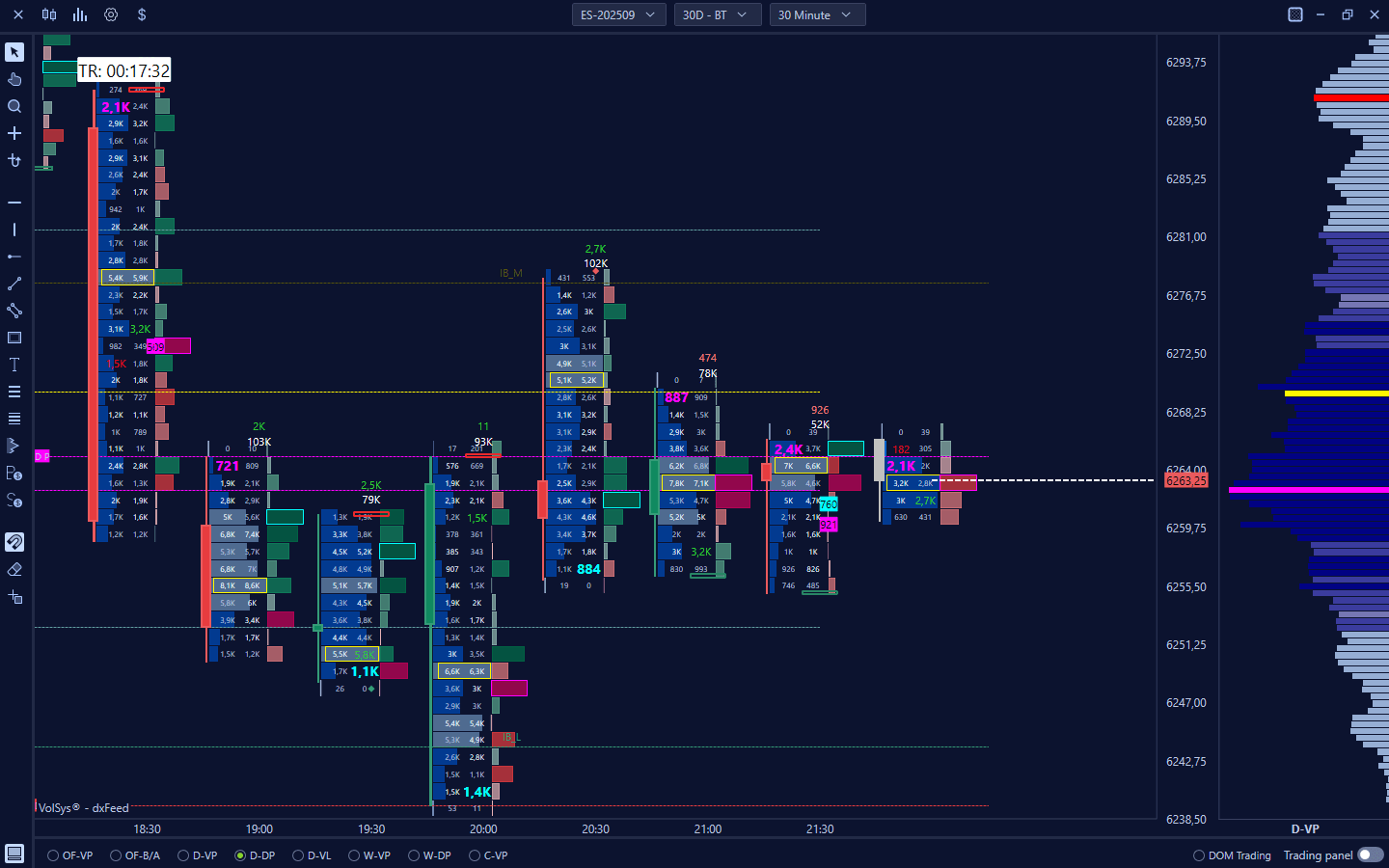

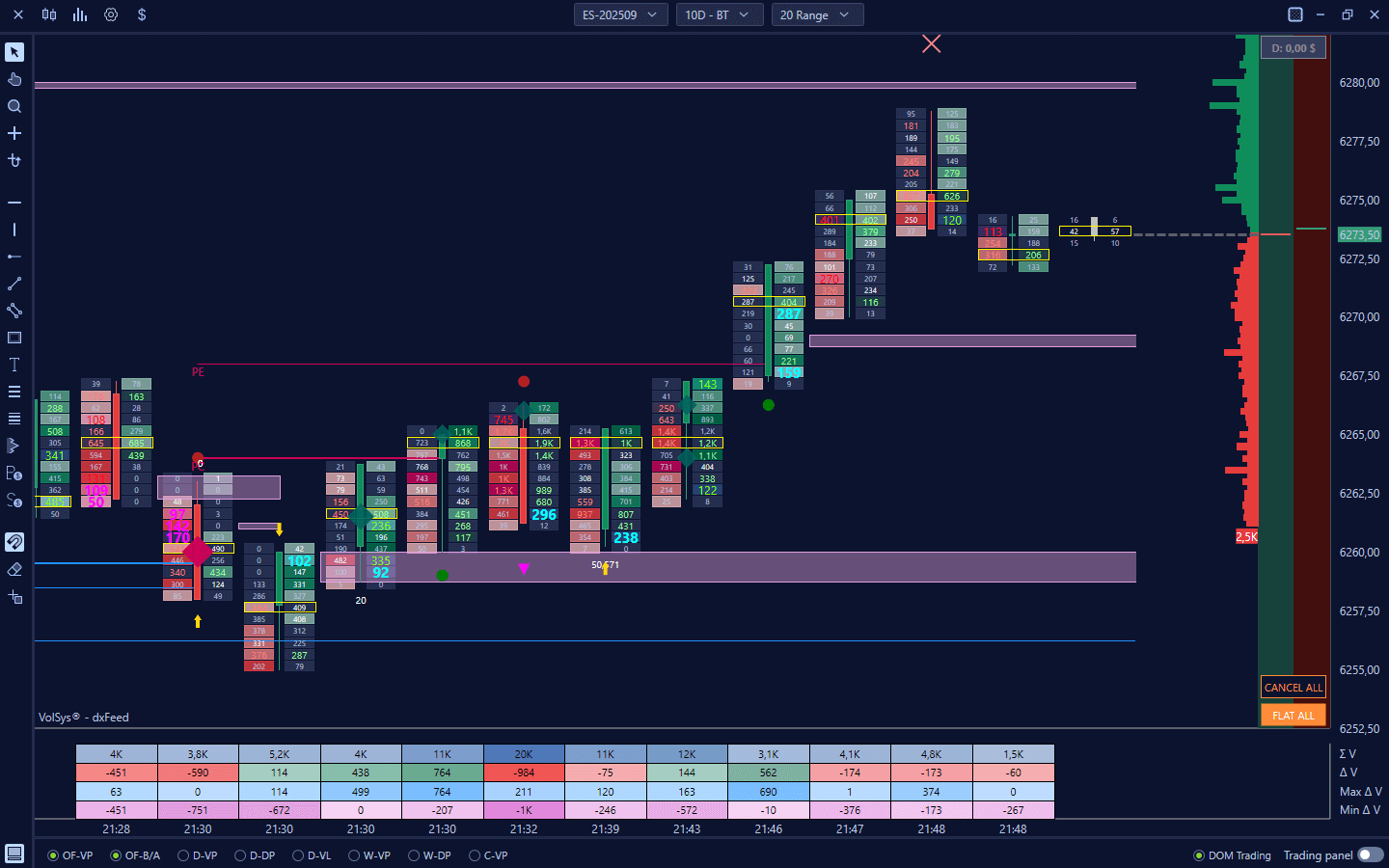

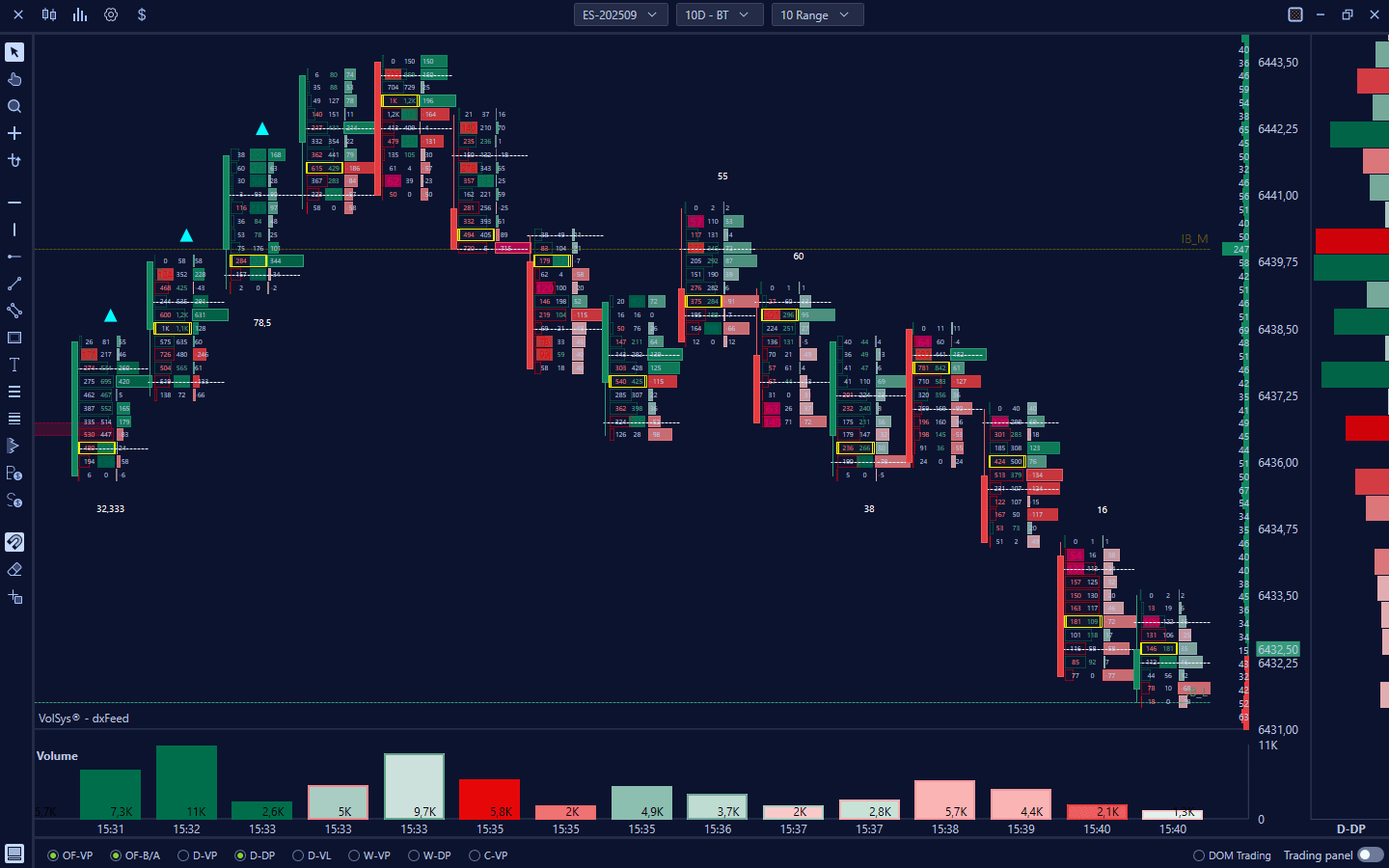

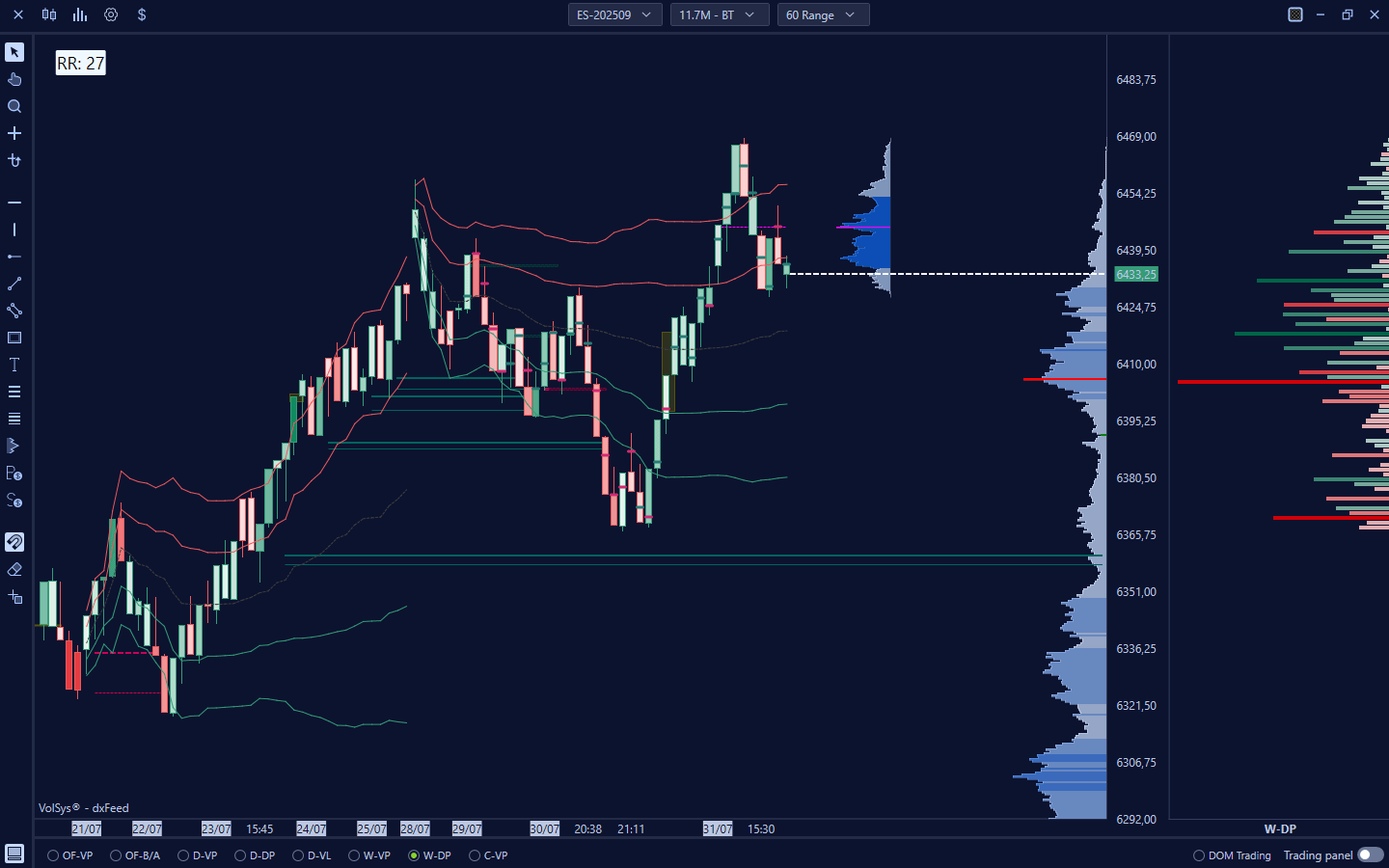

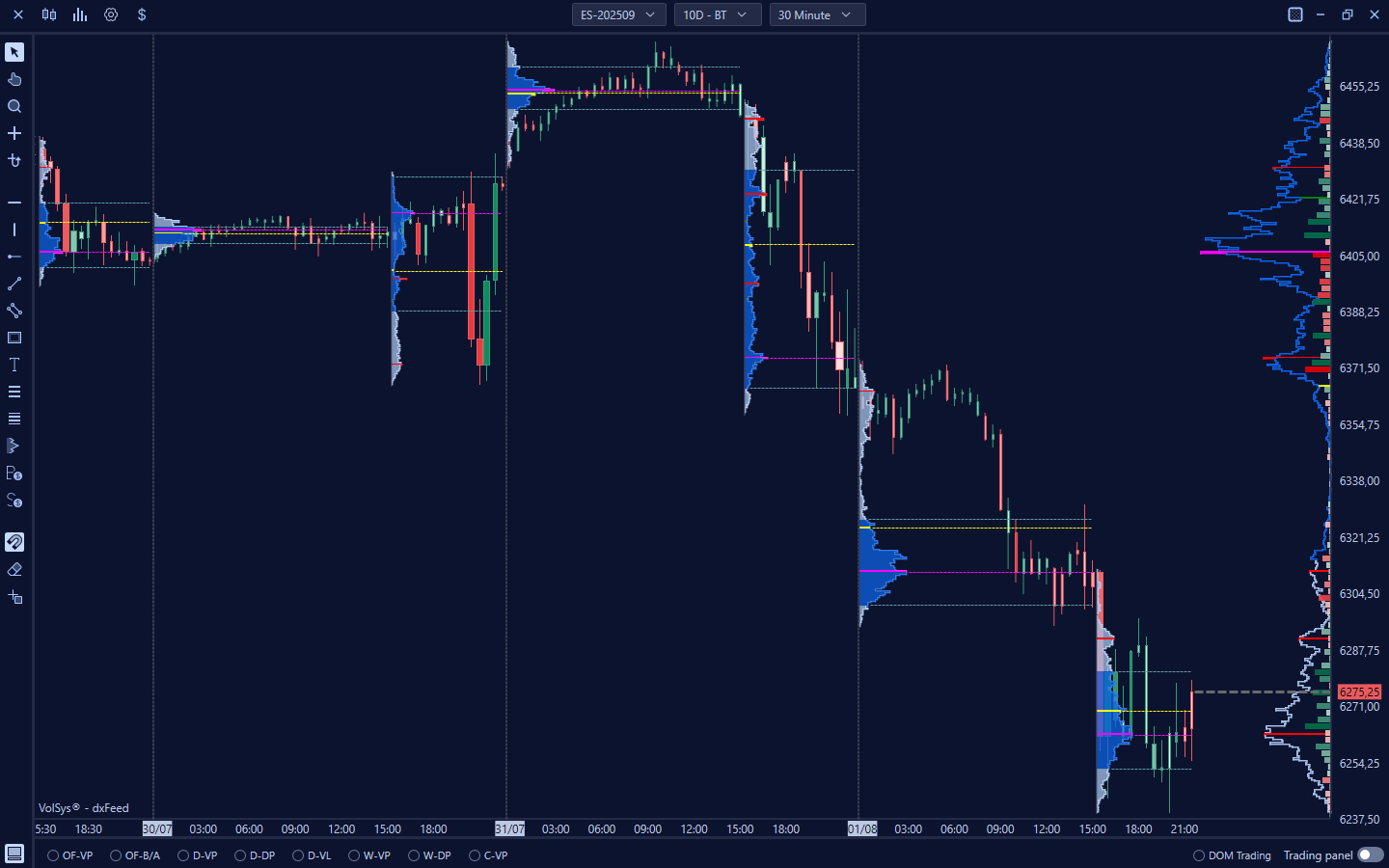

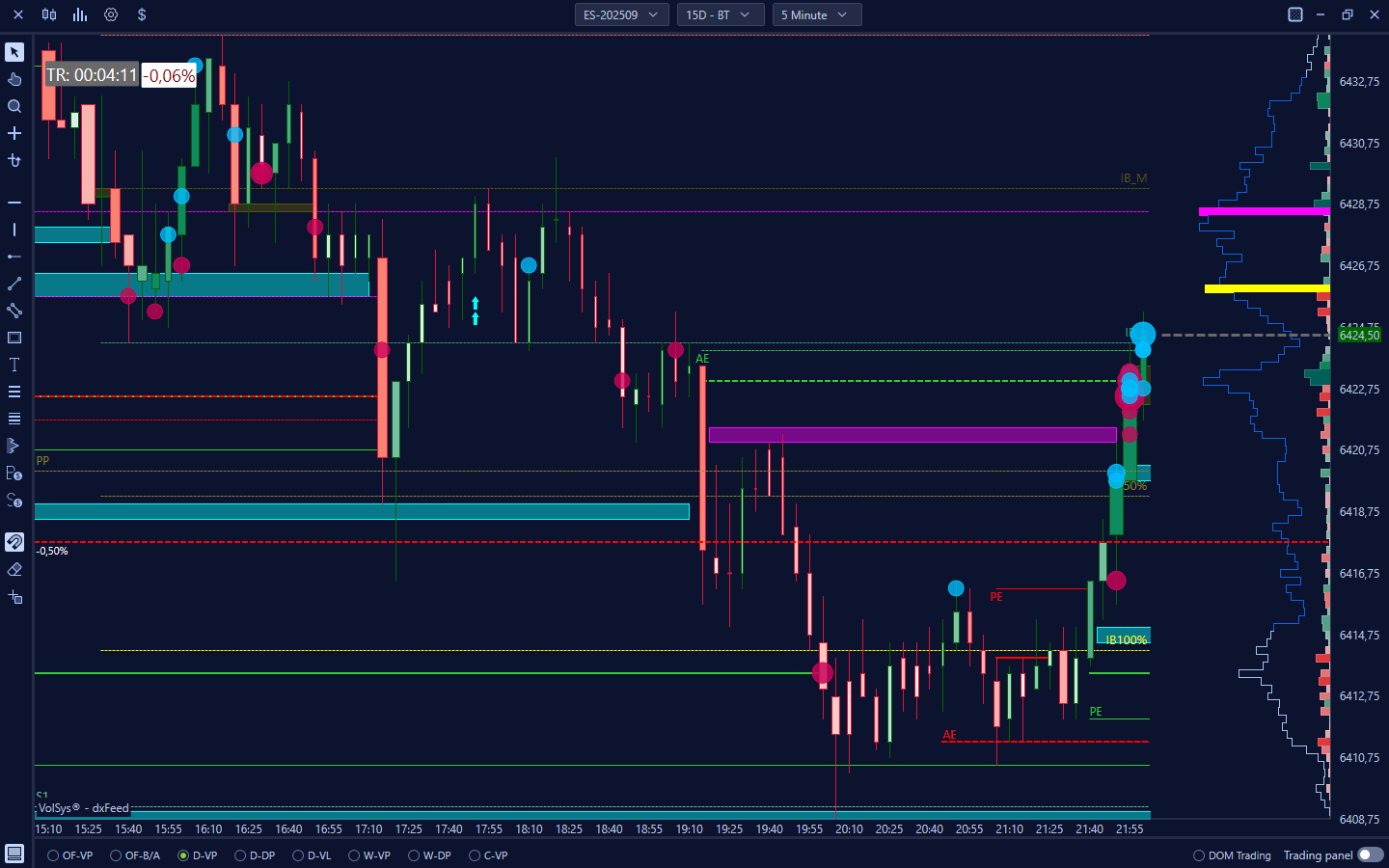

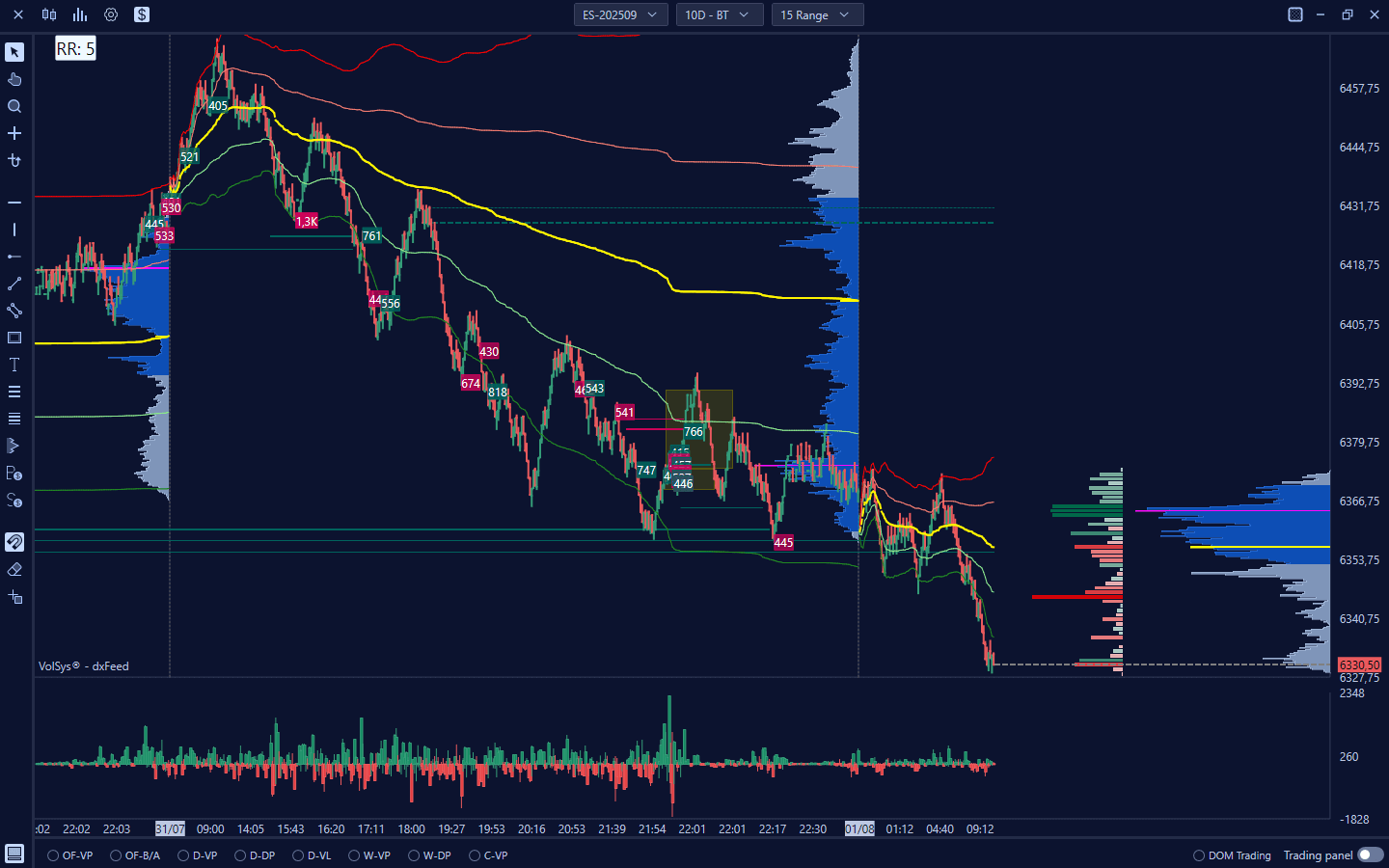

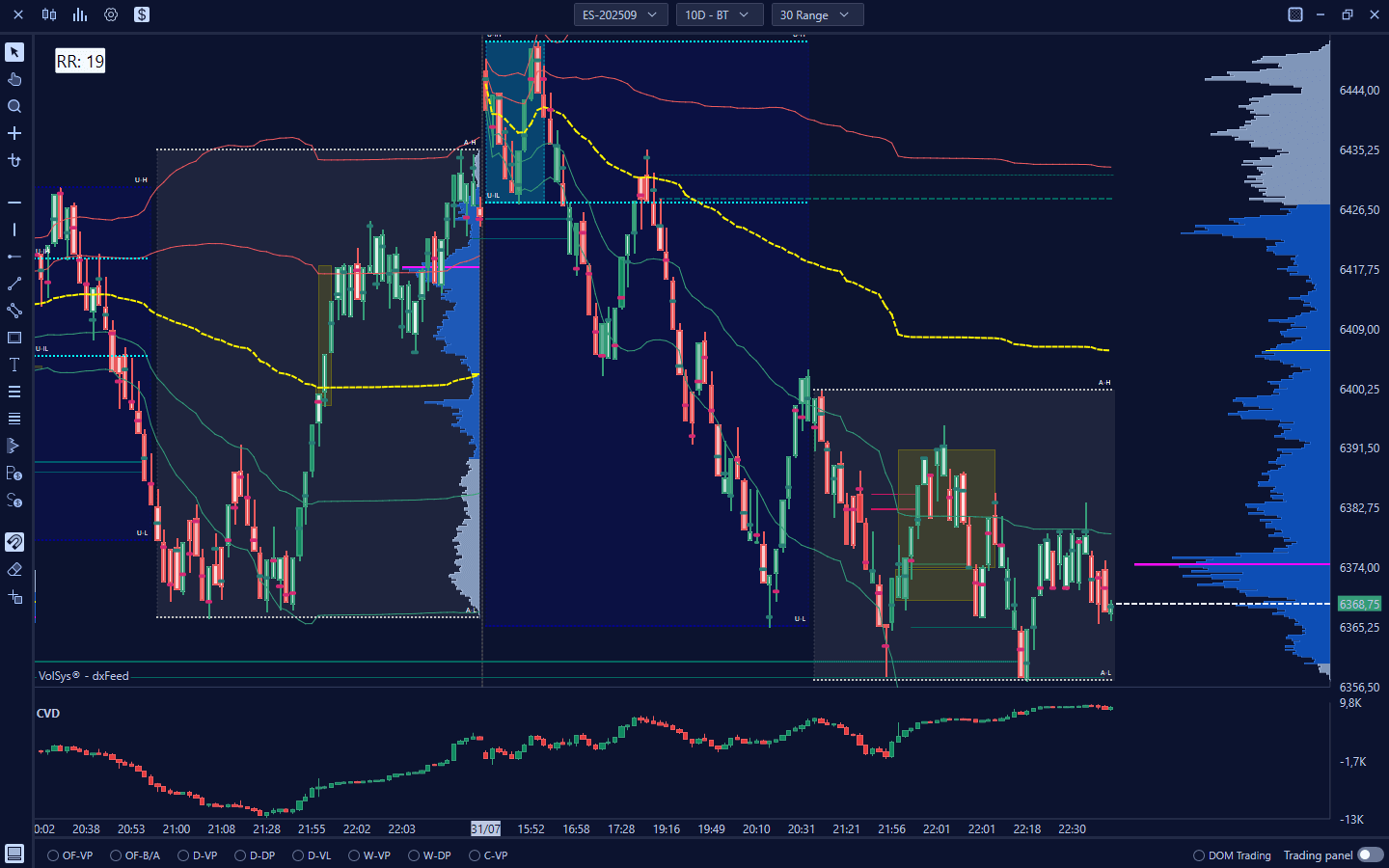

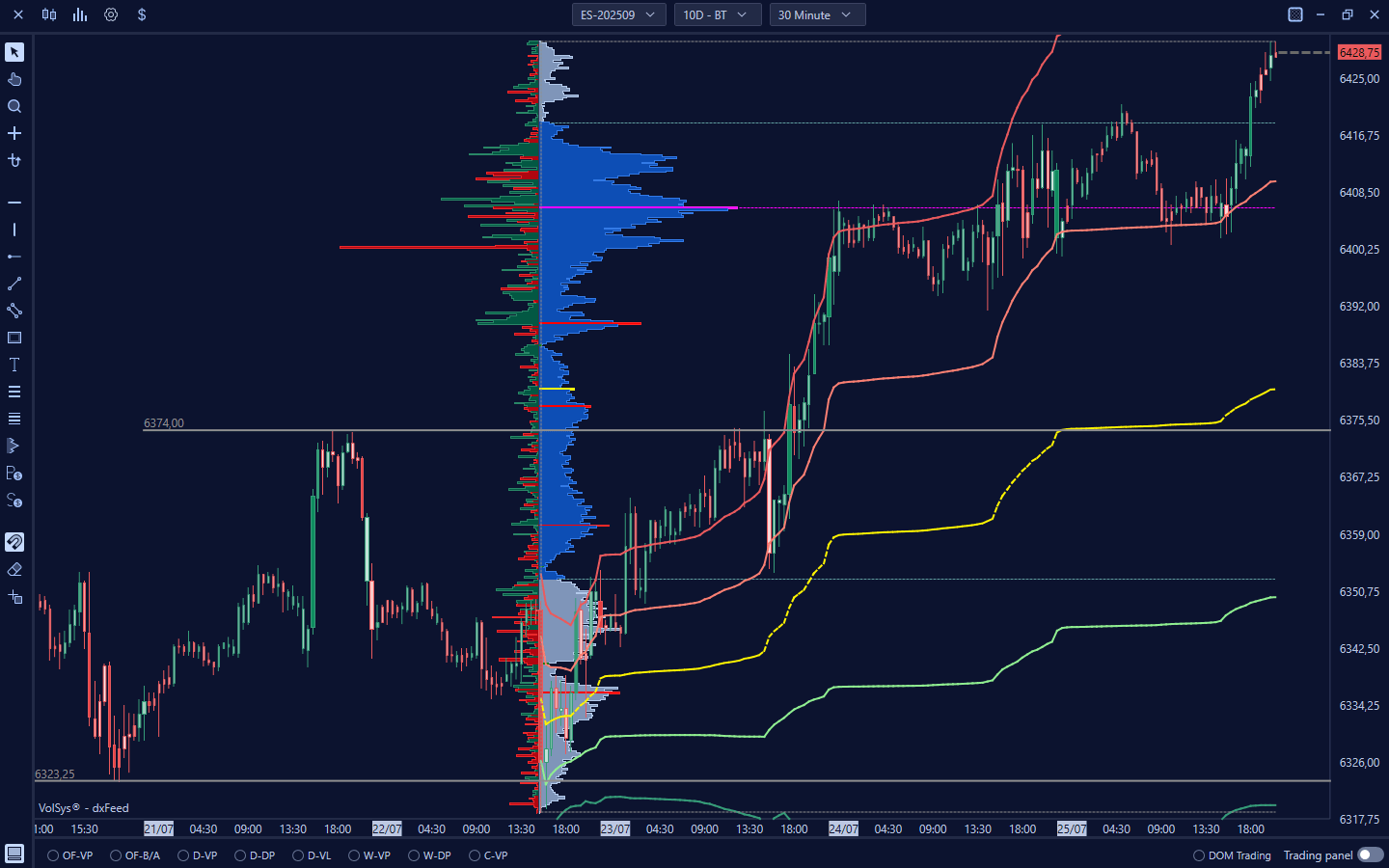

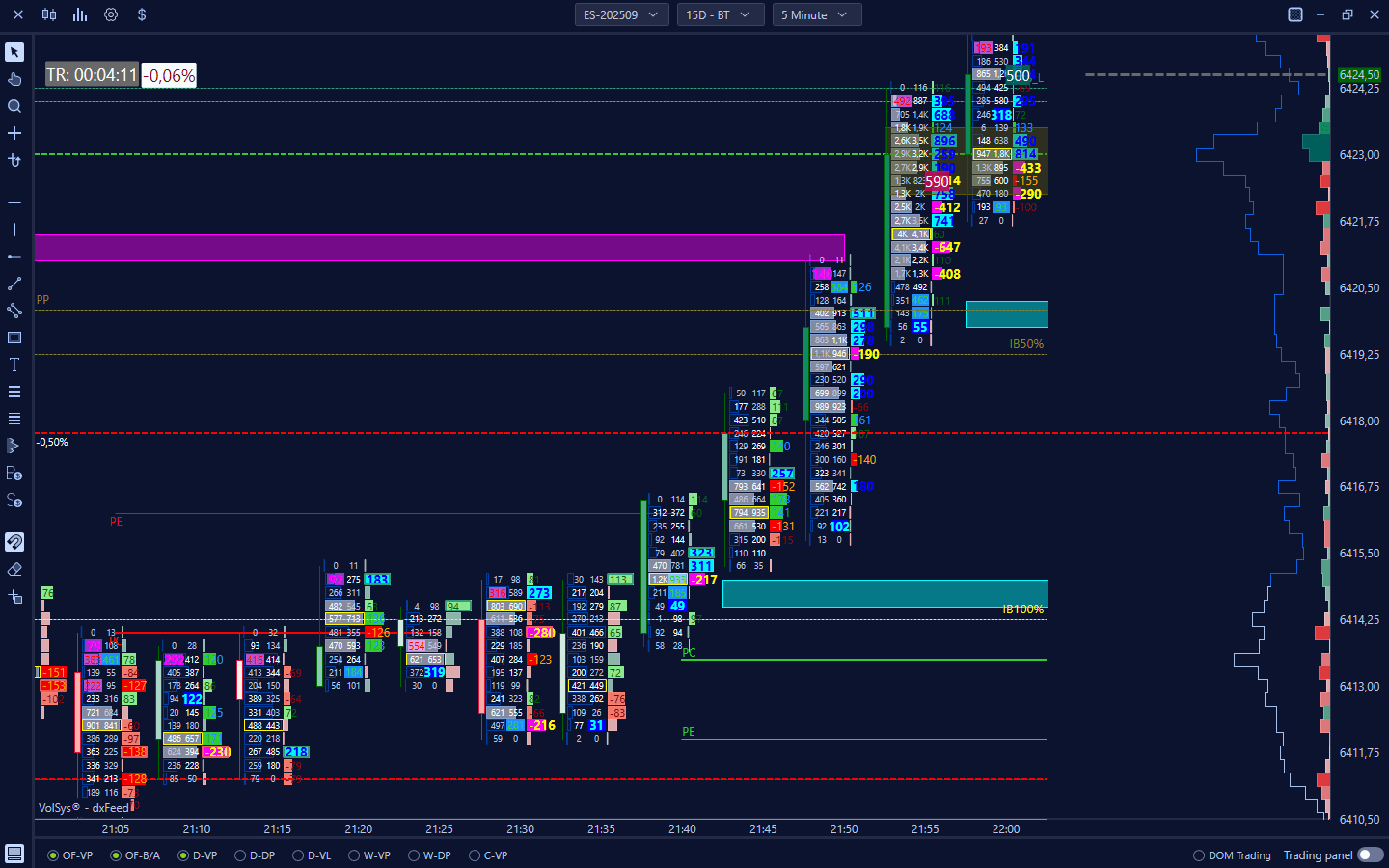

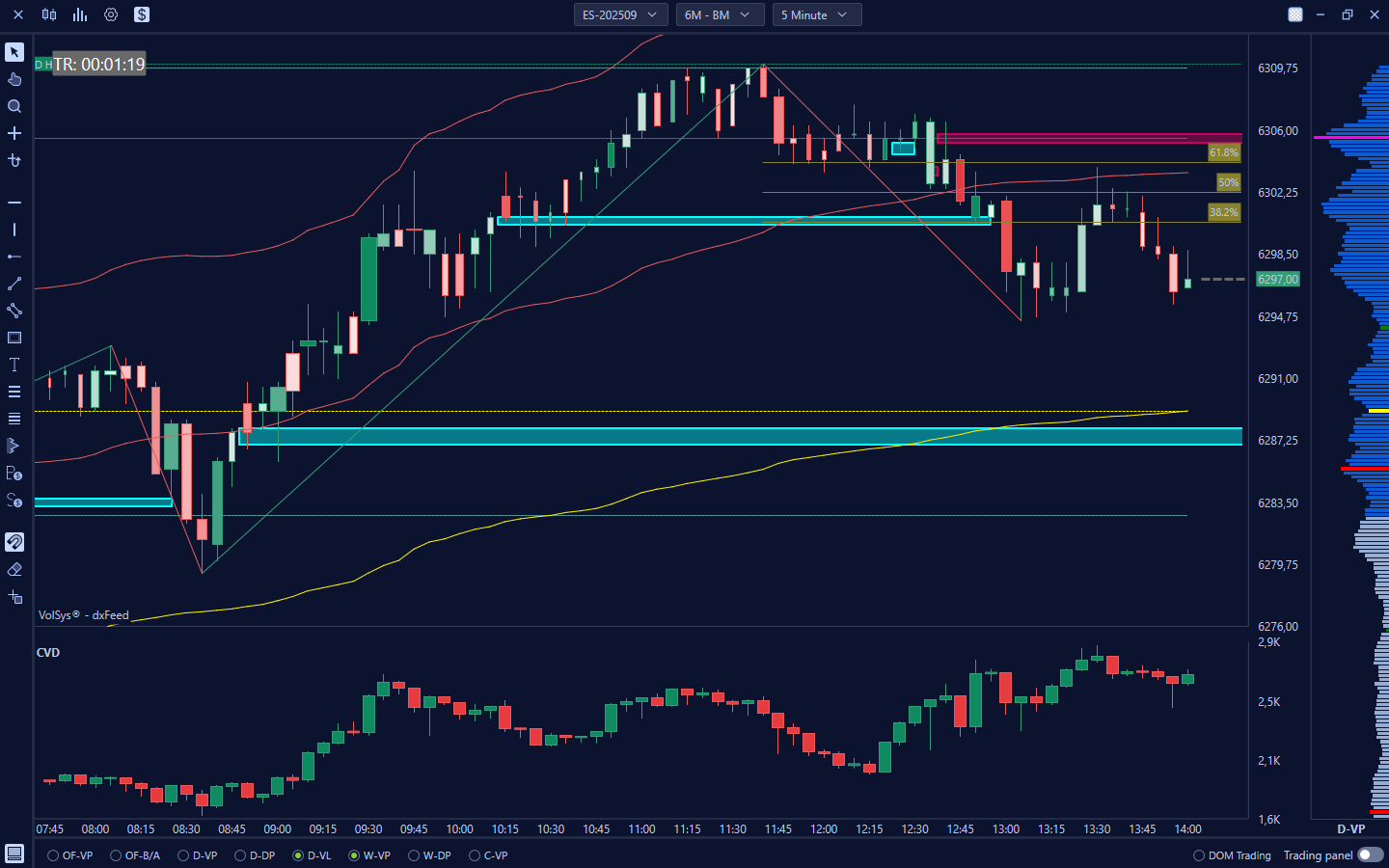

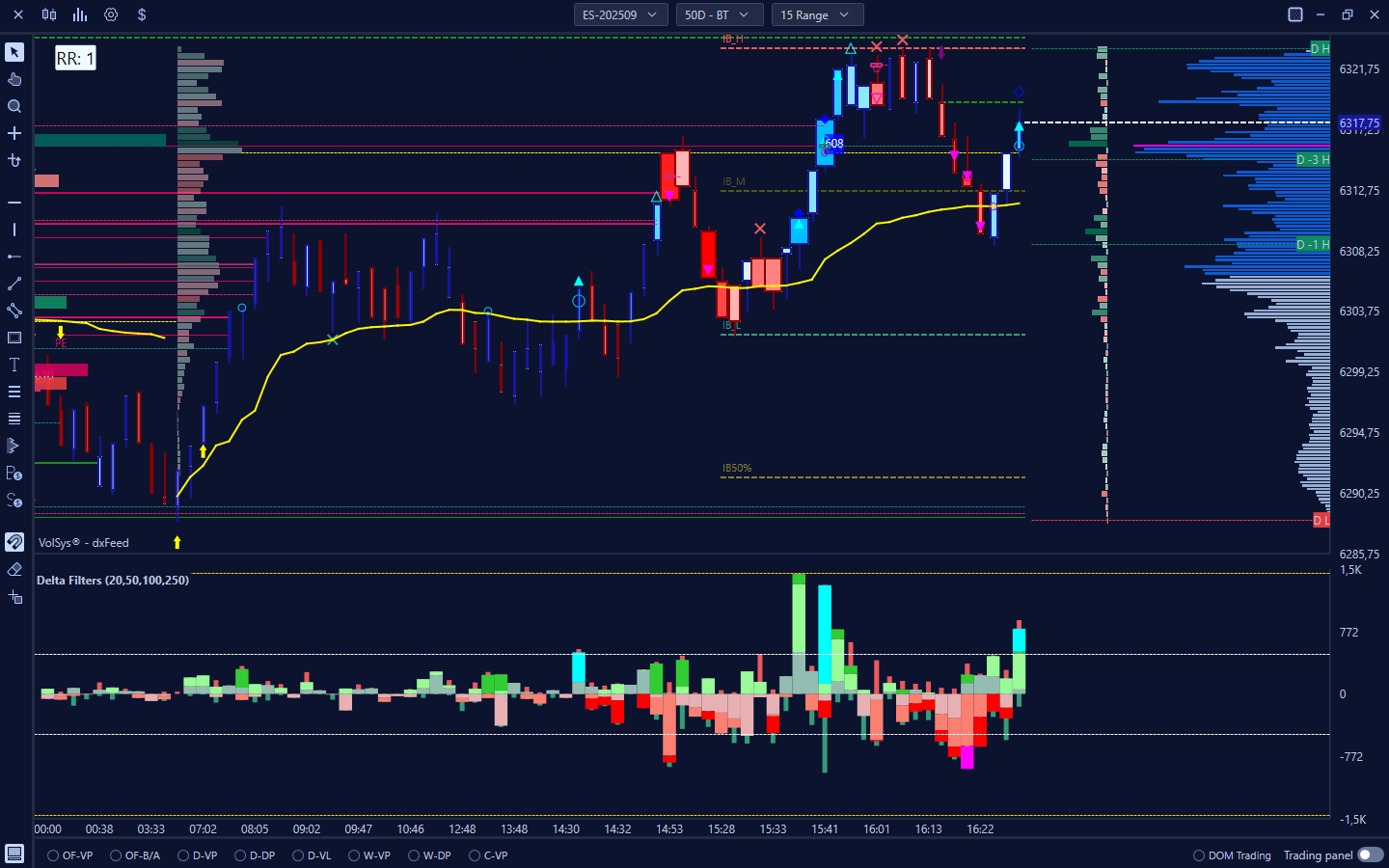

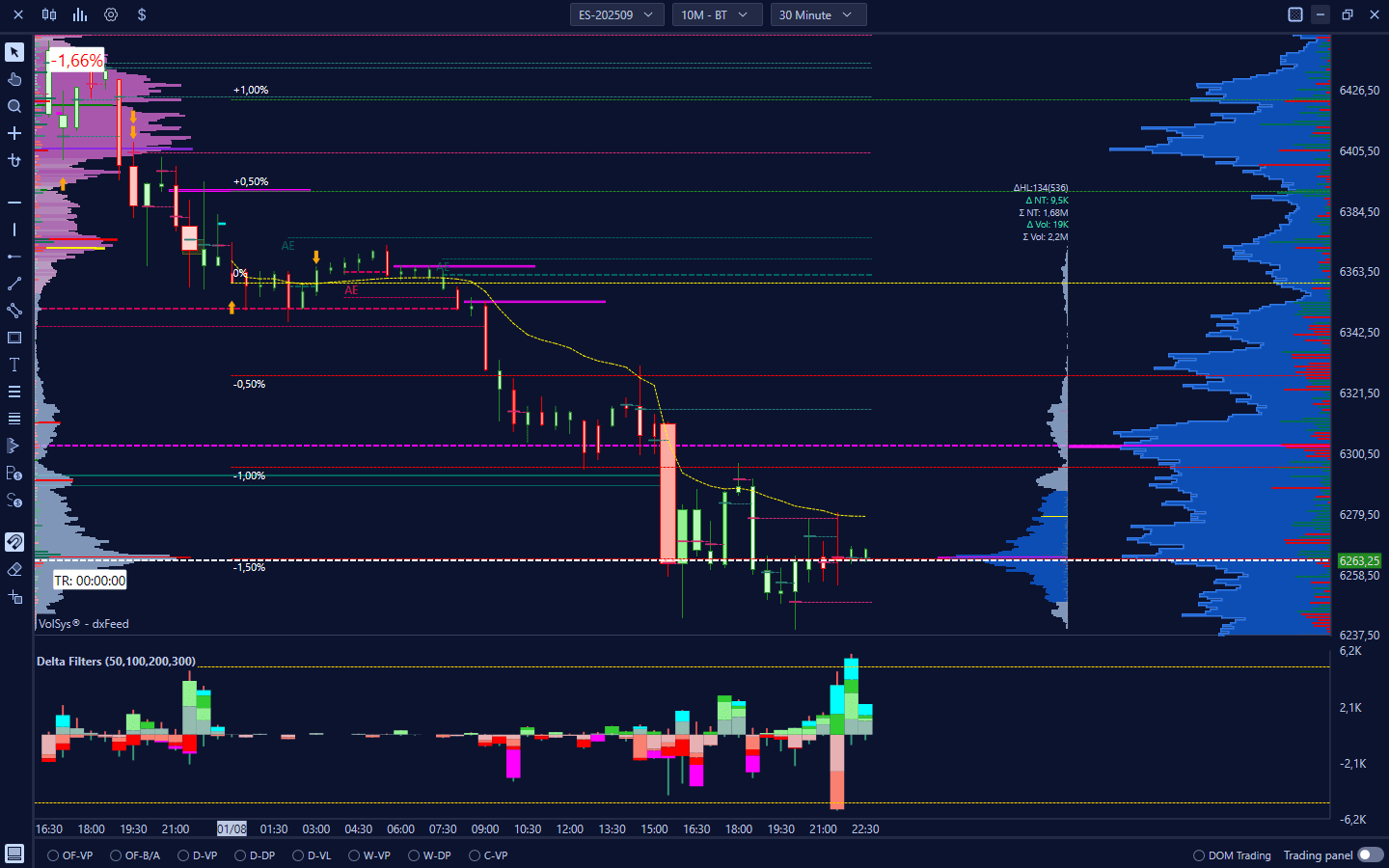

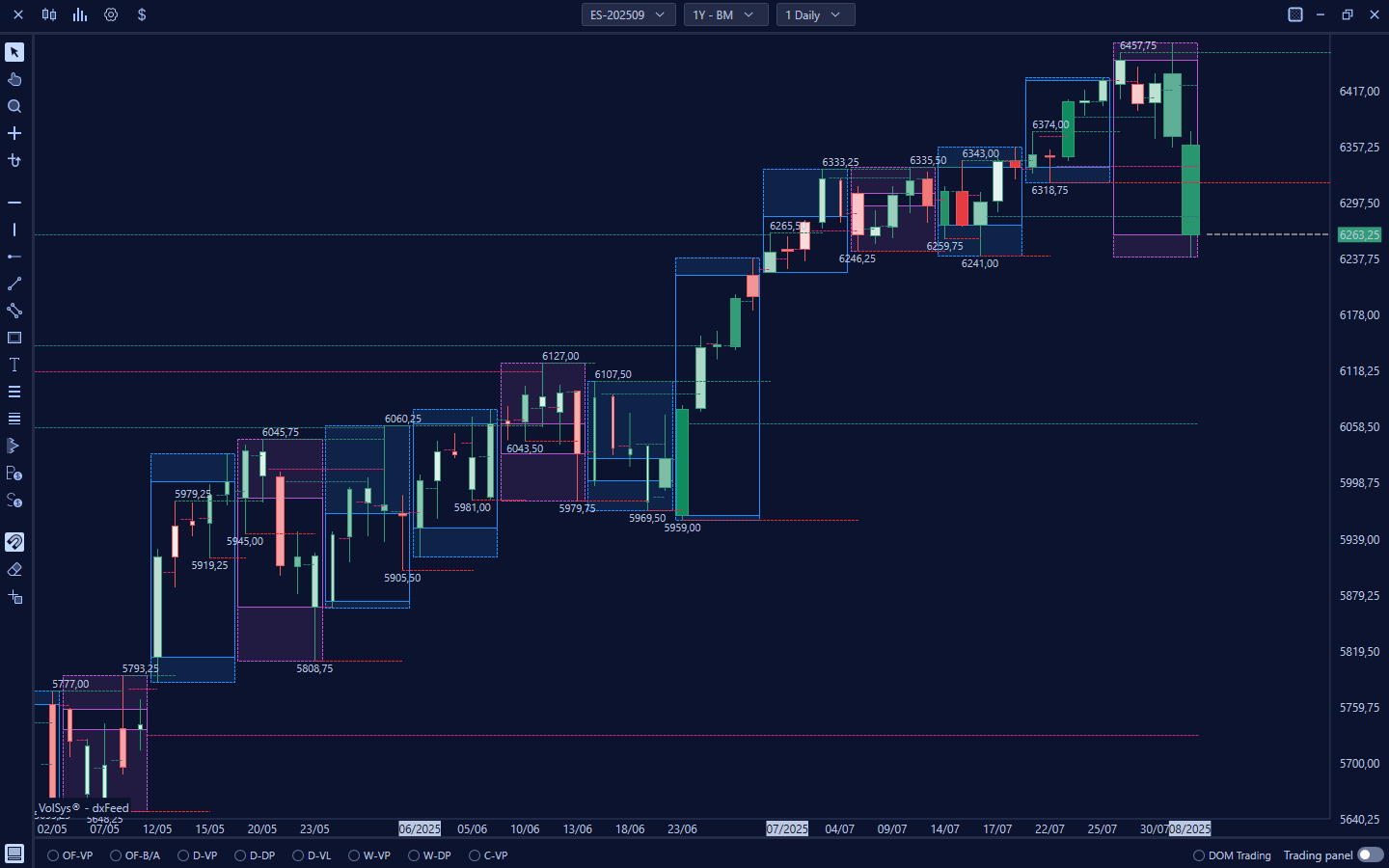

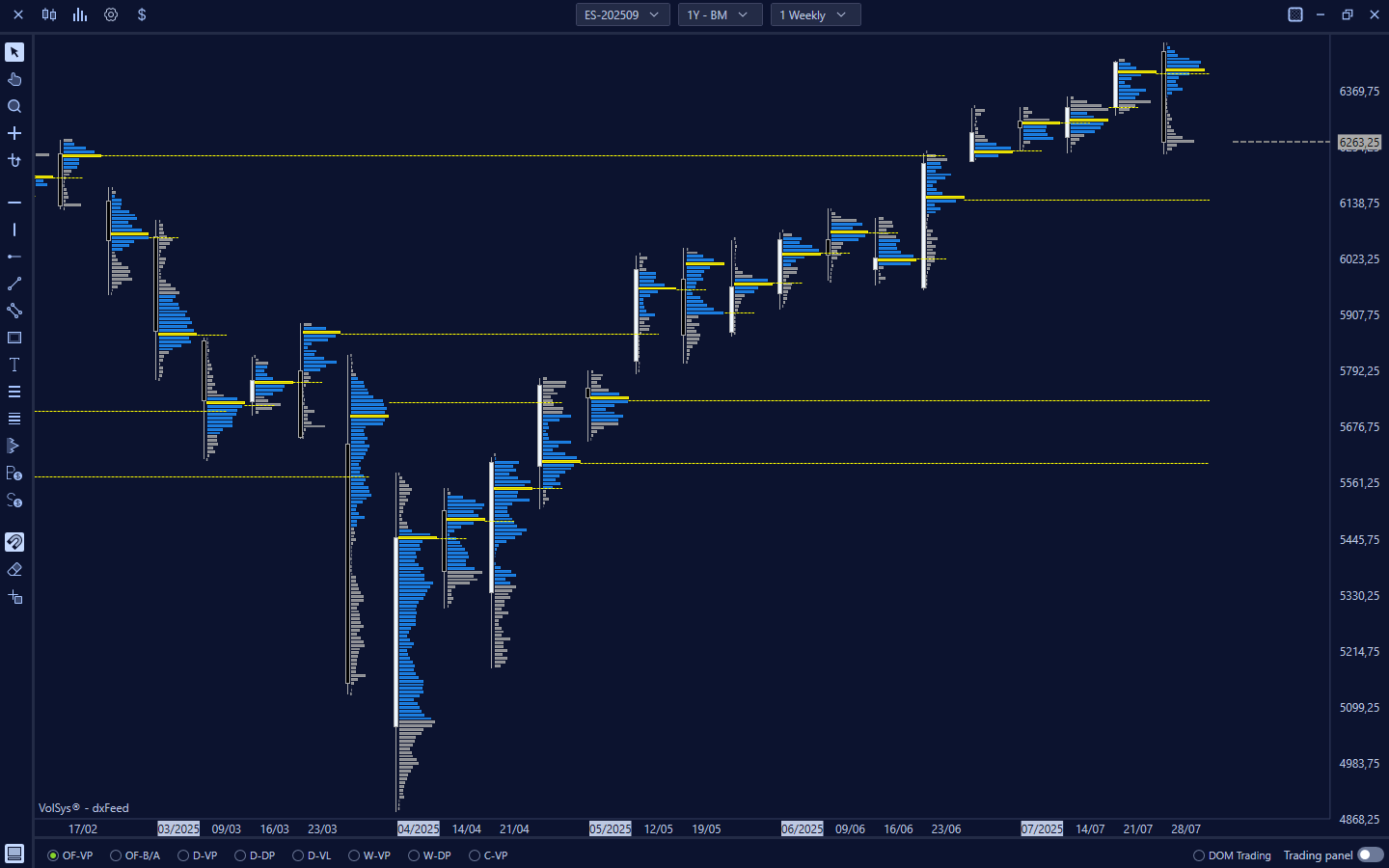

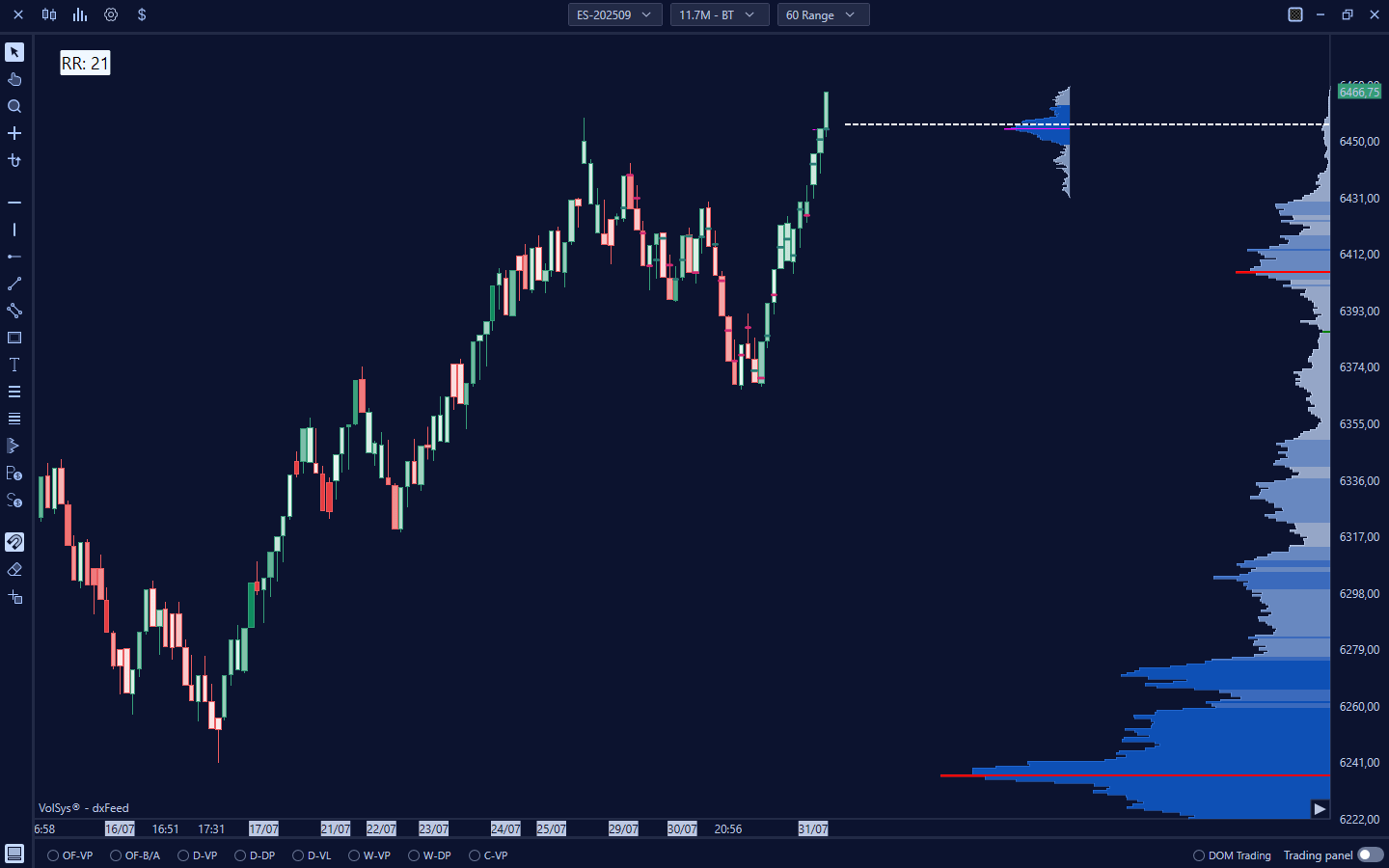

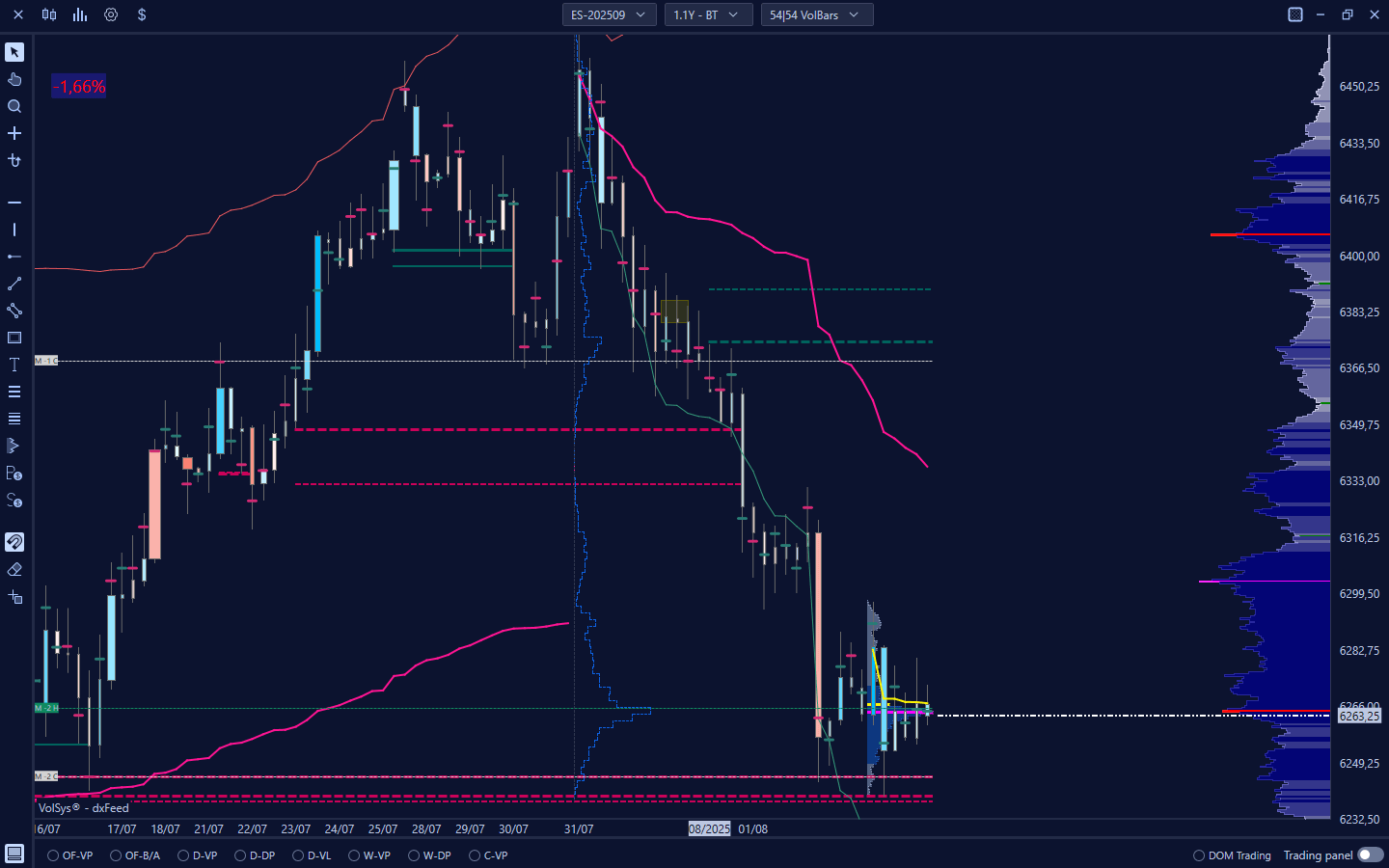

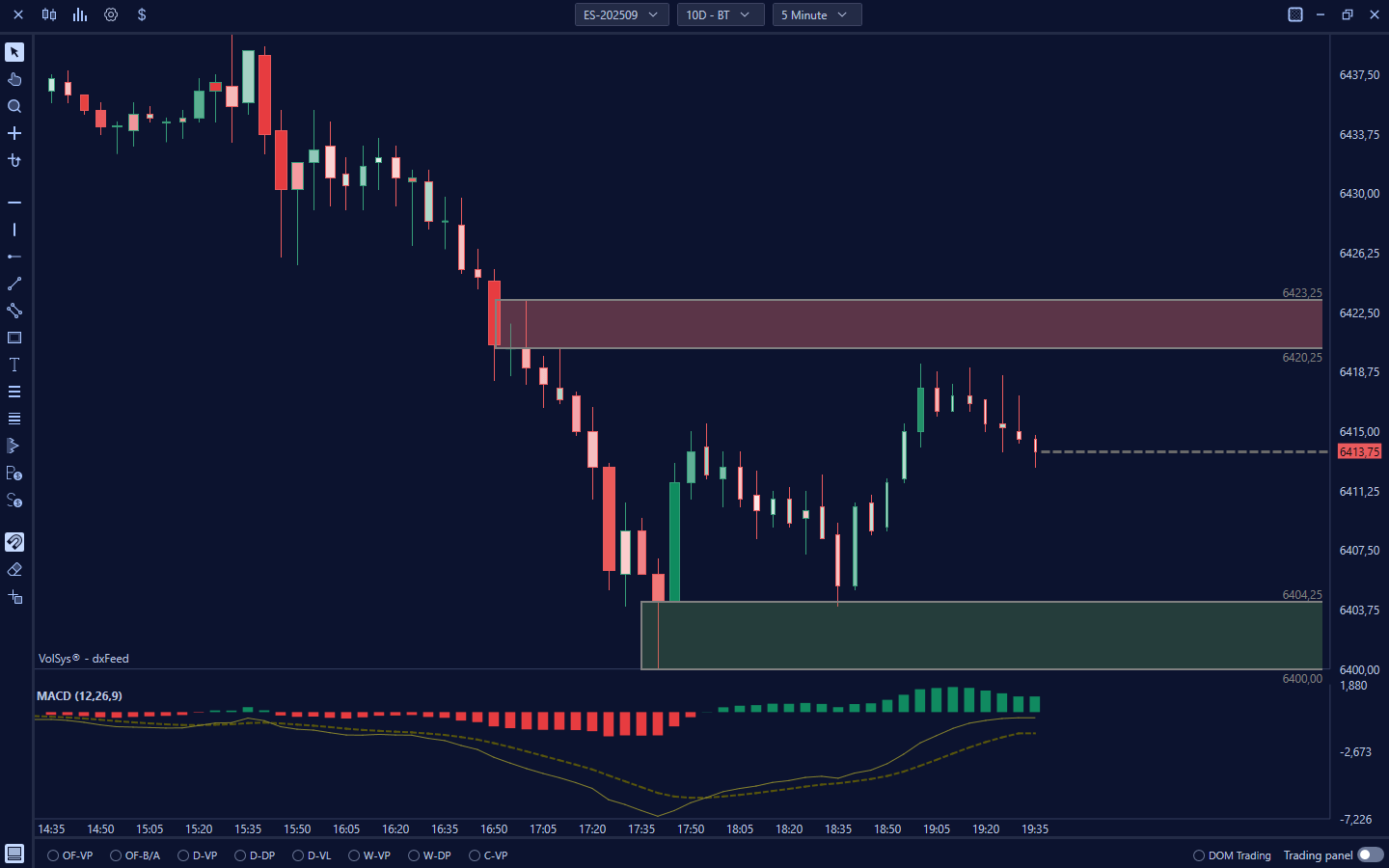

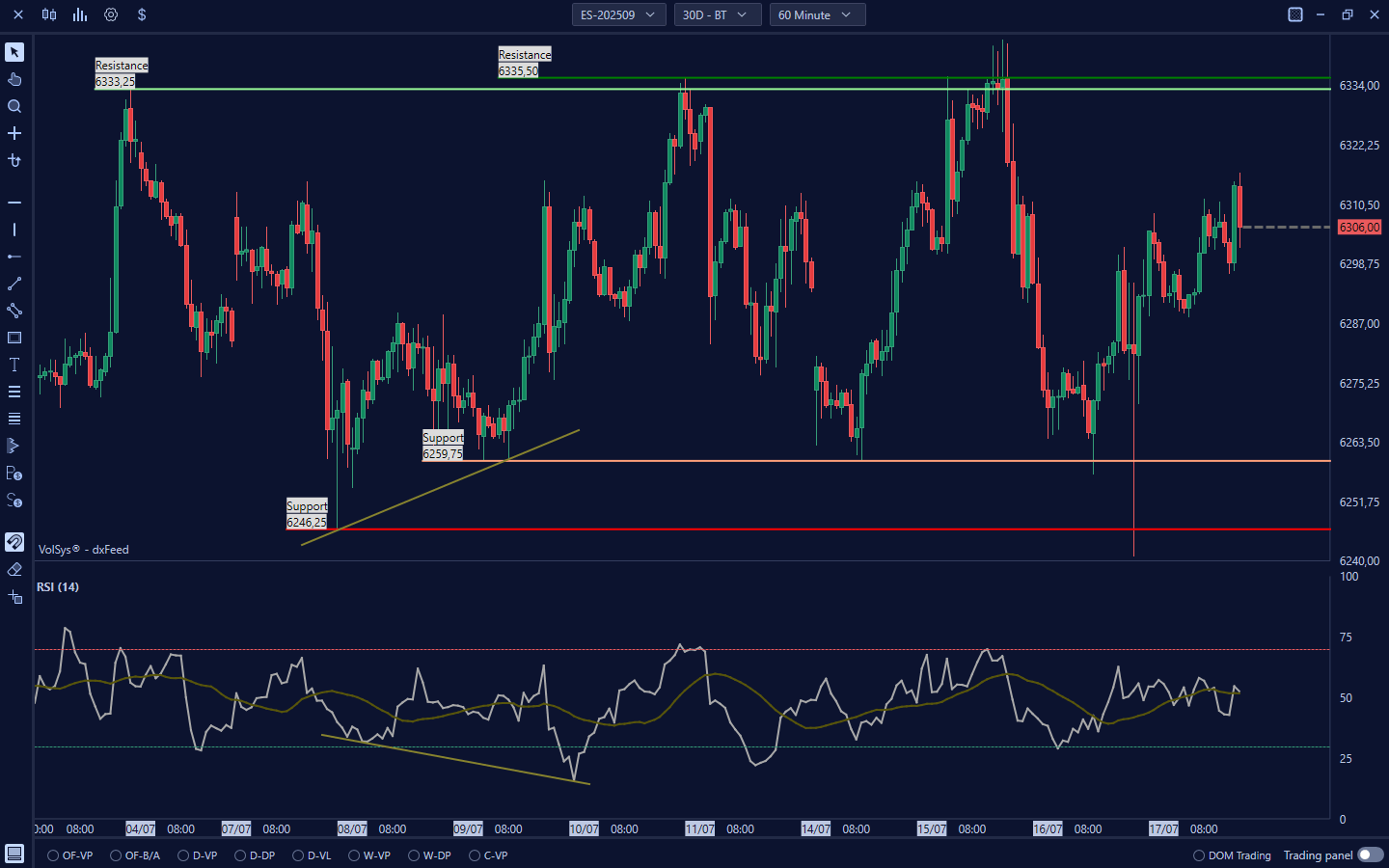

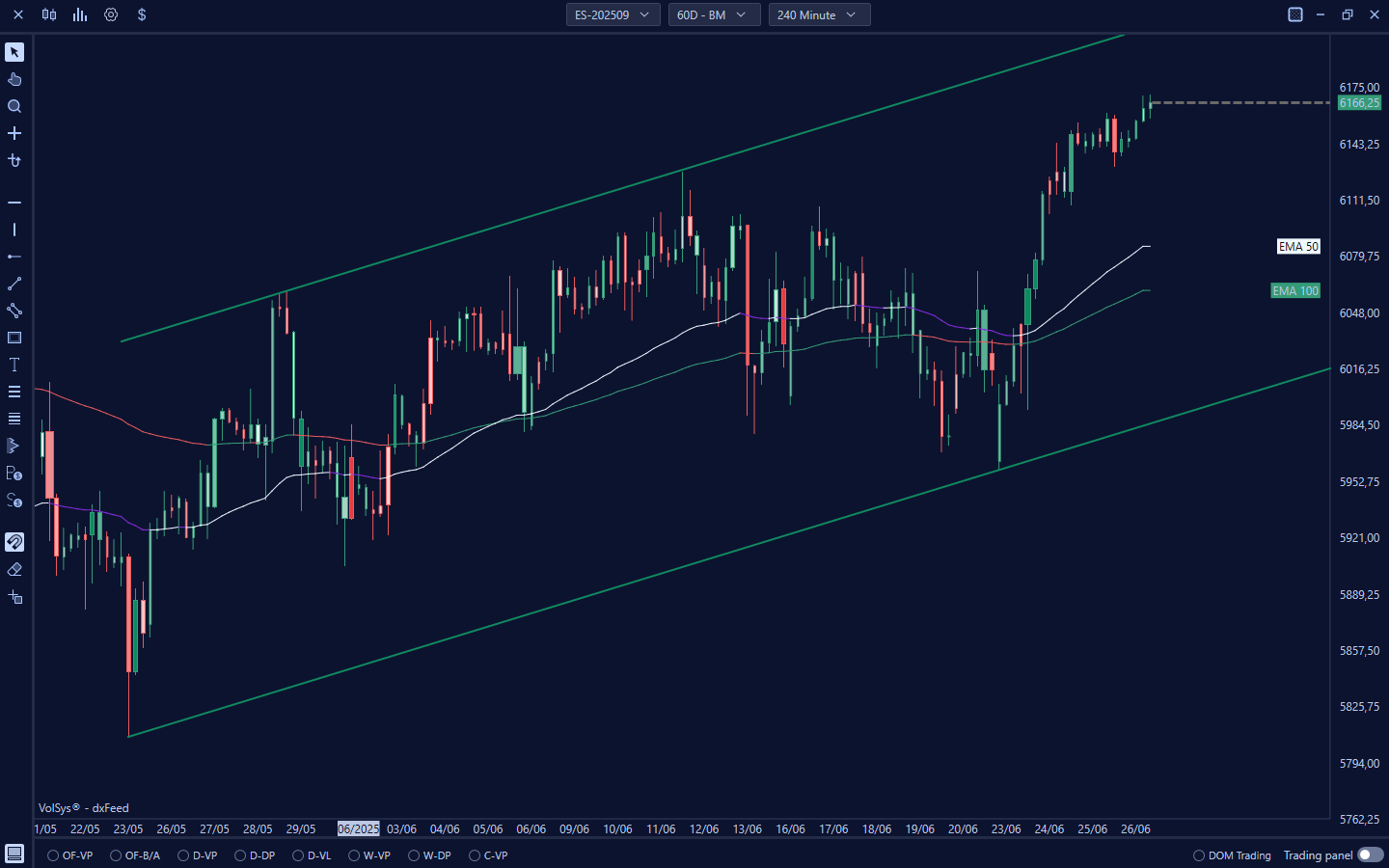

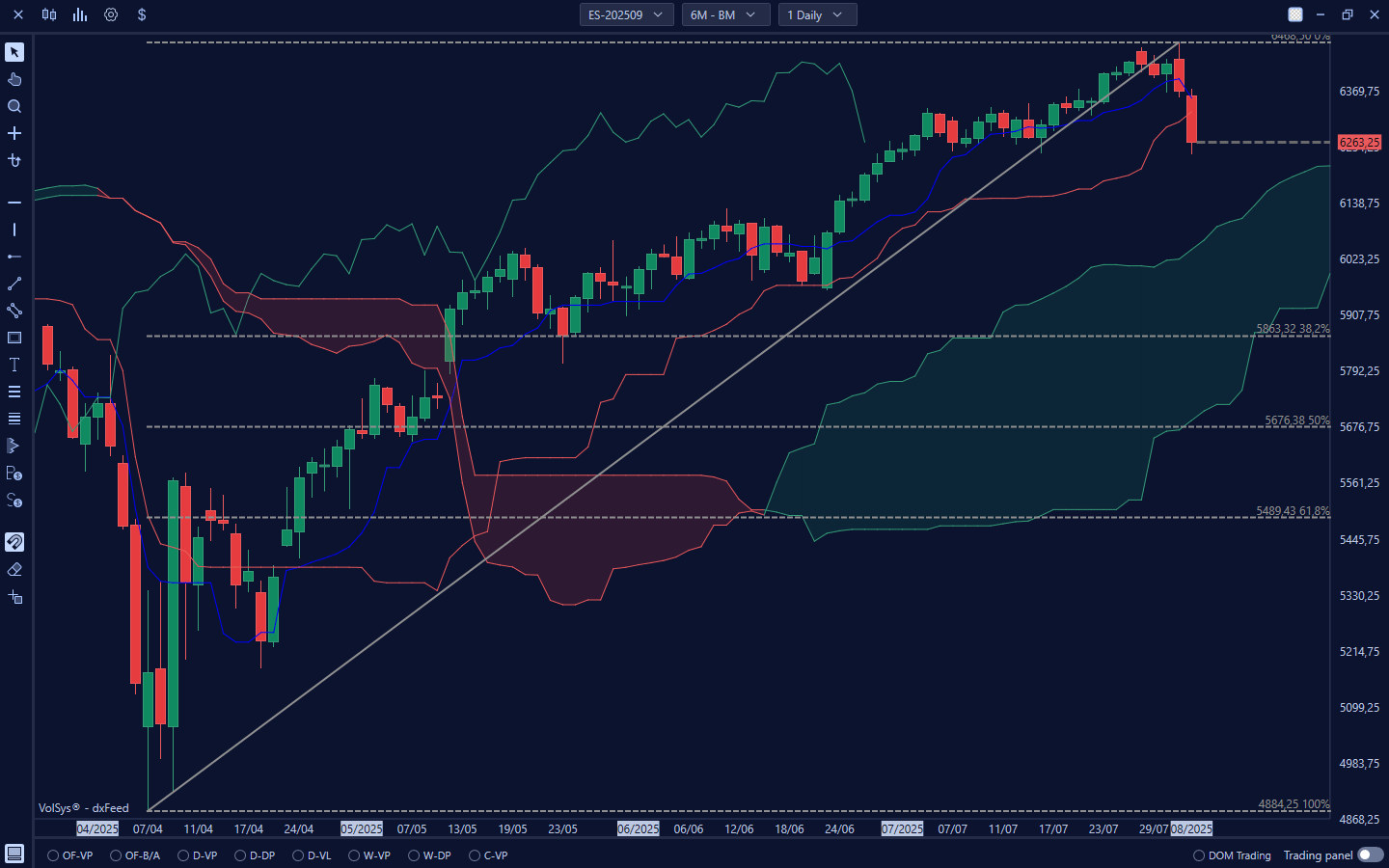

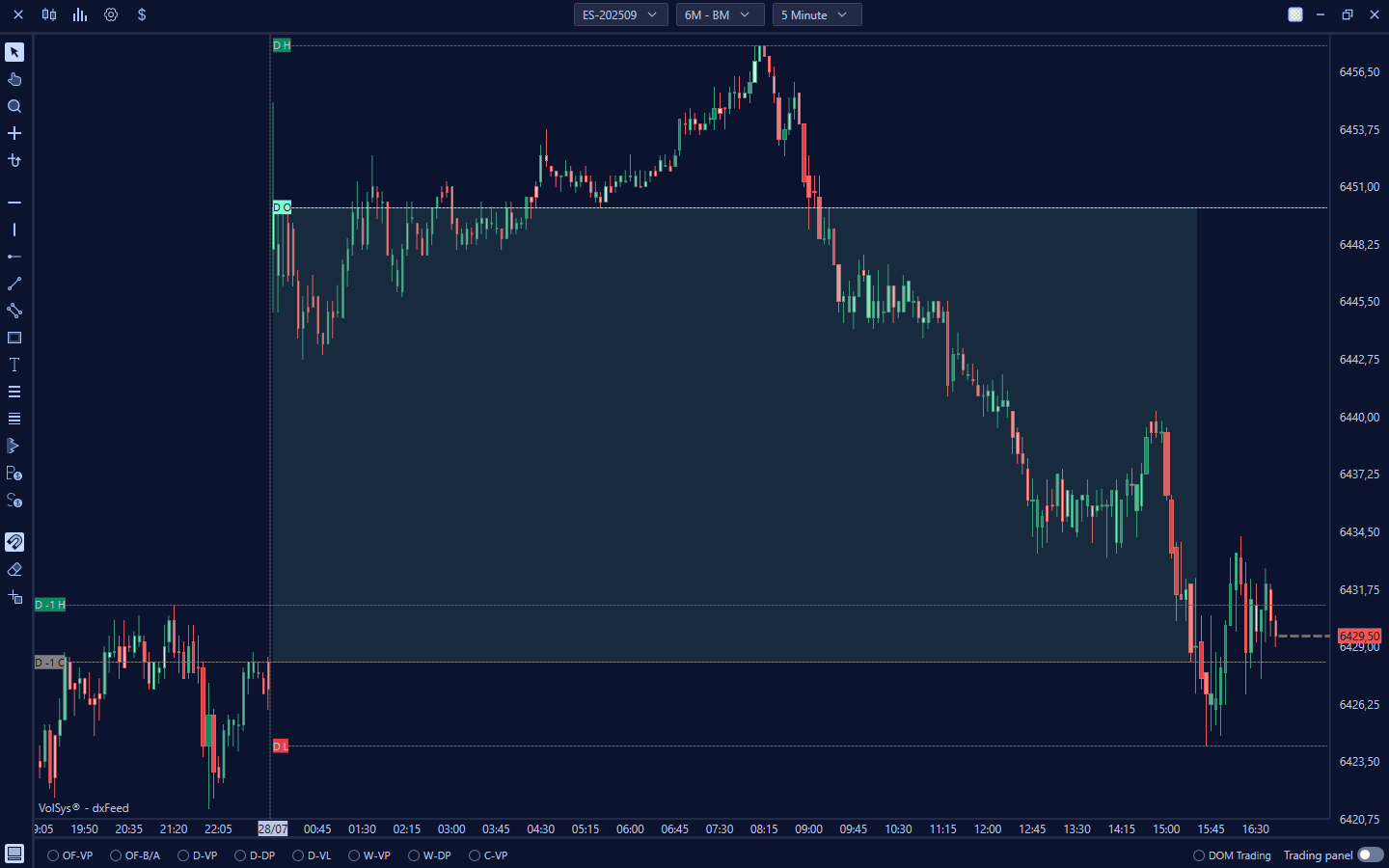

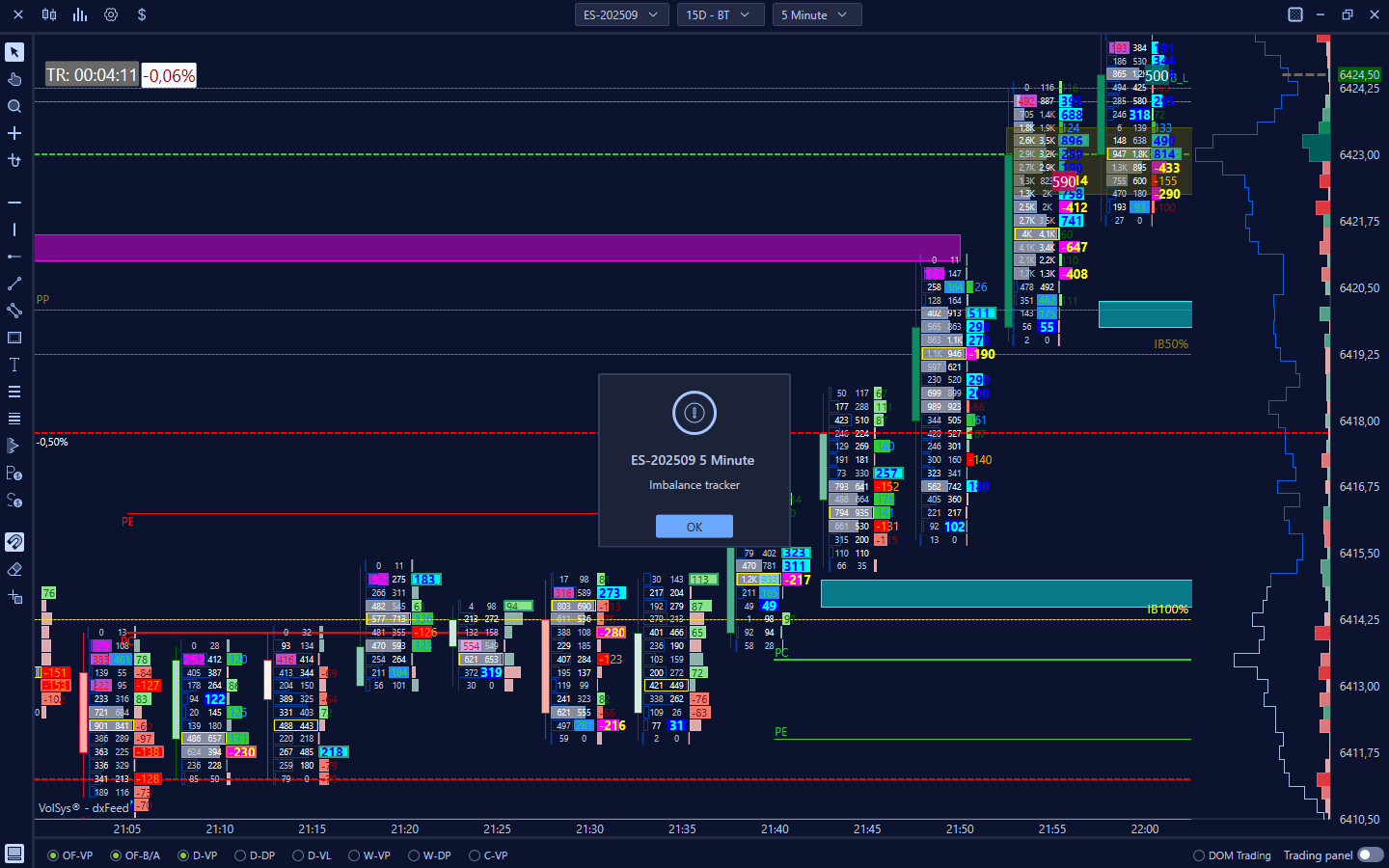

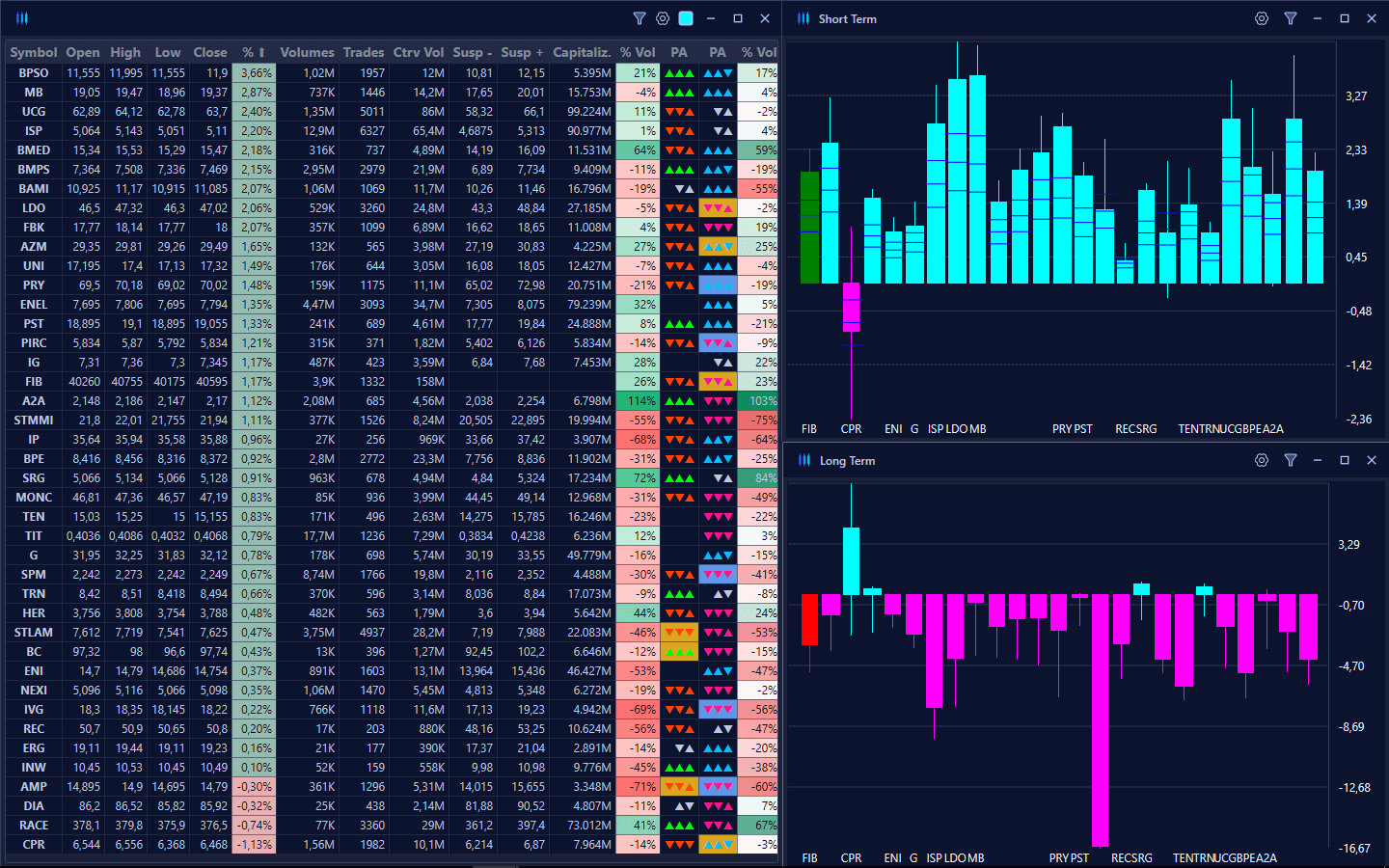

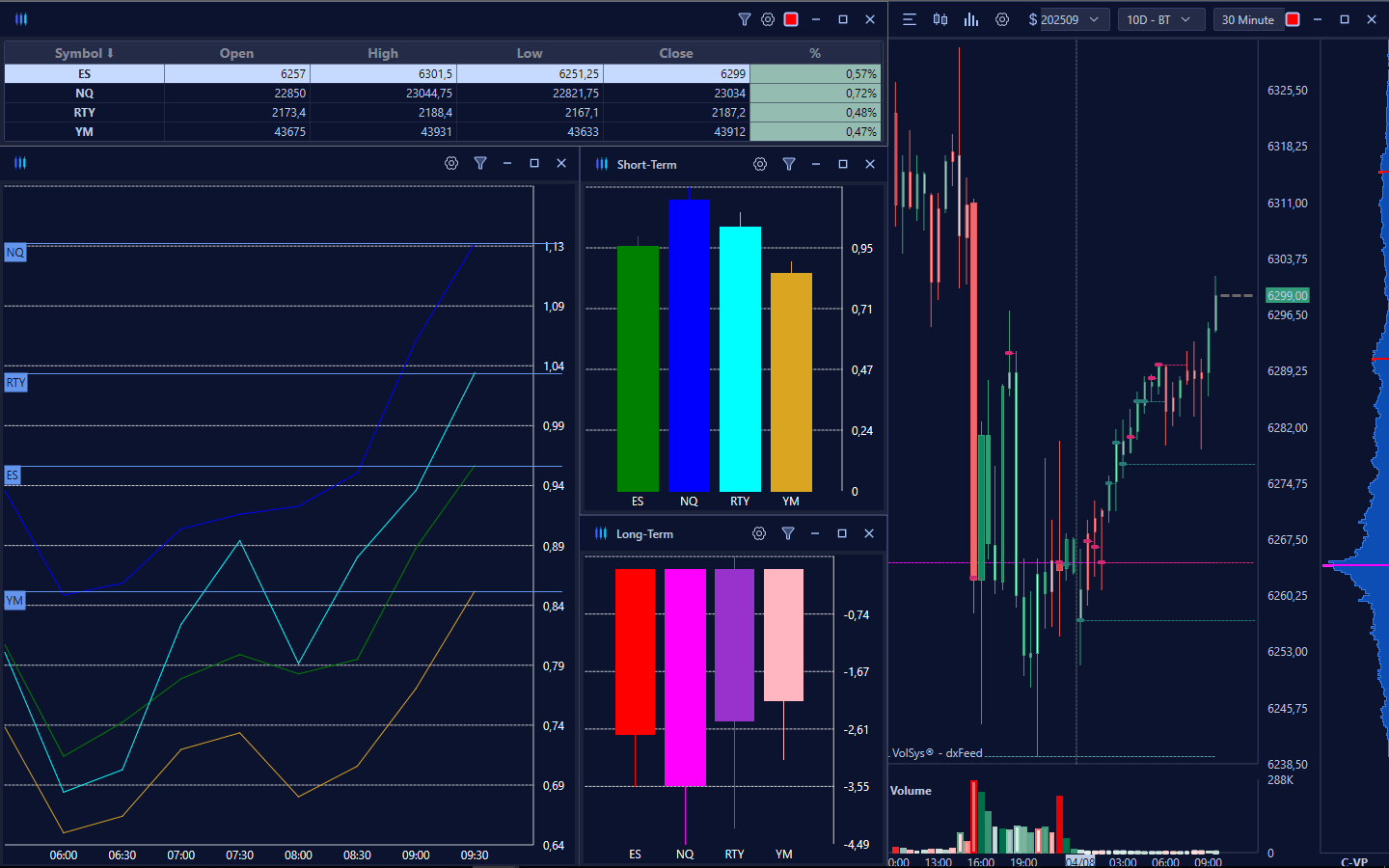

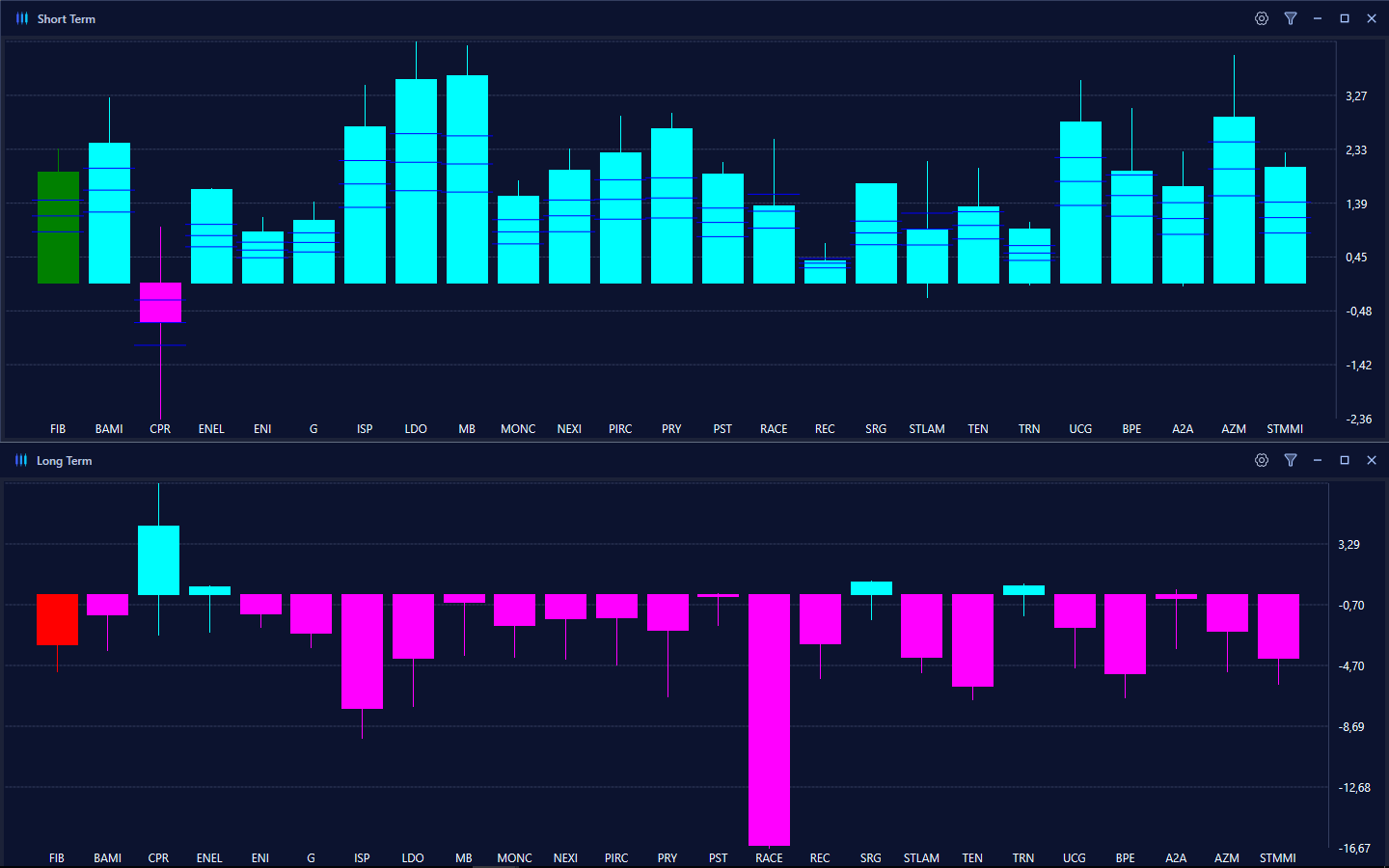

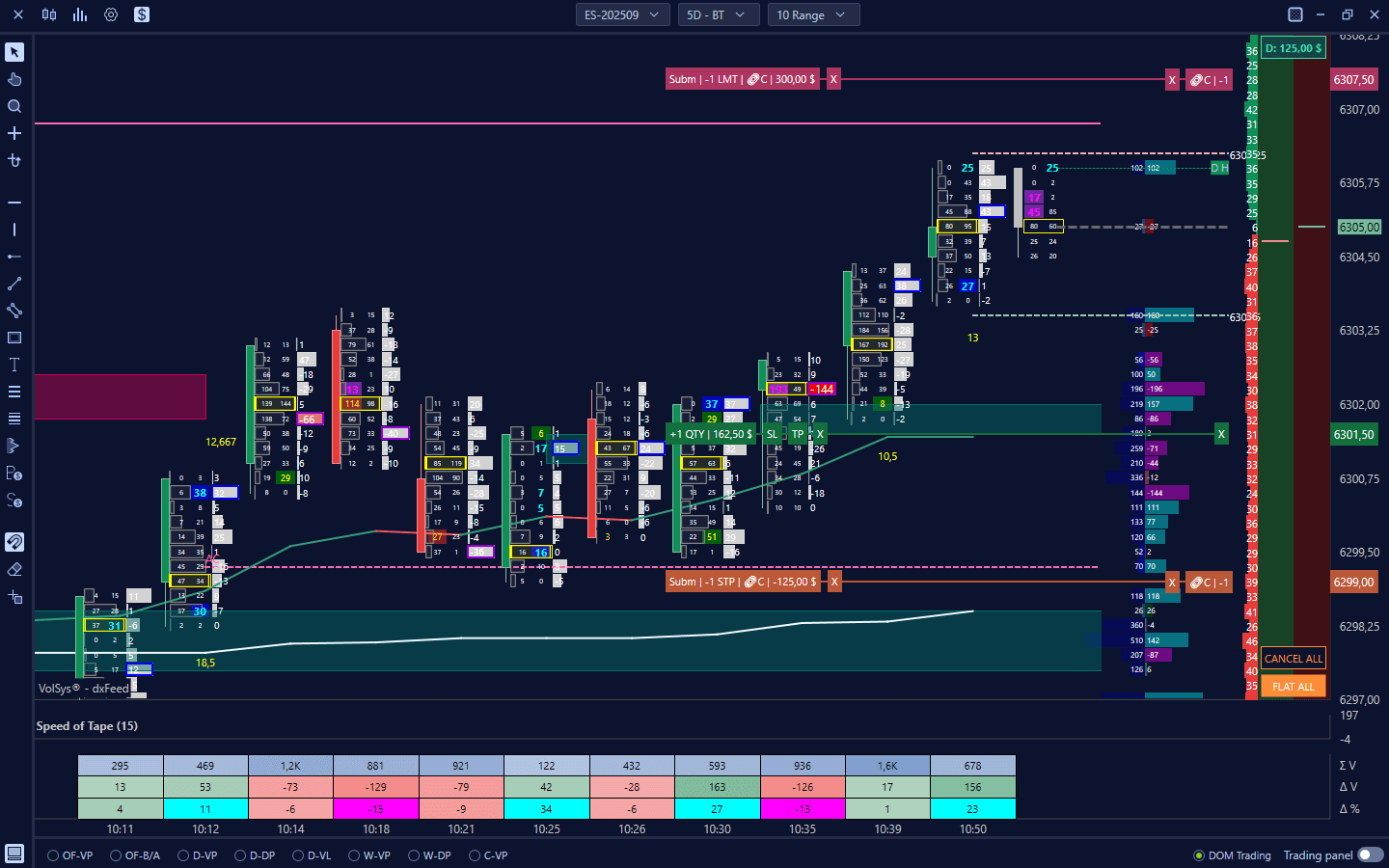

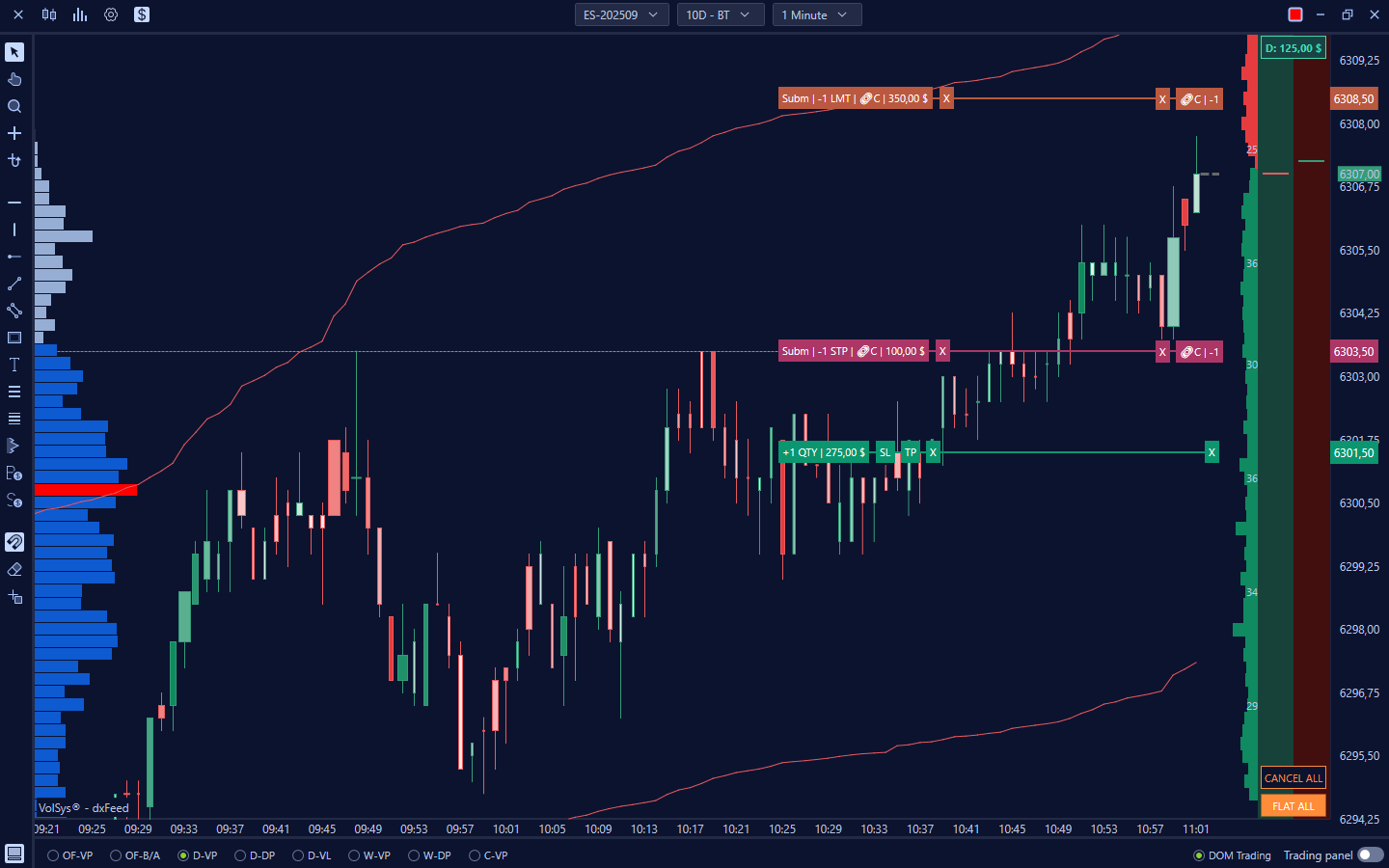

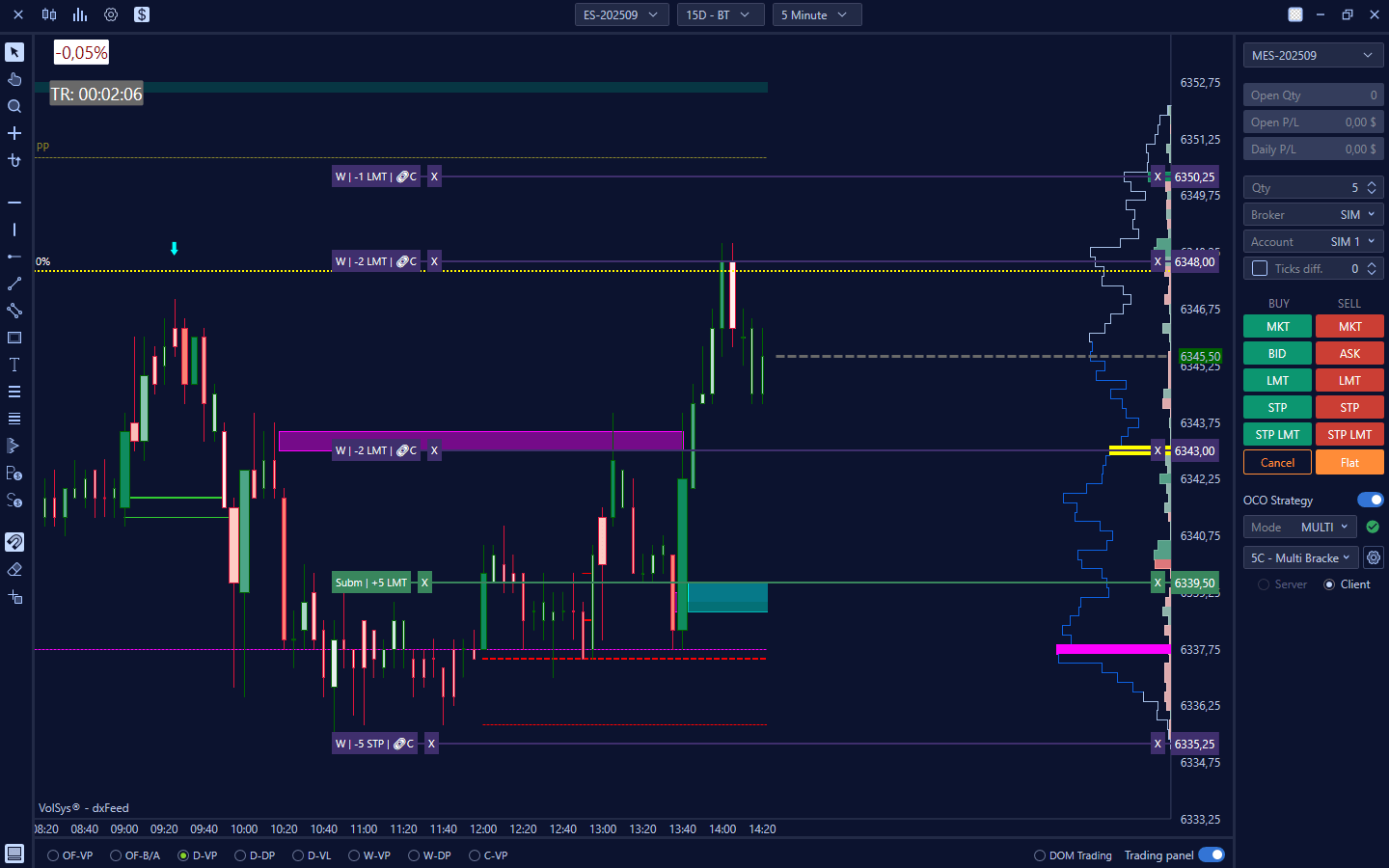

VolSys® is a professional trading platform whose main focus is Order Flow Analyzer, Volume Profile, Time & Sales and Order Flow analysis. We have developed many proprietary indicators based on our market experience and partner traders.

Use our unique and dedicated volumetric analysis tools!

With Volumetrica, you have a whole arsenal of technologies at your disposal, designed to give you a deeper, more accurate and informed reading of the market.

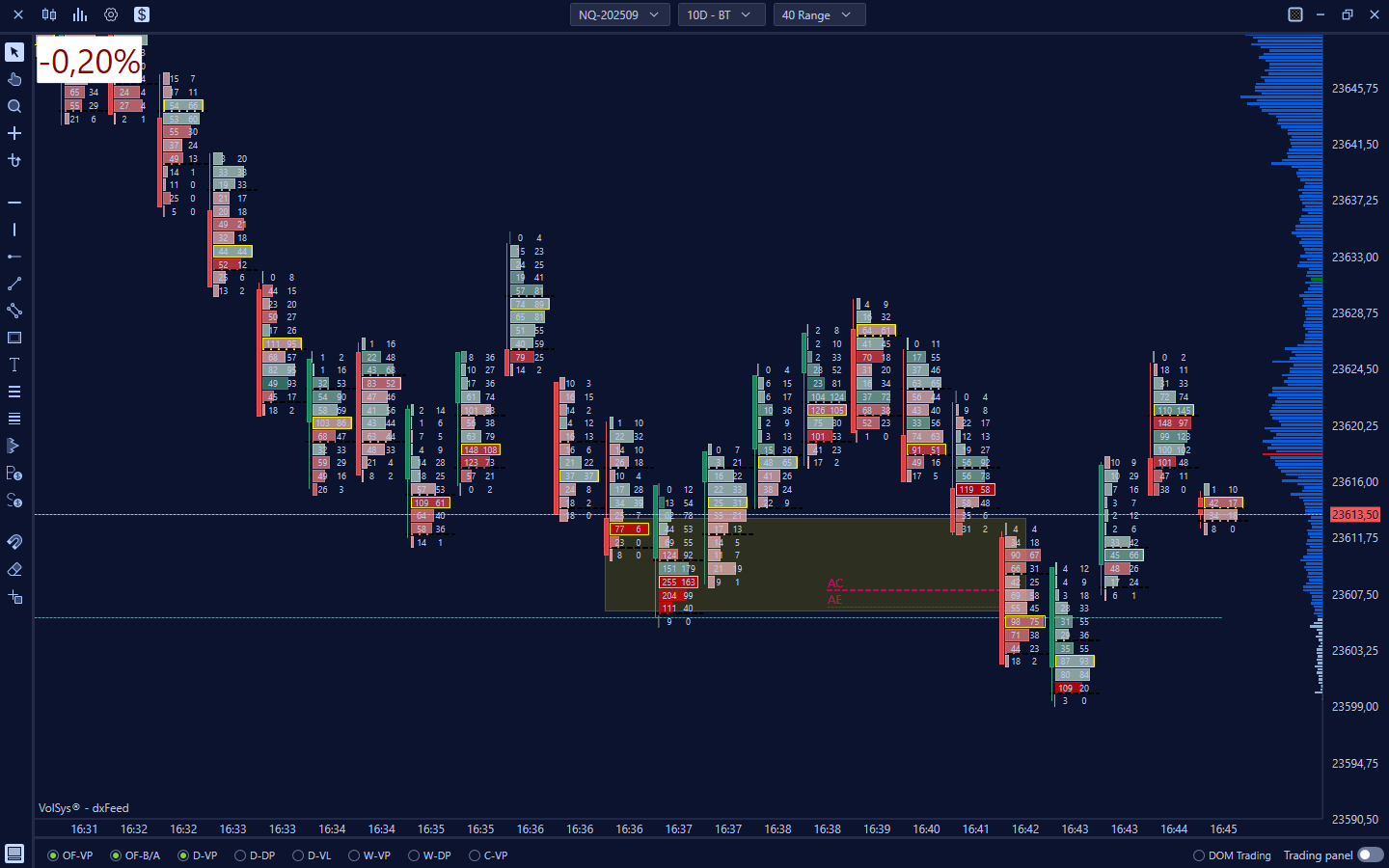

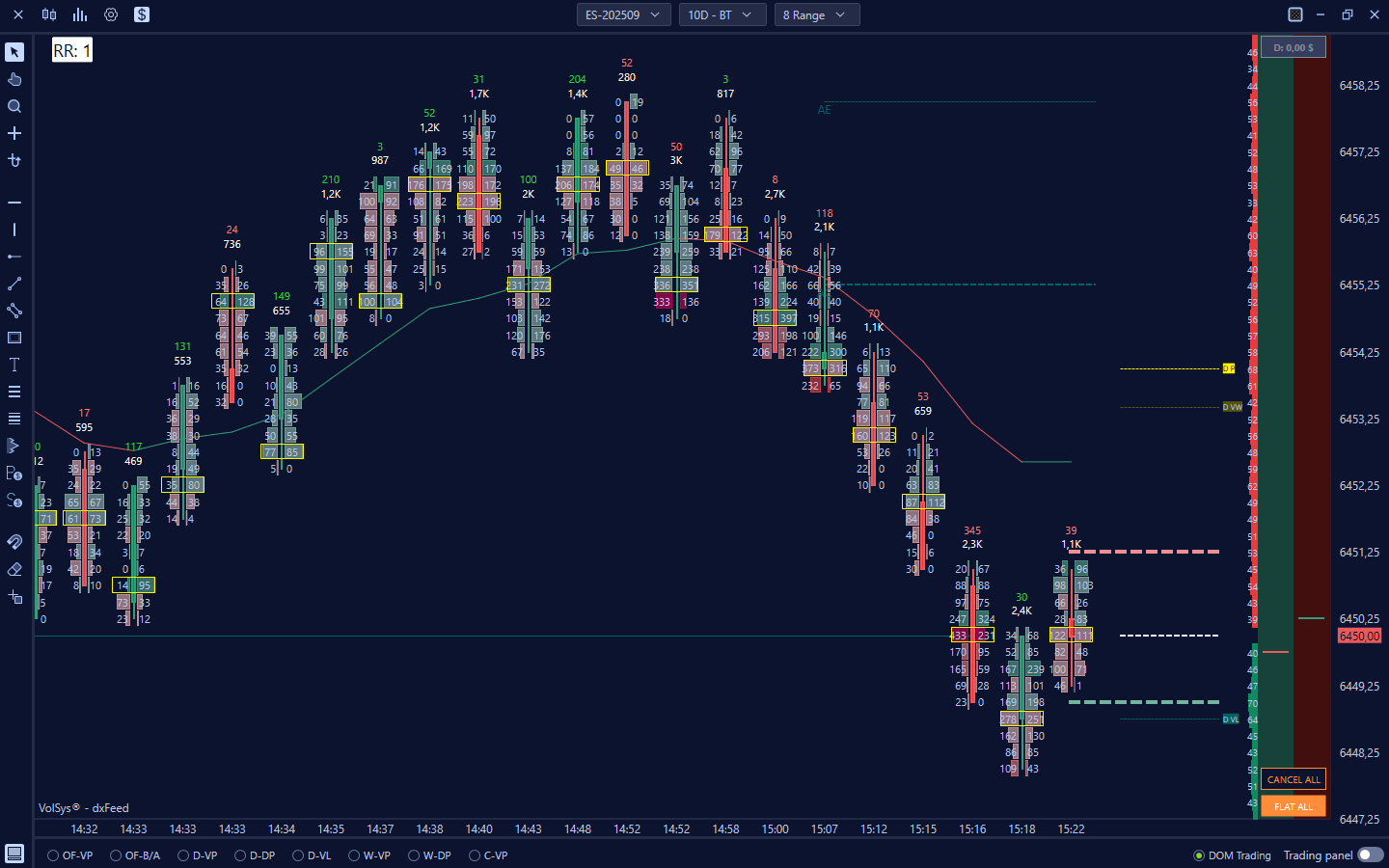

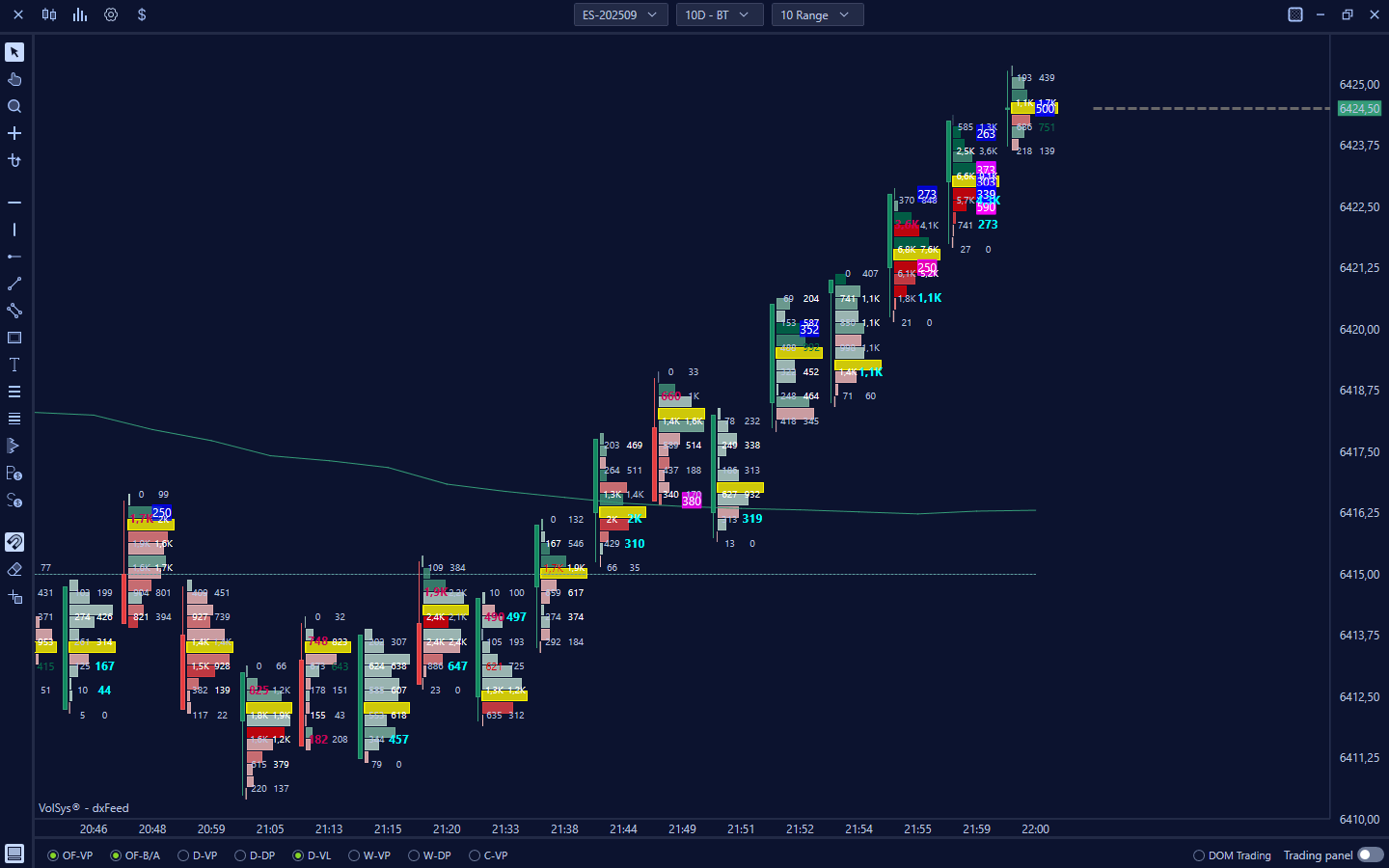

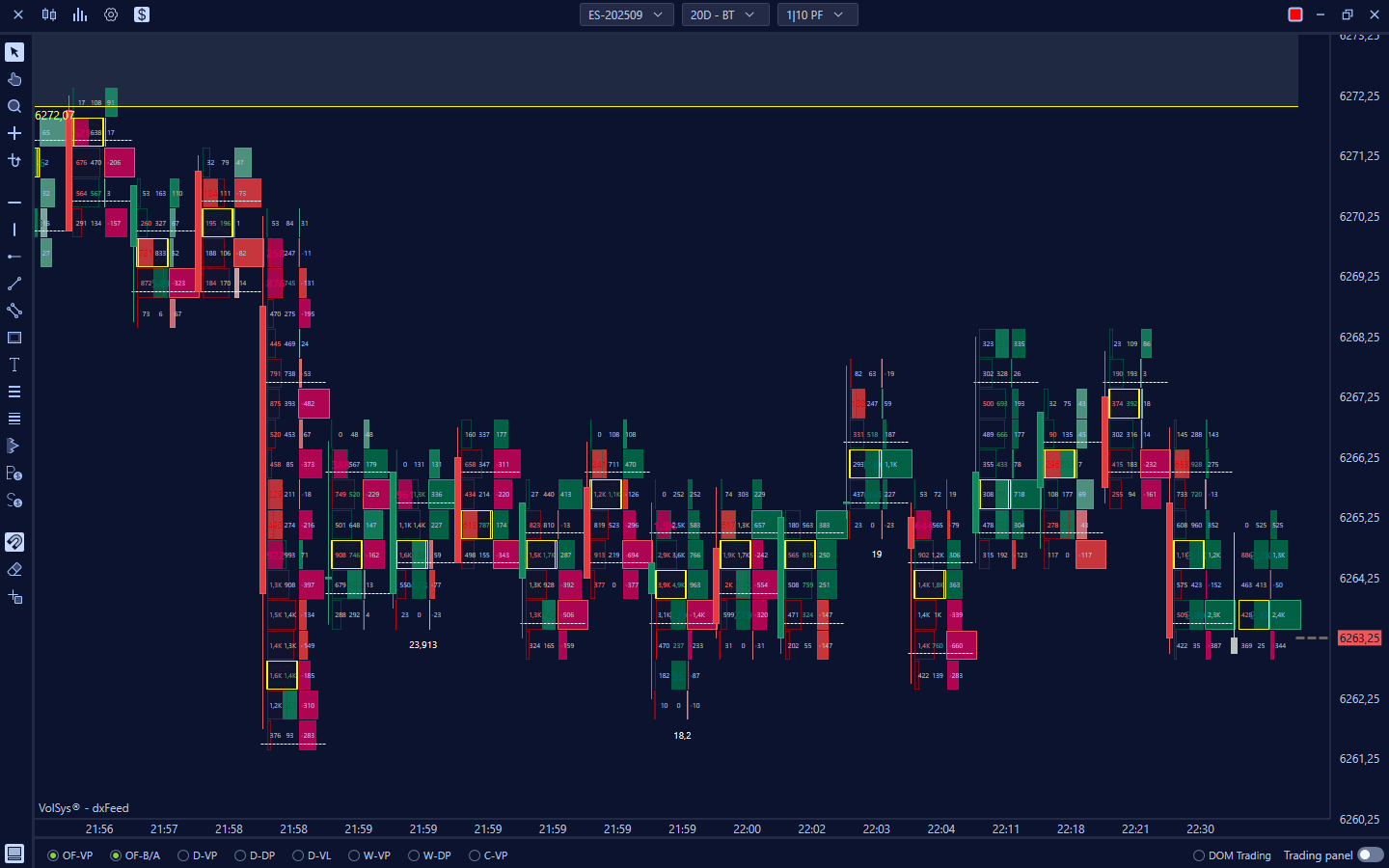

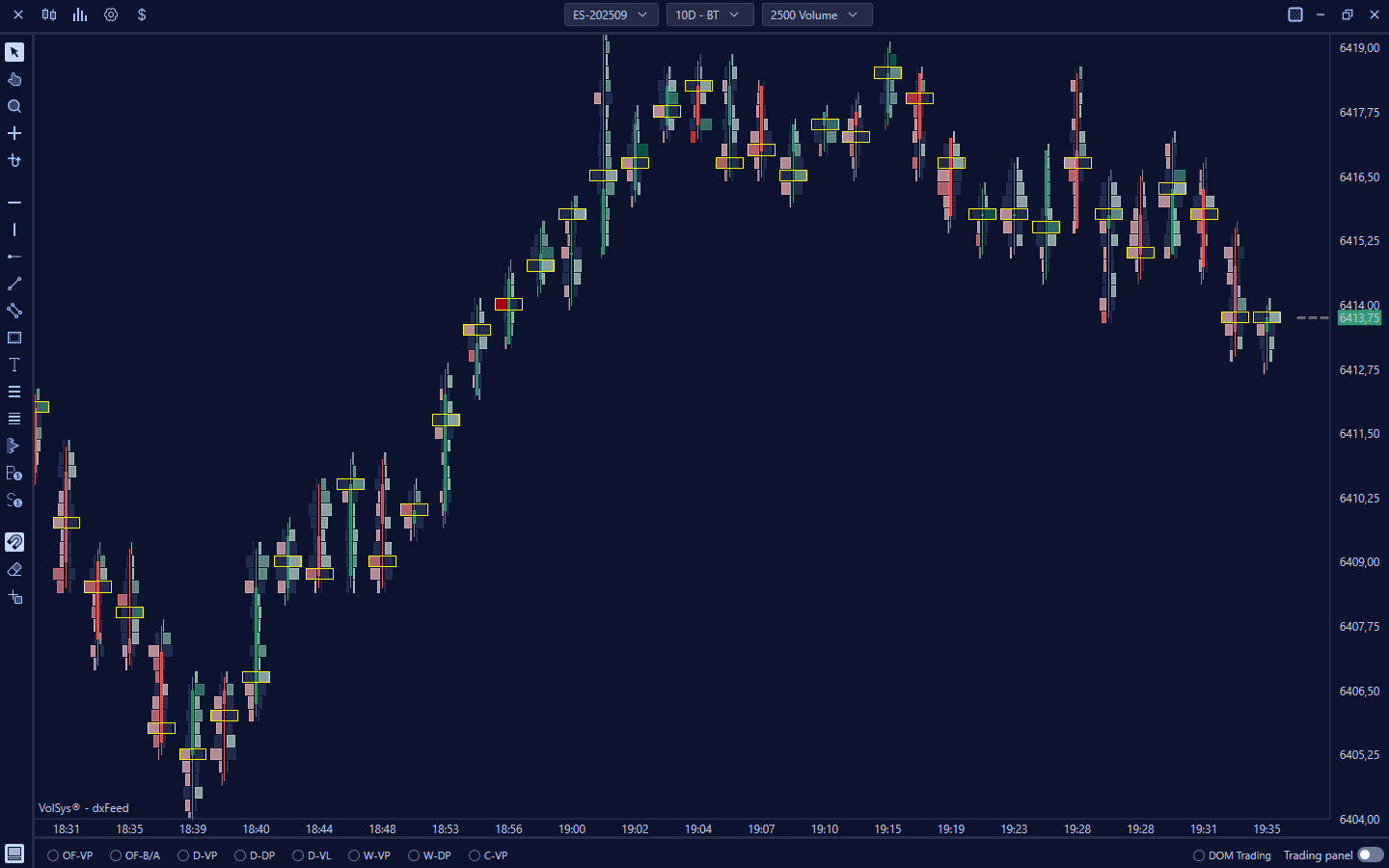

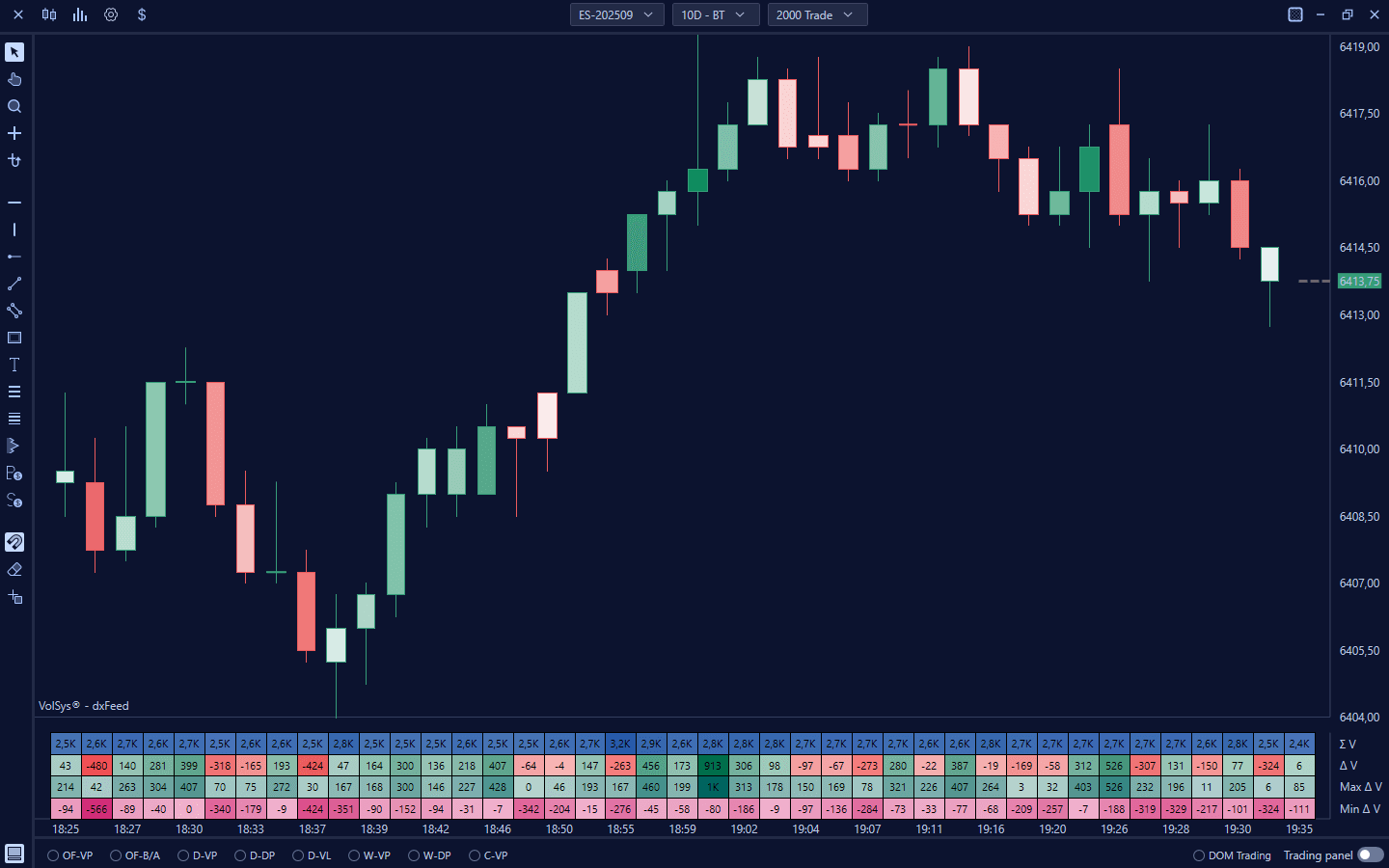

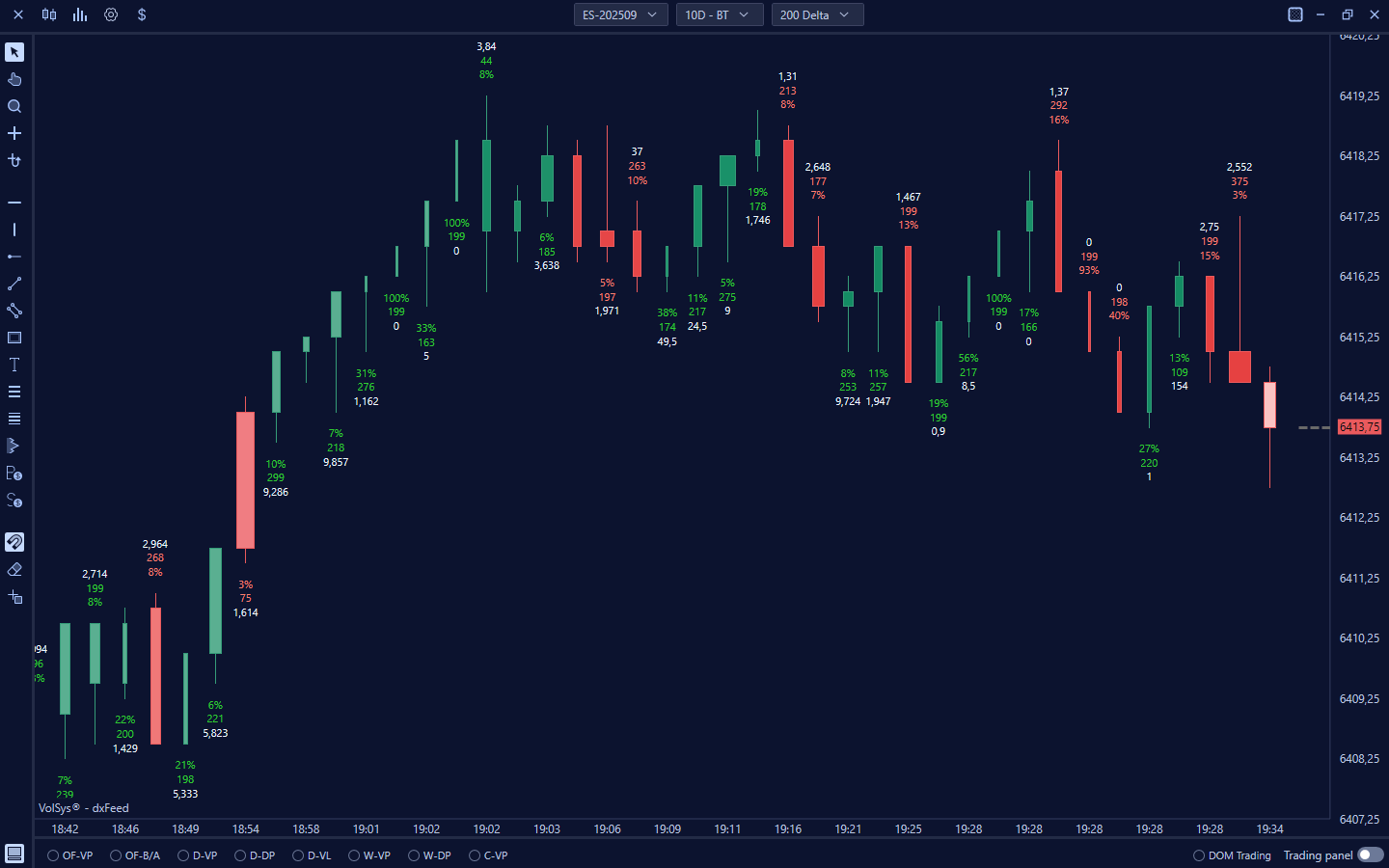

All the ways to "read" inside a candle!

With our platforms, you don't have to settle for just seeing the price. We offer a multitude of variations for viewing clusters, allowing you to look inside each individual bar.

The Market Analysis Revolution has Arrived!

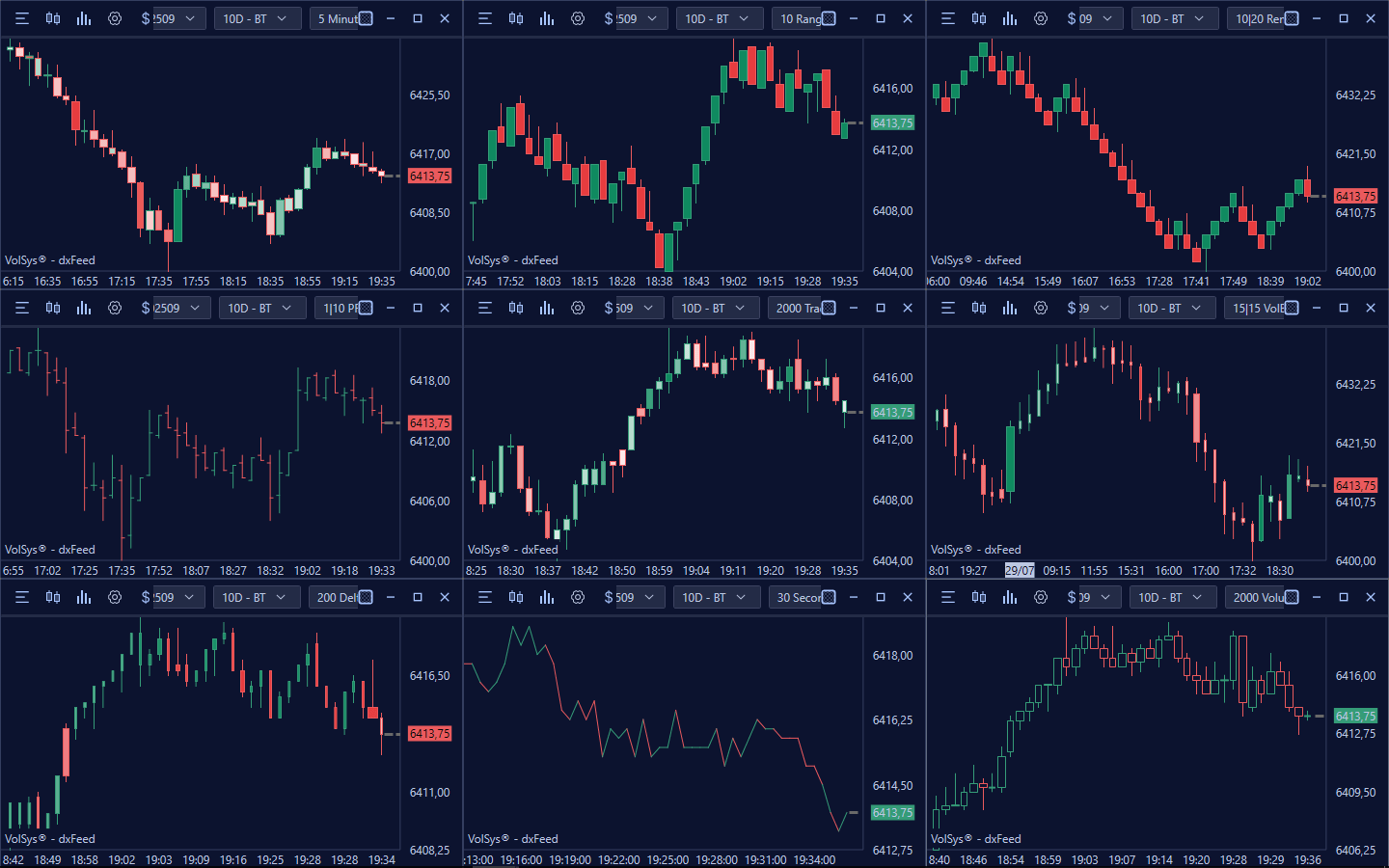

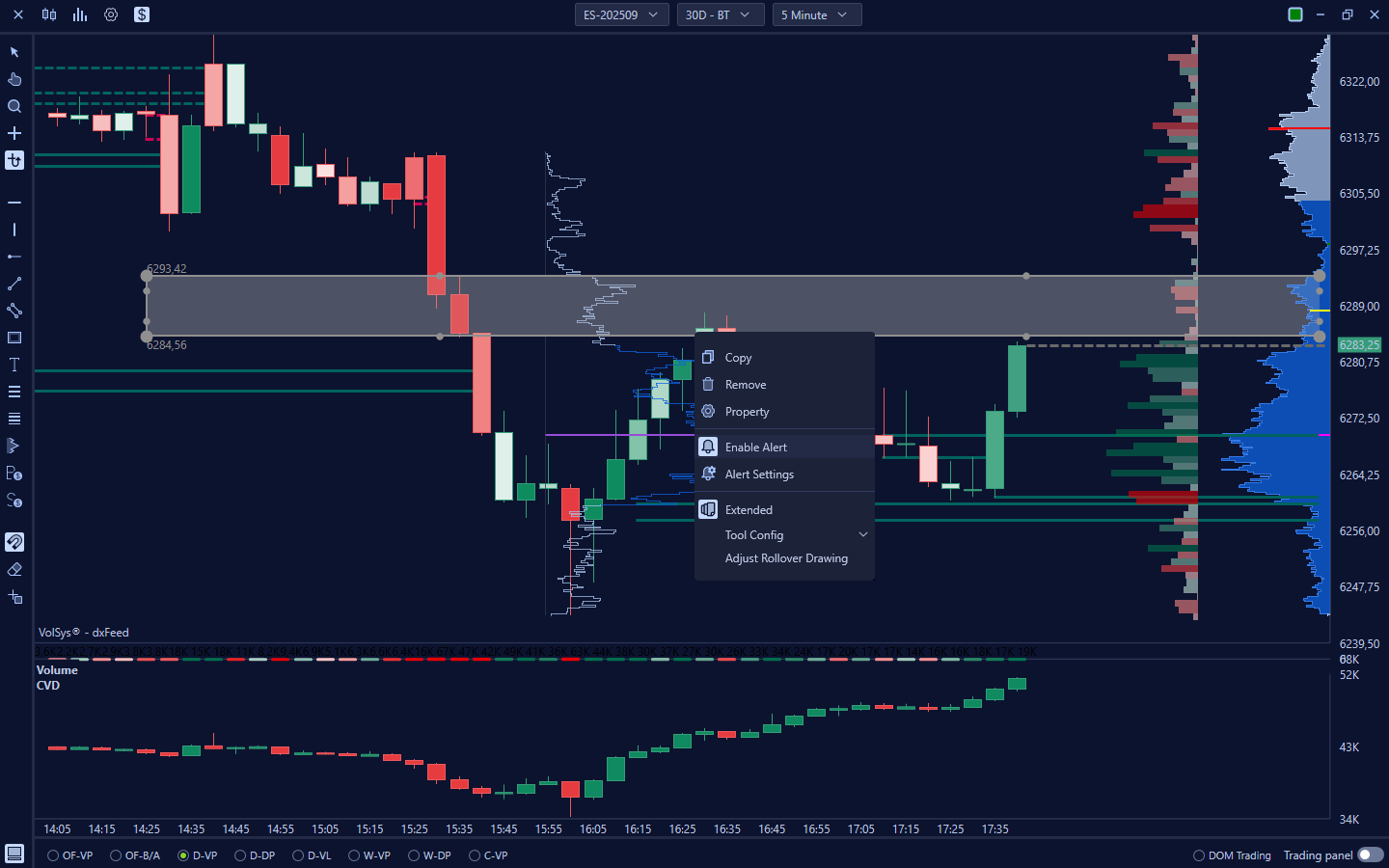

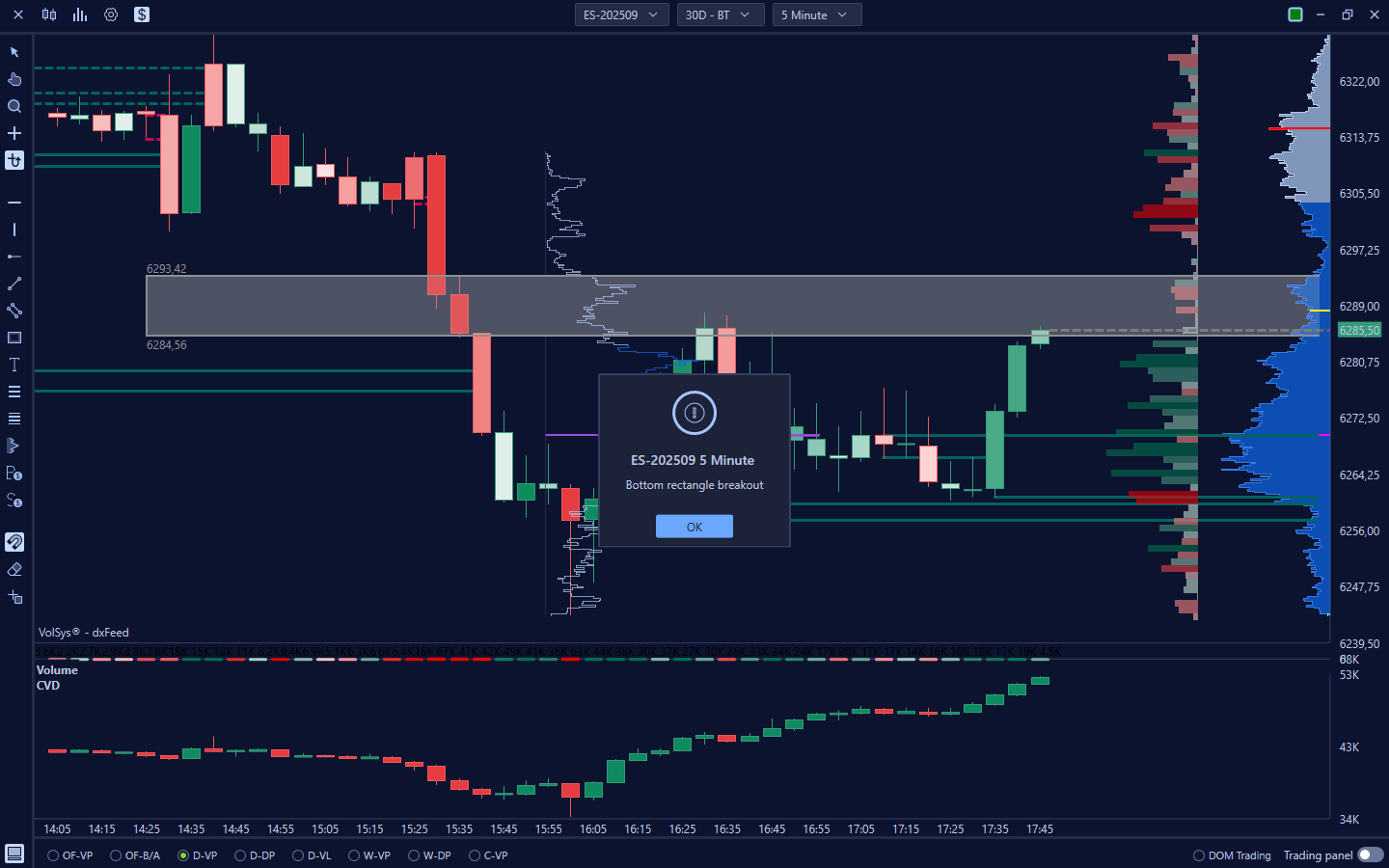

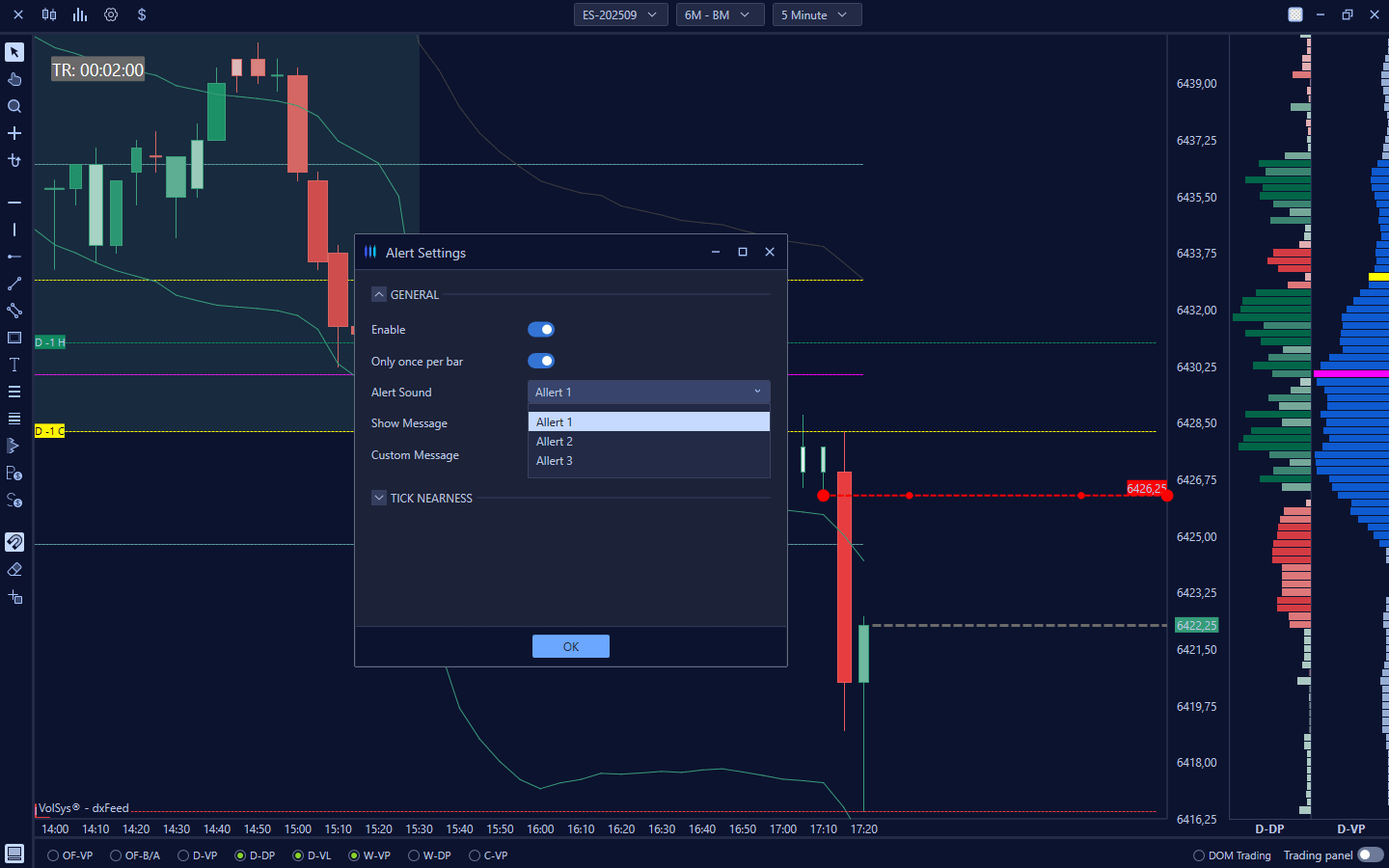

Let's put an end to compromise: with our platforms, you have a full arsenal of market analyzers at your disposal. From the most classic tools to those we have created exclusively, every single resource is available to you in a single, very powerful workspace.

Let's put an end to compromise: with our platforms, you have a full arsenal of market analyzers at your disposal. From the most classic tools to those we have created exclusively, every single resource is available to you in a single, very powerful workspace.

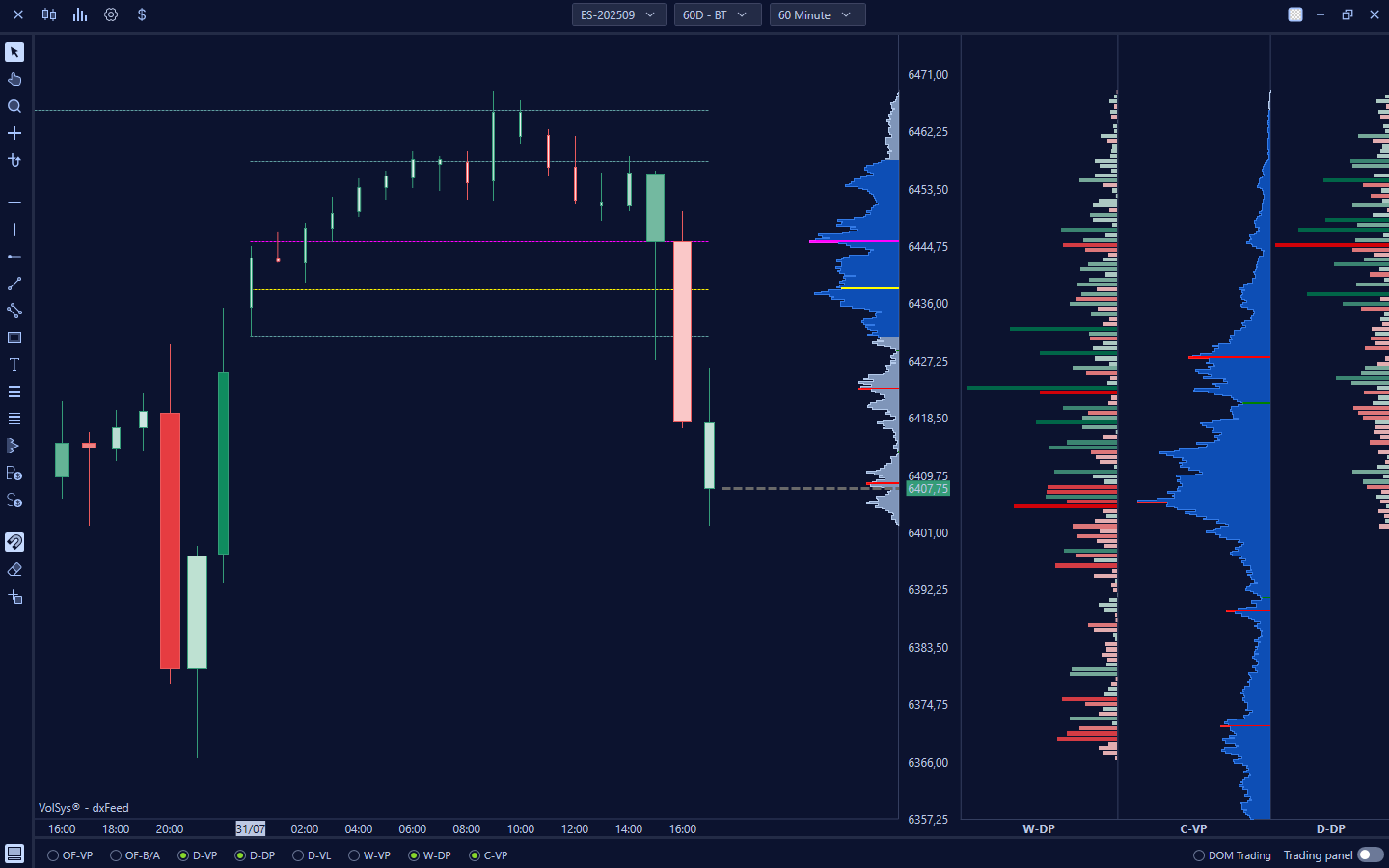

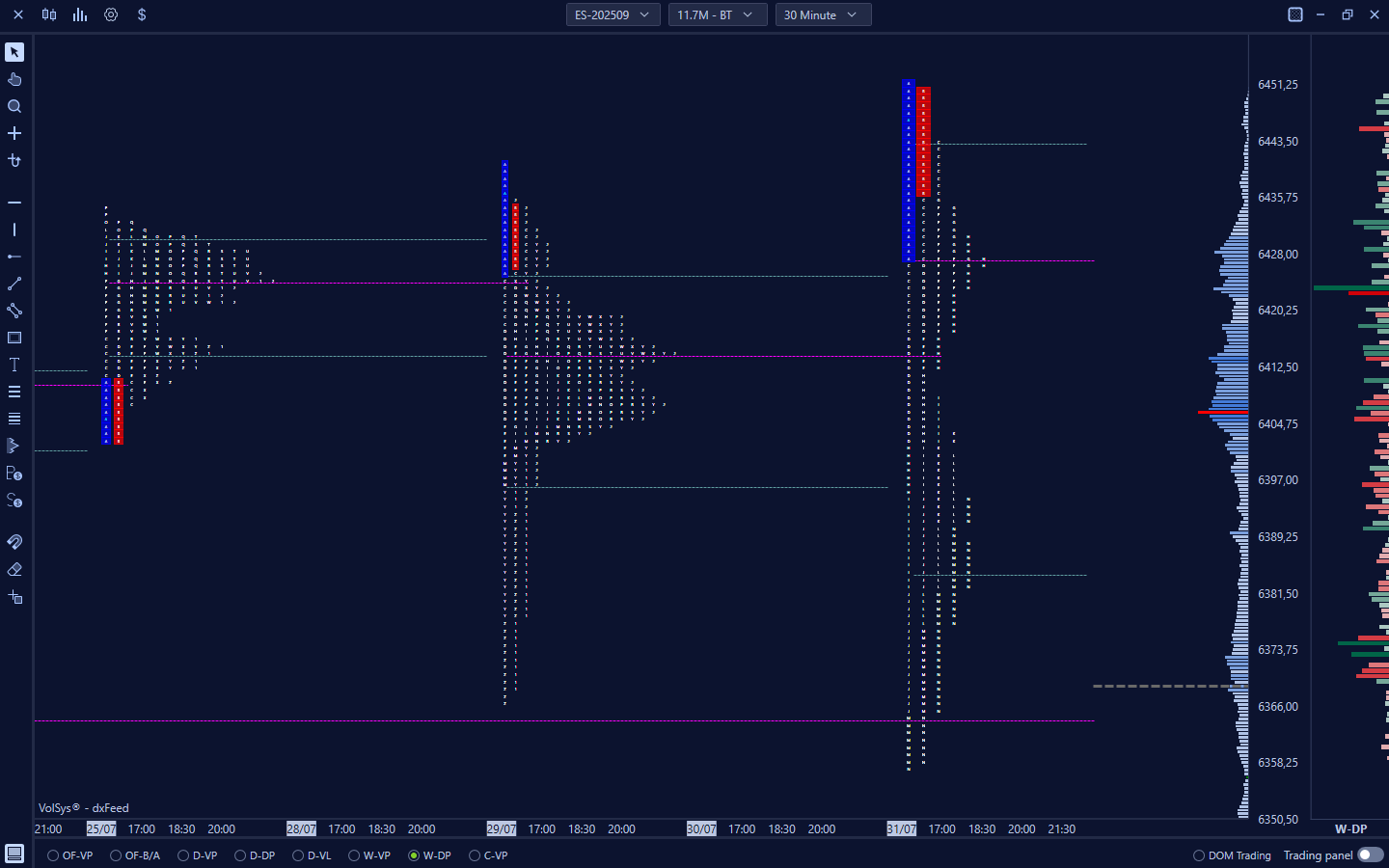

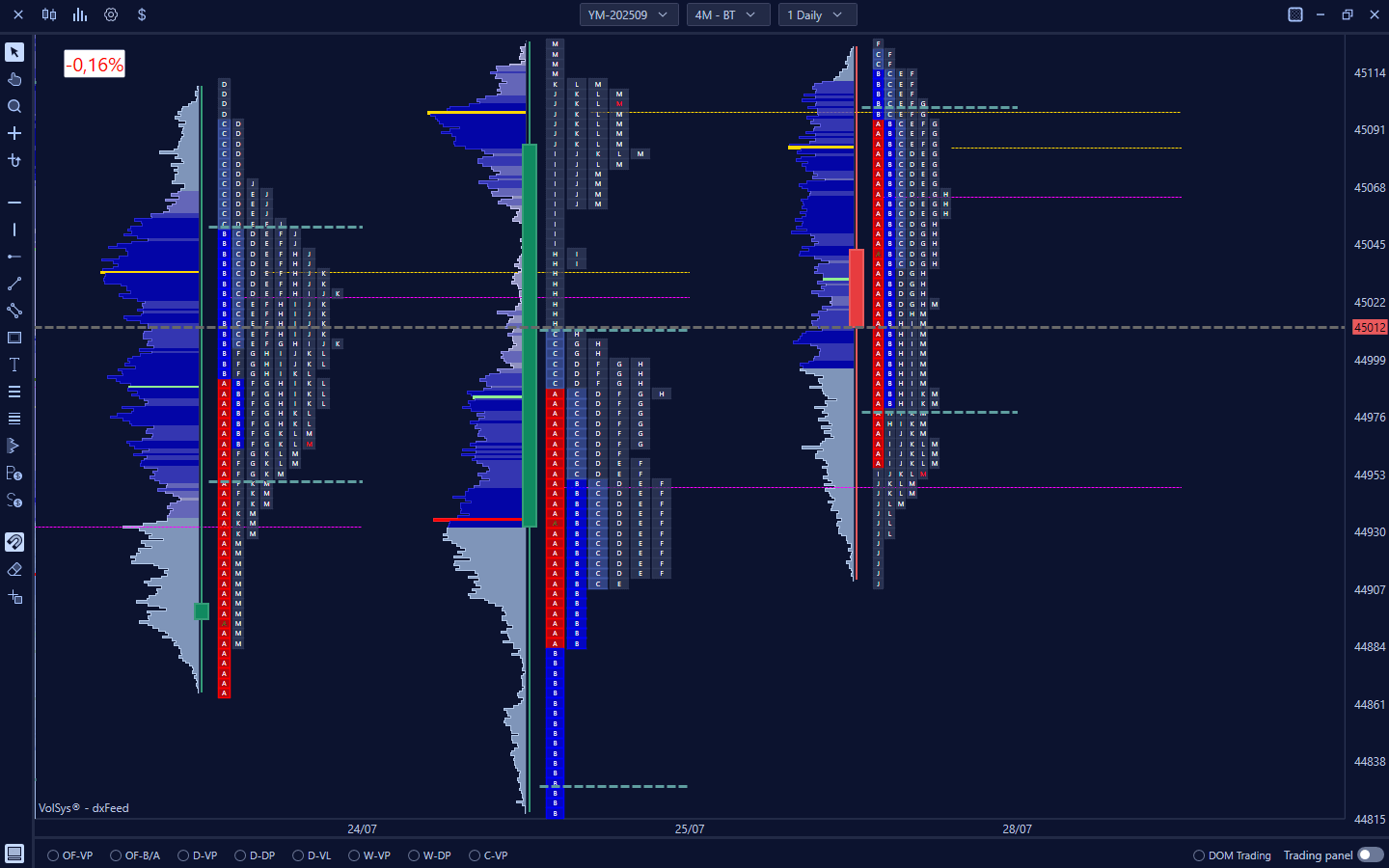

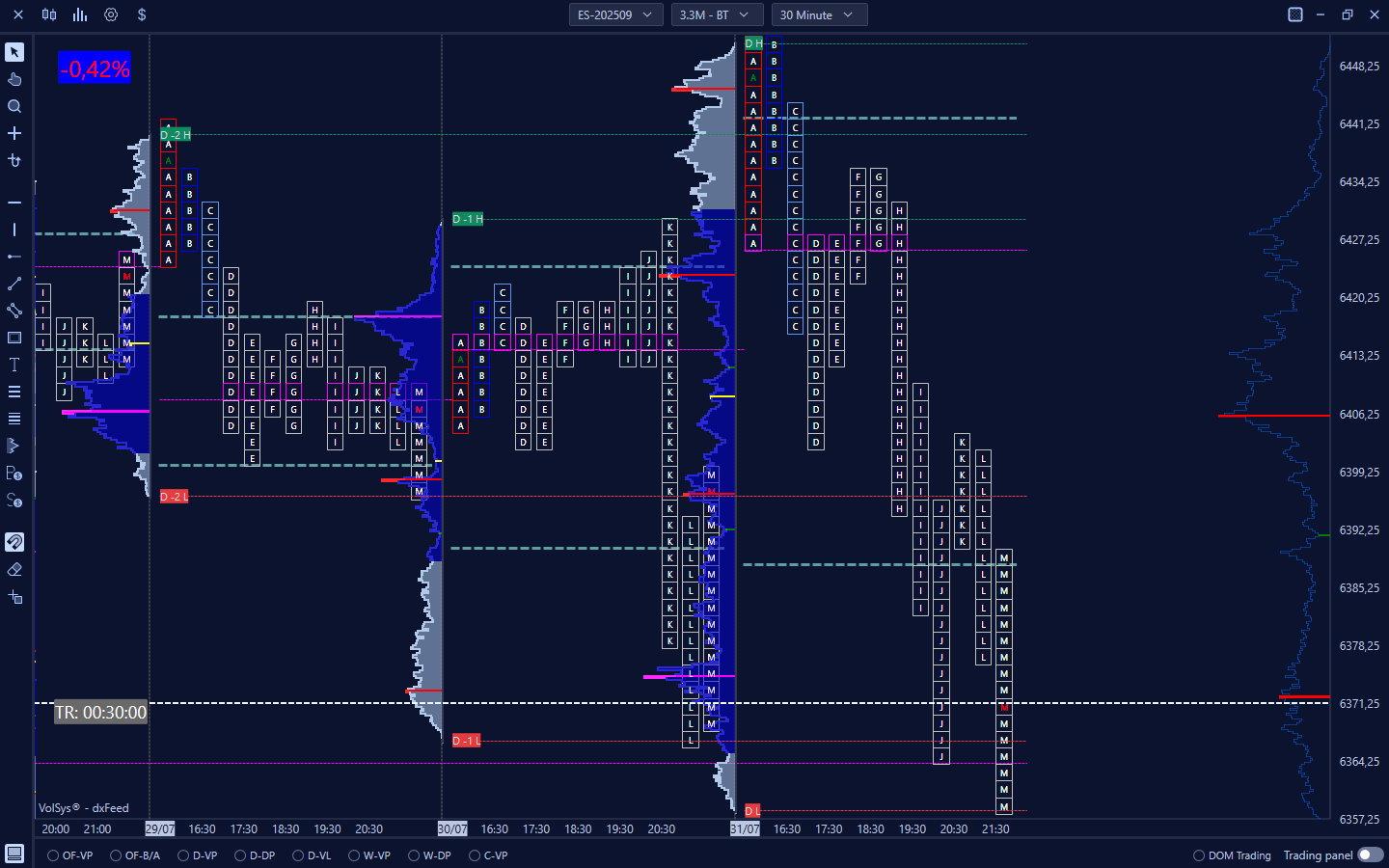

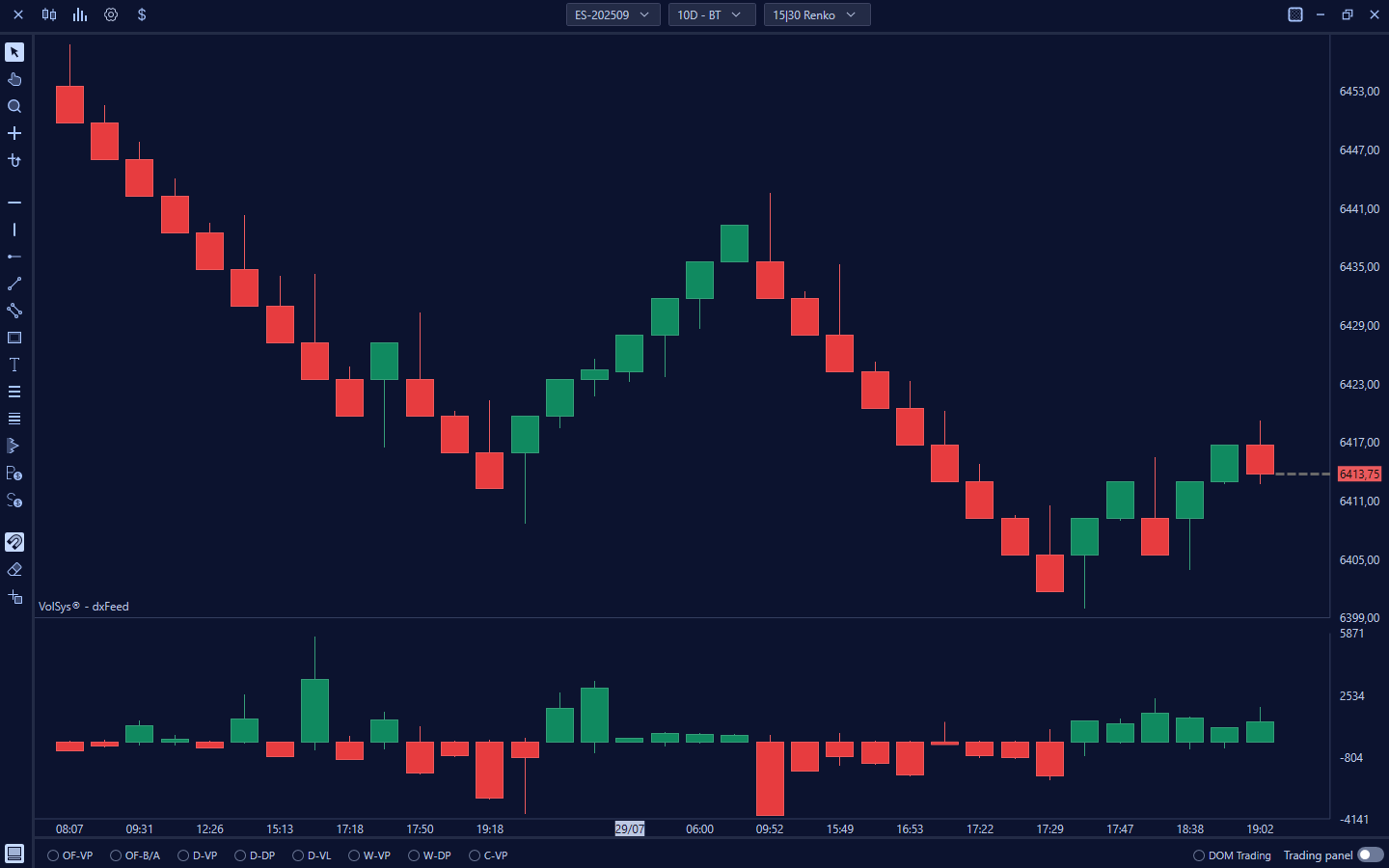

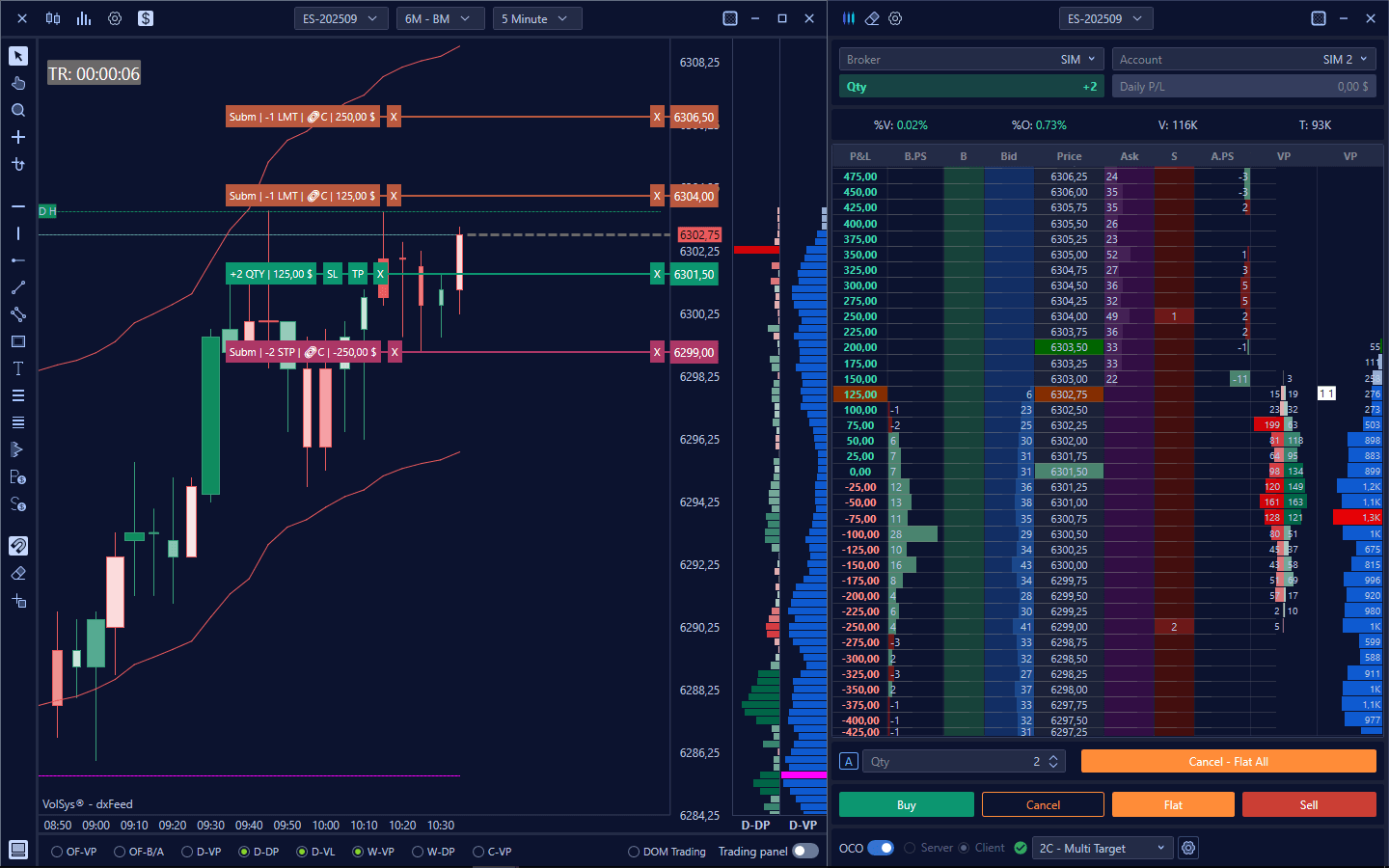

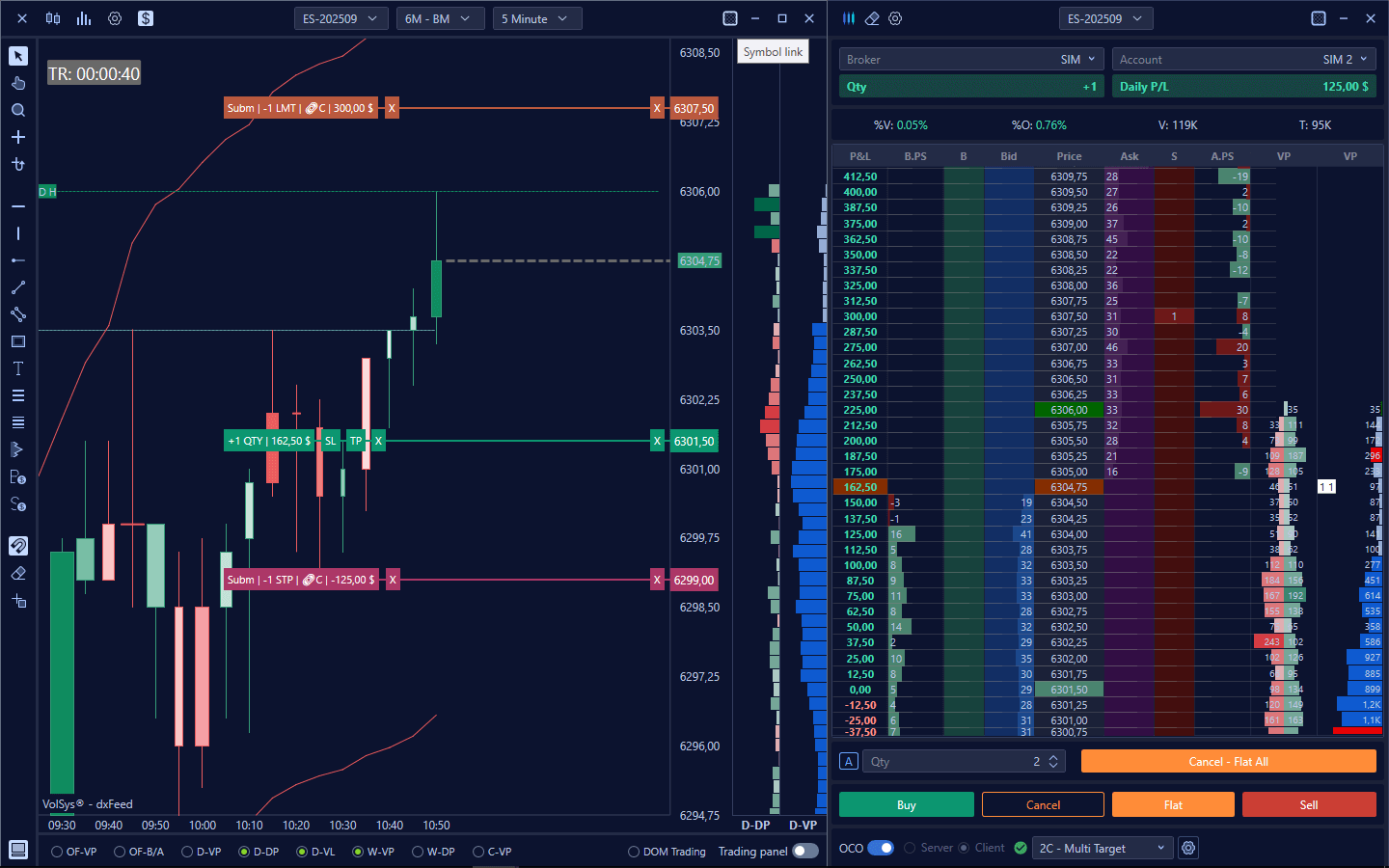

Volume Charting

Charting Analytics

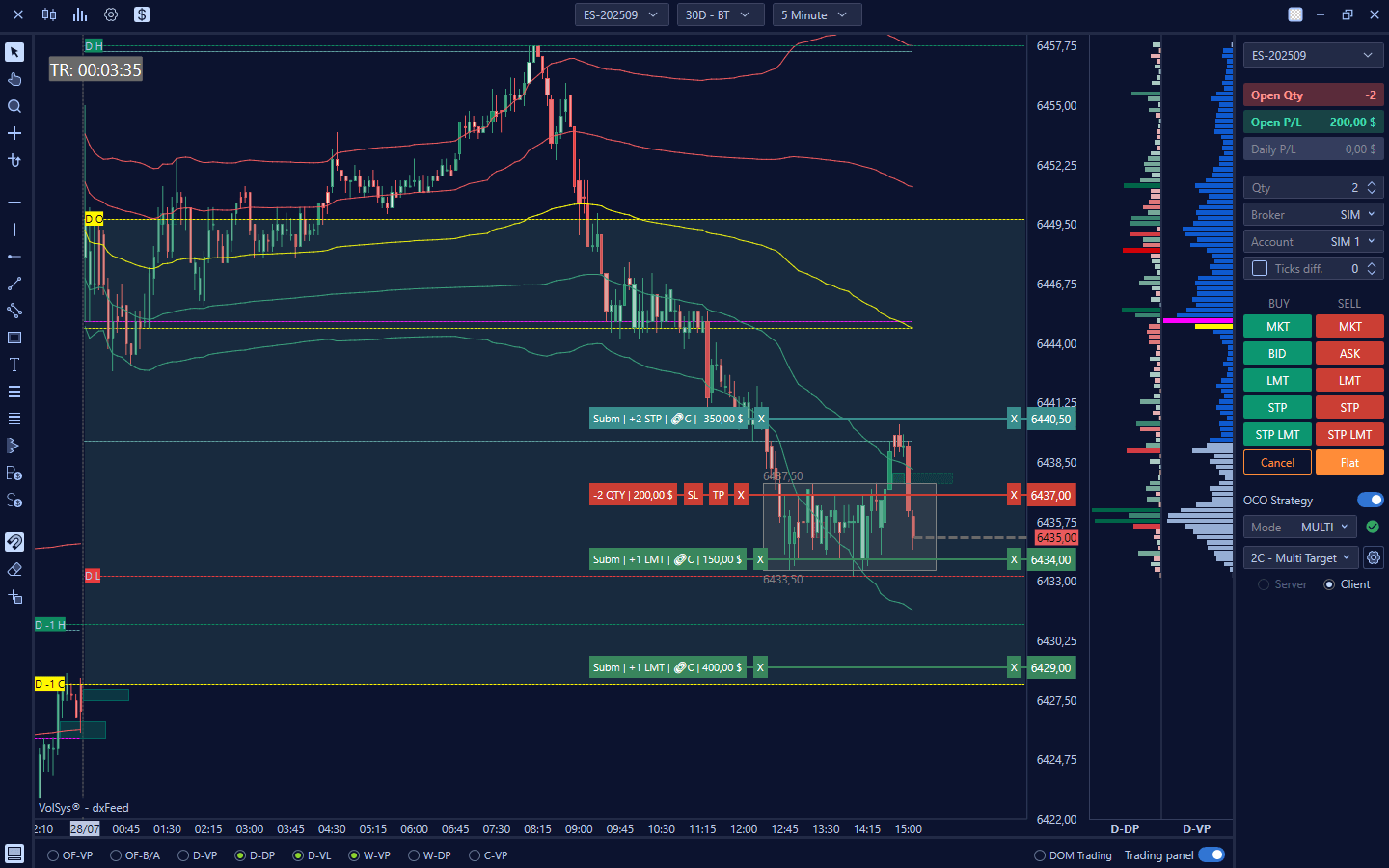

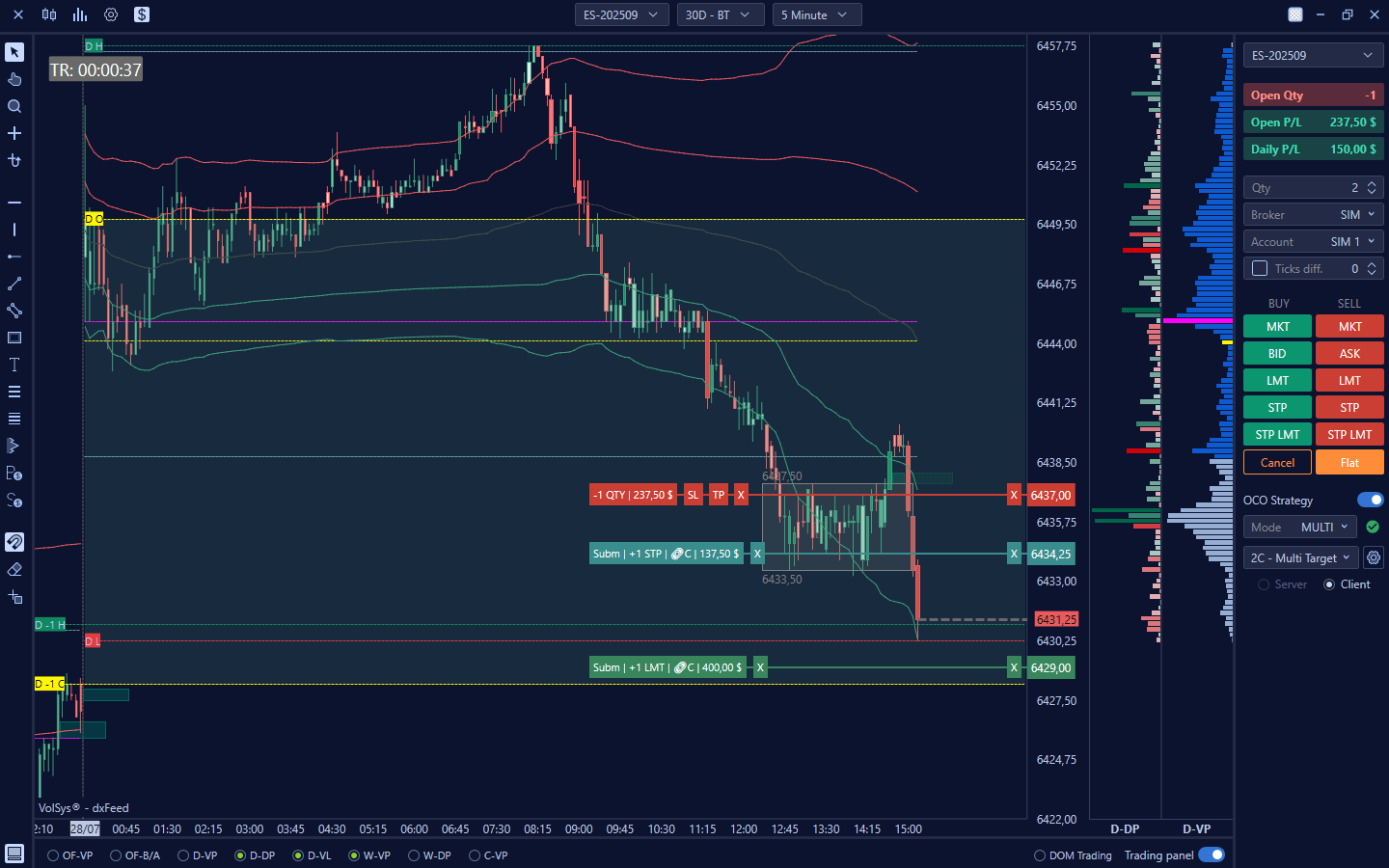

Order Execution

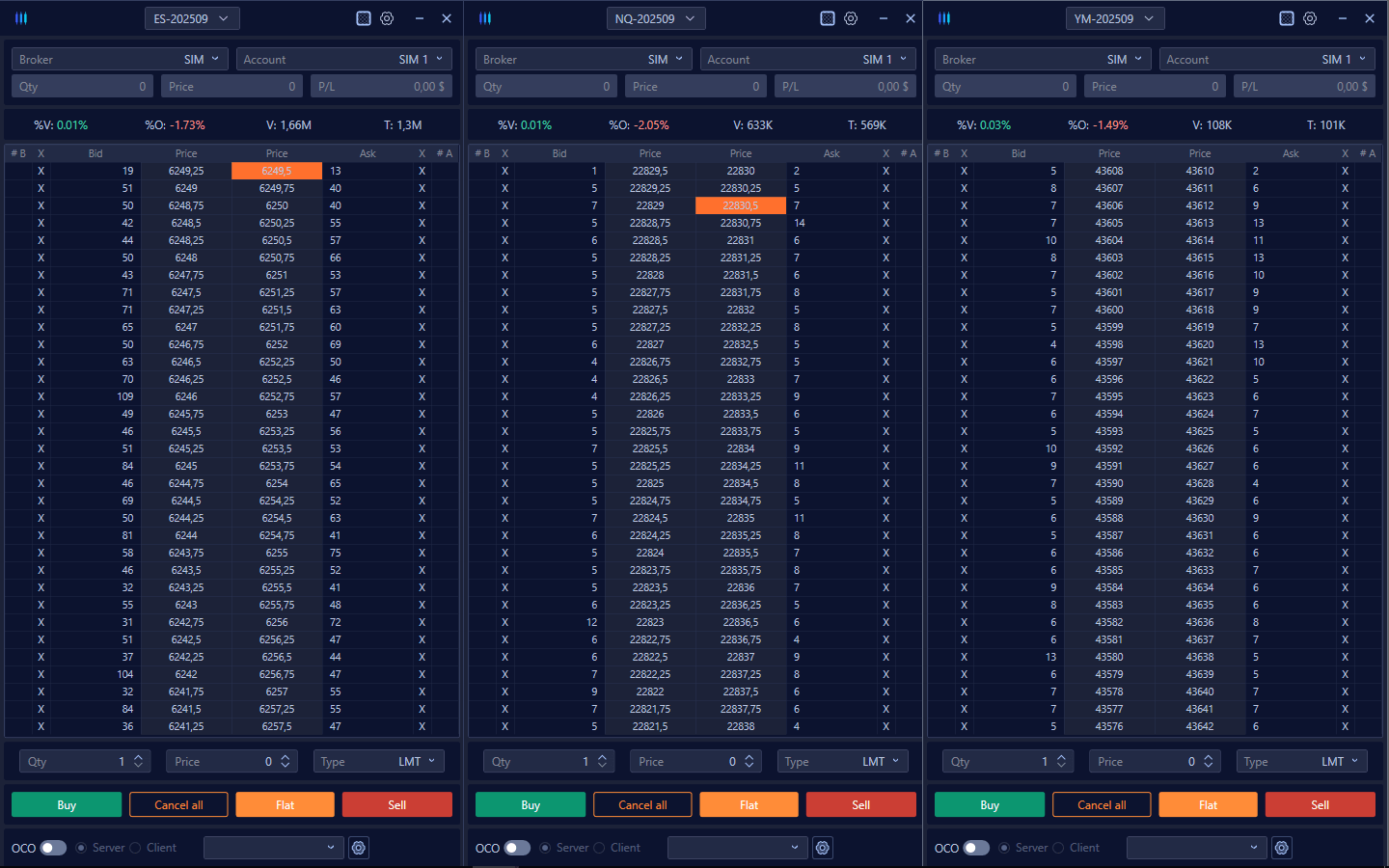

Book

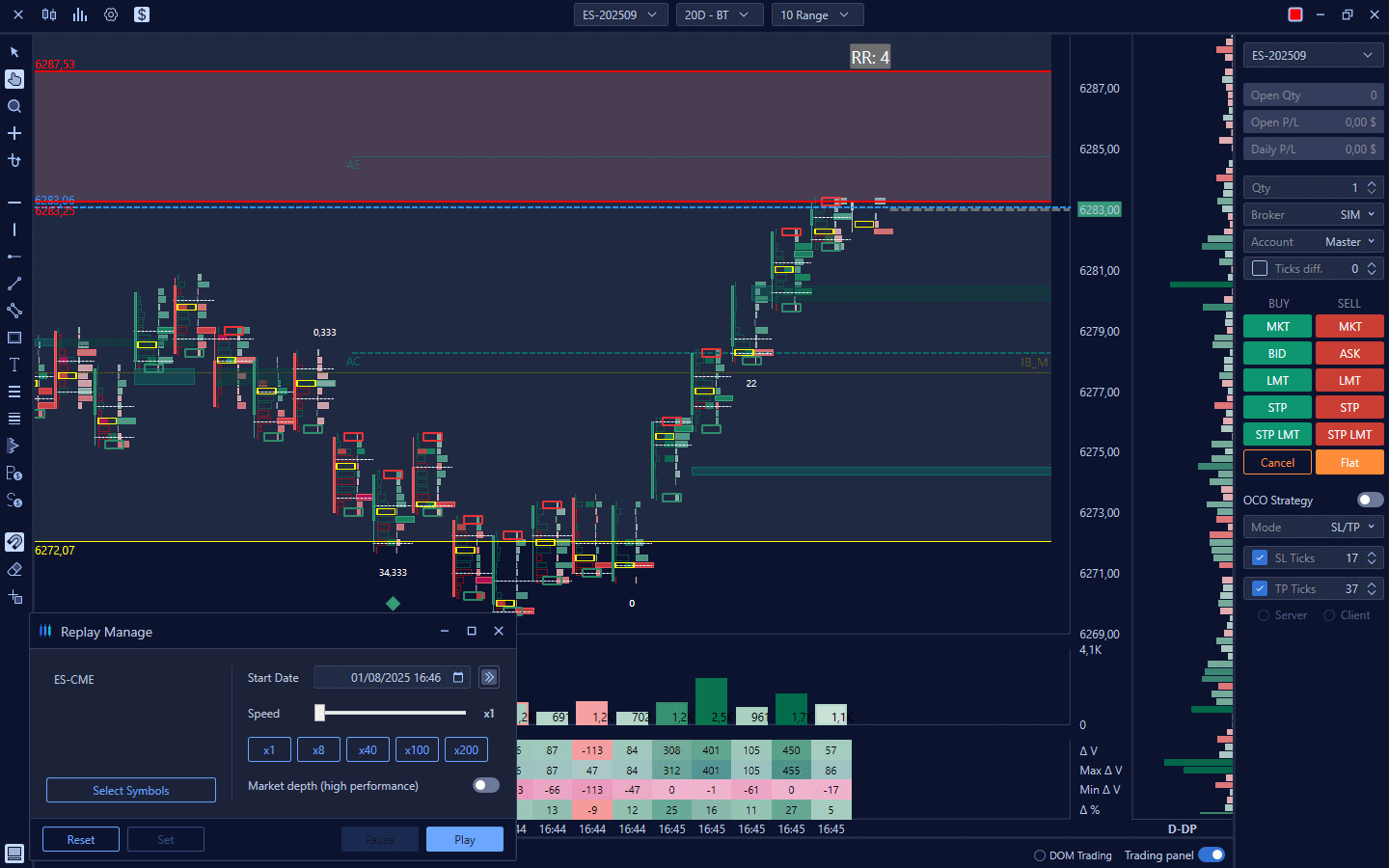

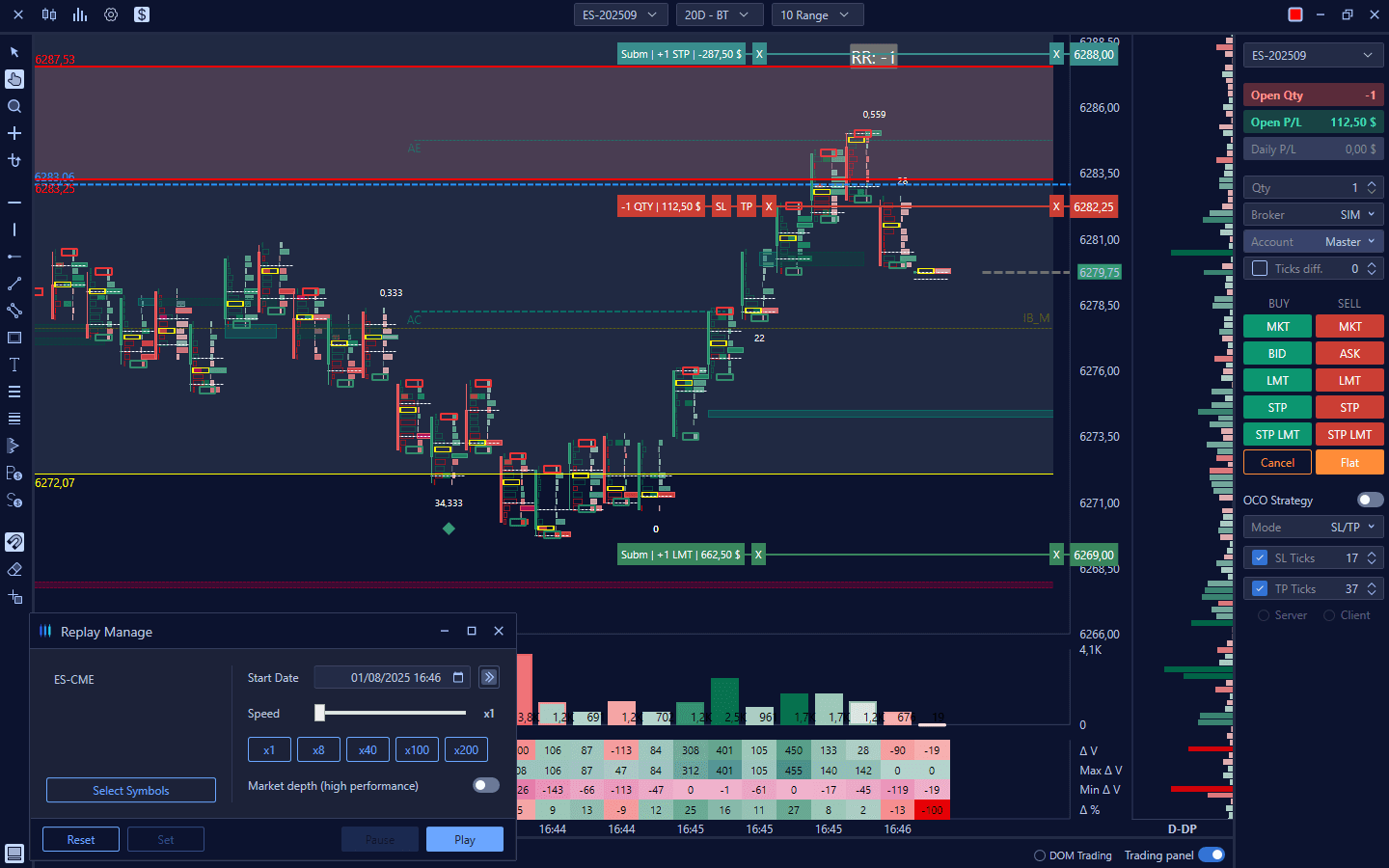

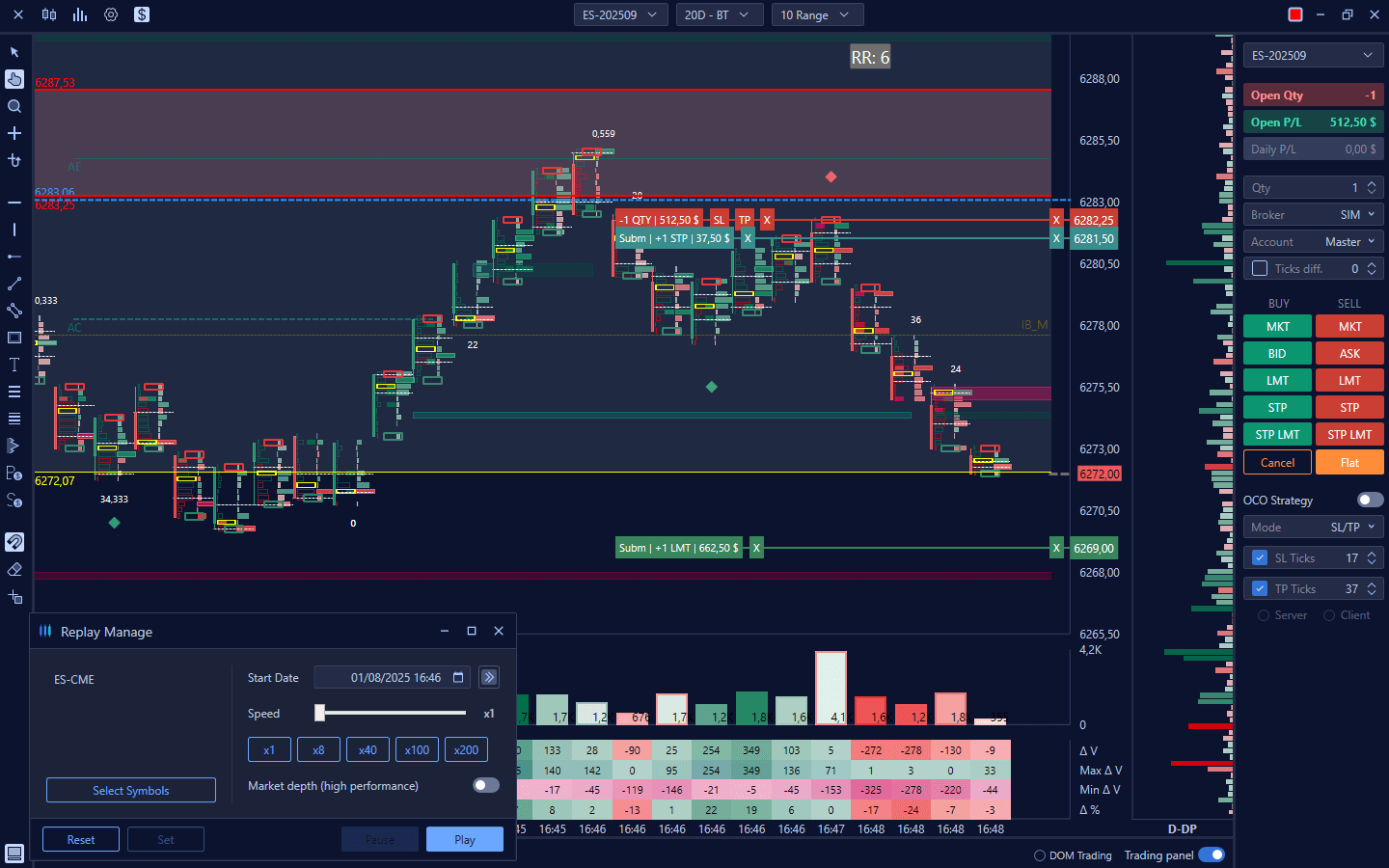

Replay tick data

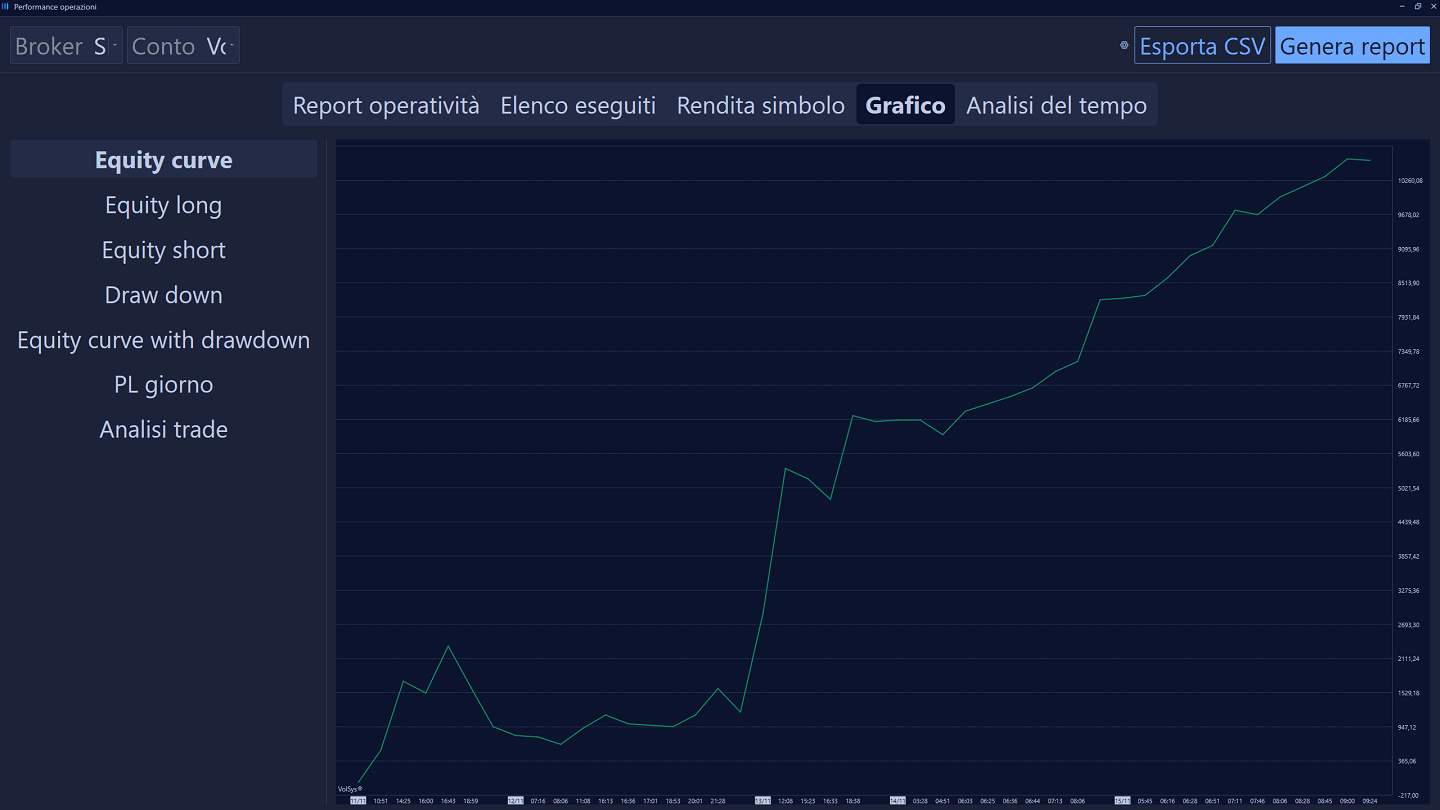

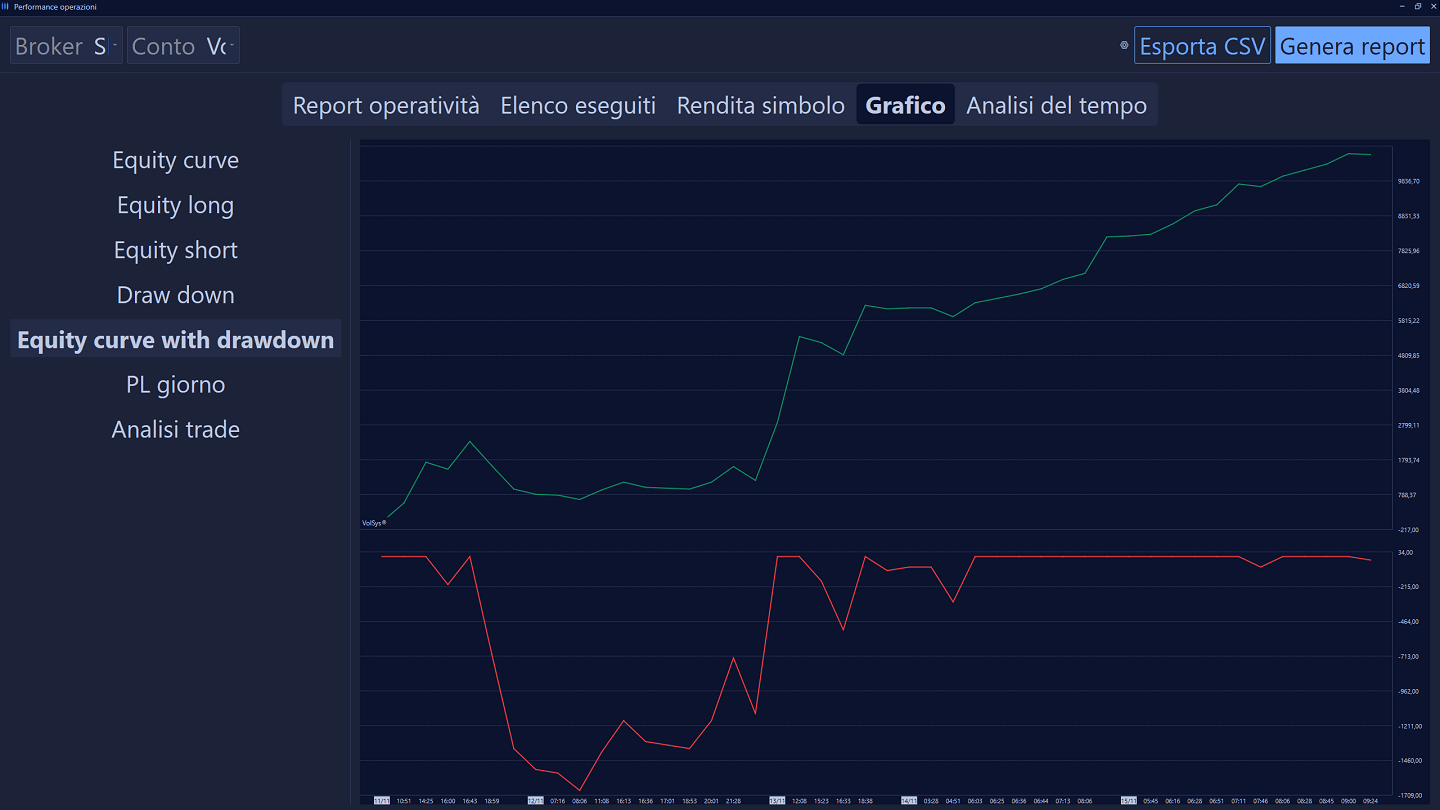

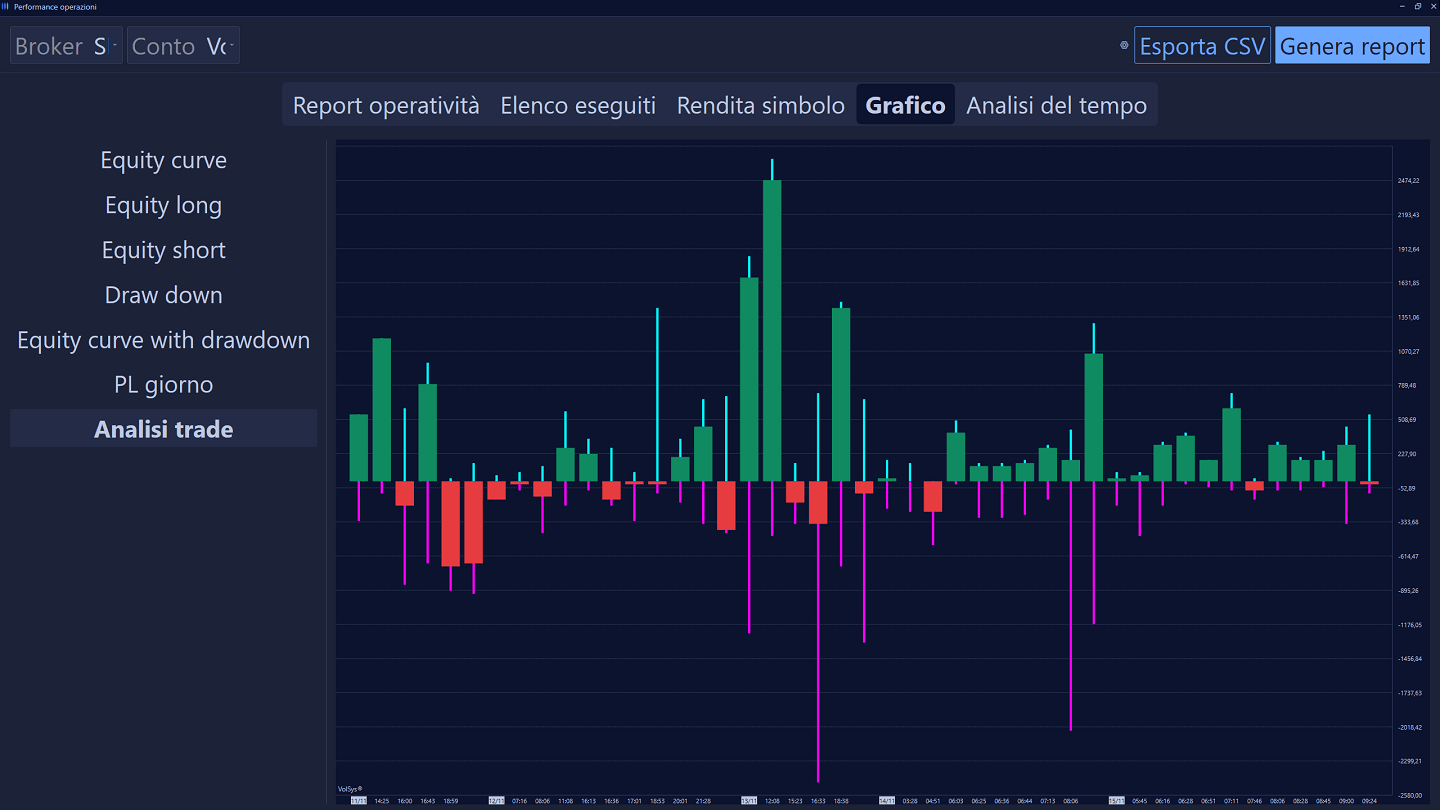

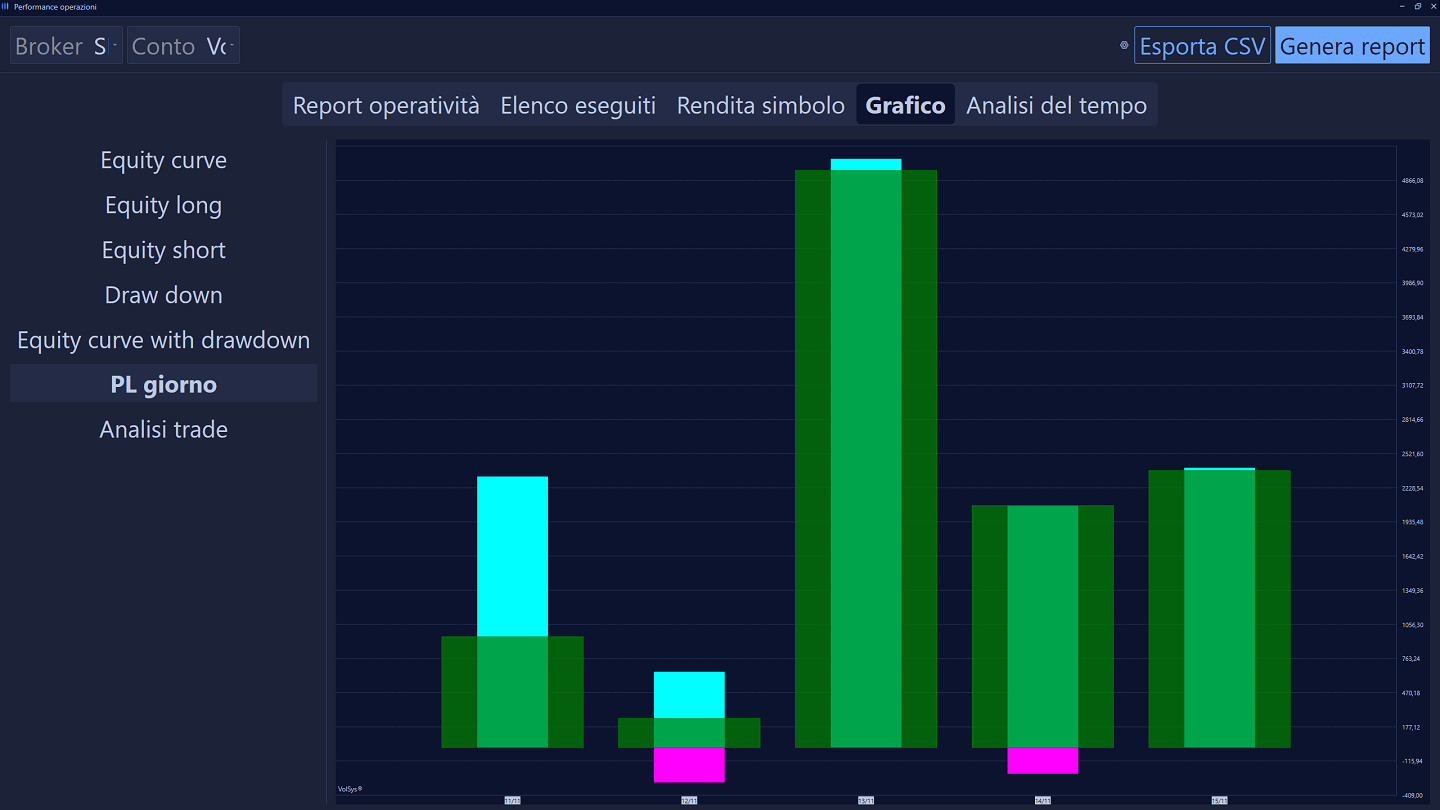

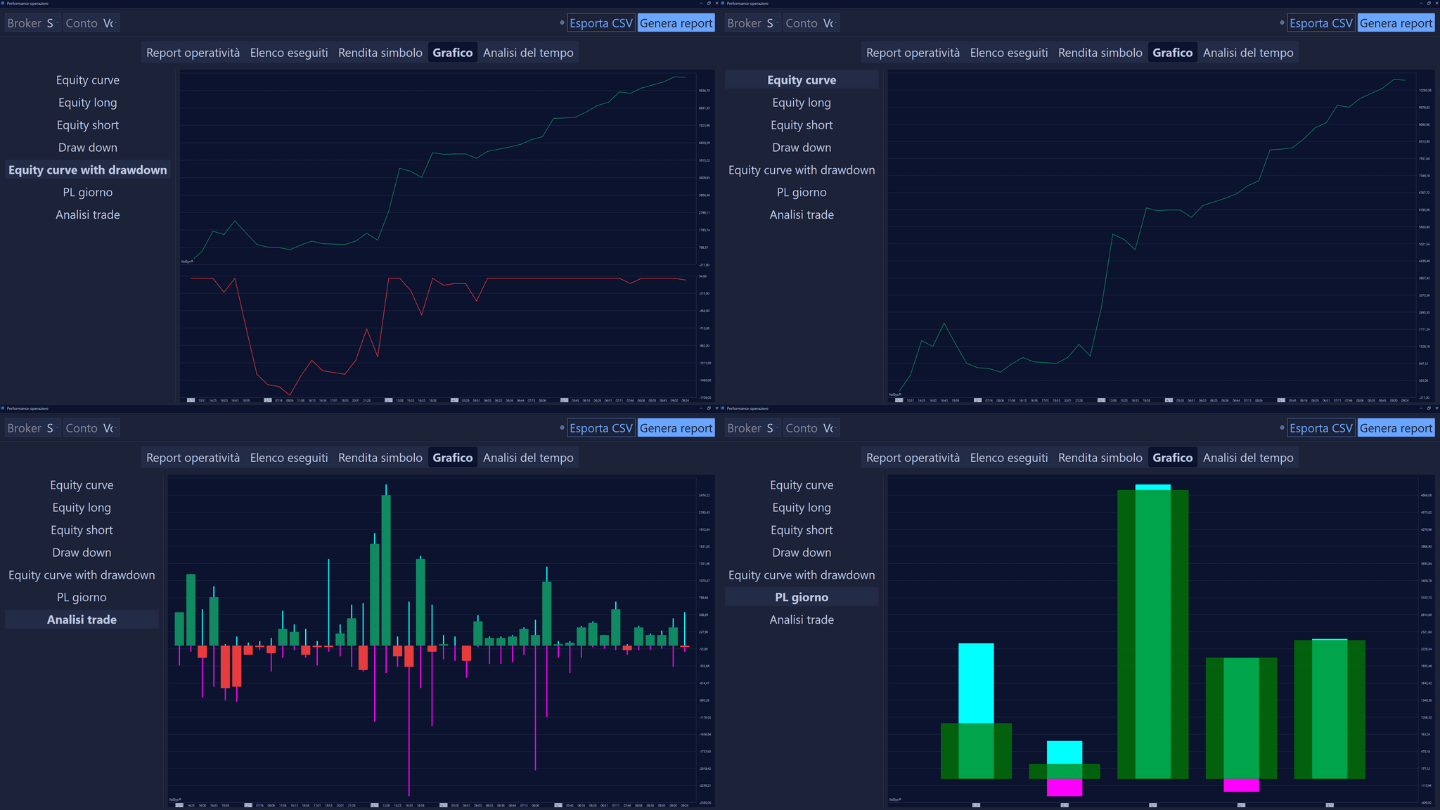

The Replay Tick Data feature allows you to relive past market sessions, tick by tick, simulating real-time observation. You can pause, rewind or speed up, controlling the time dynamics. It is great for executing trades in simulation, without risk. It is a useful tool both for beginners to familiarize themselves with order flow and for experts who want to test and refine strategies (discretionary backtest) in real scenarios, including high volatility. It also allows new instruments to be studied. At the end, a detailed report with statistics such as equity line, drawdown, percentage of winning trades, and risk/return ratio helps you objectively evaluate and improve your trading, building a solid and measurable approach to trading.

Start now

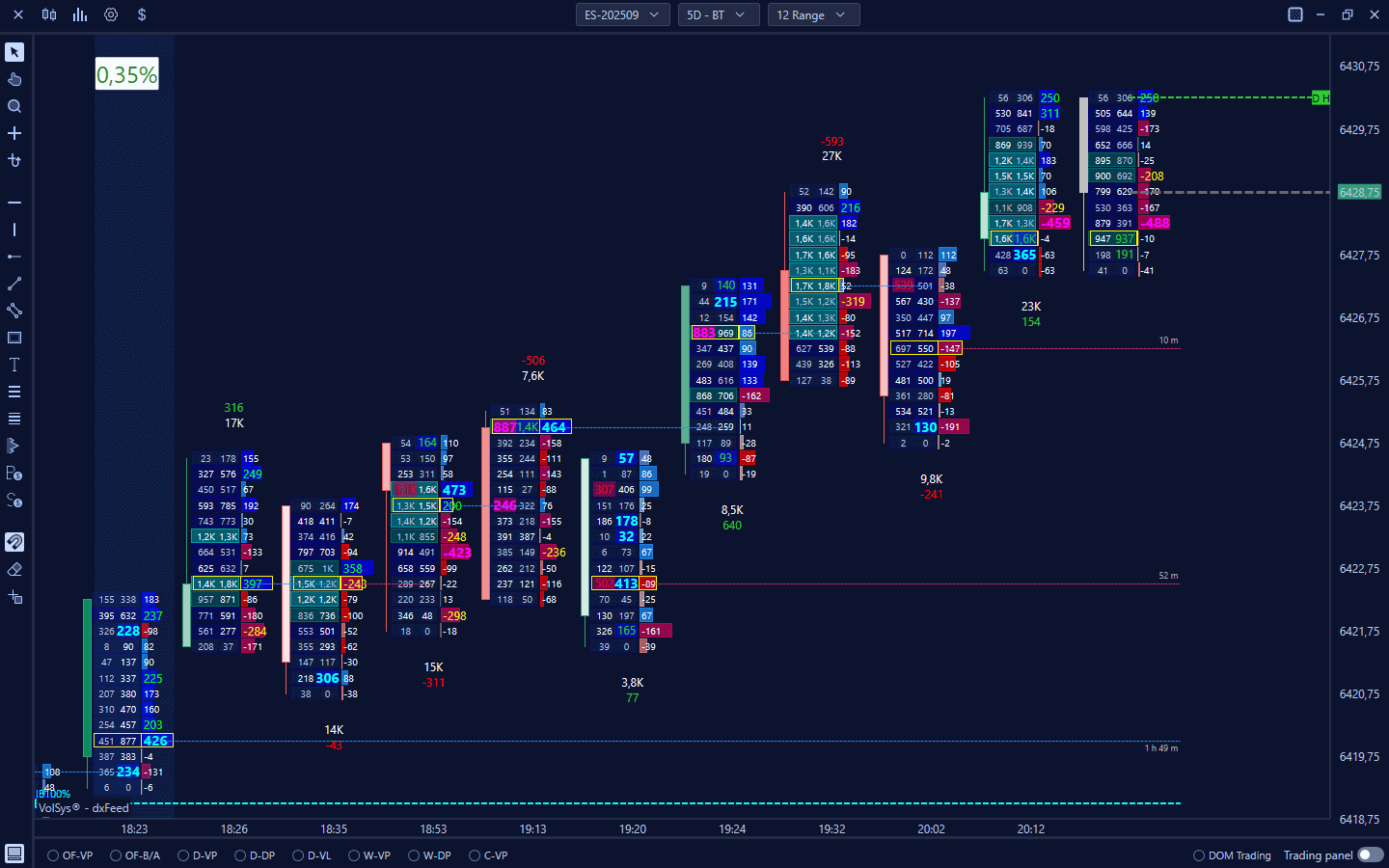

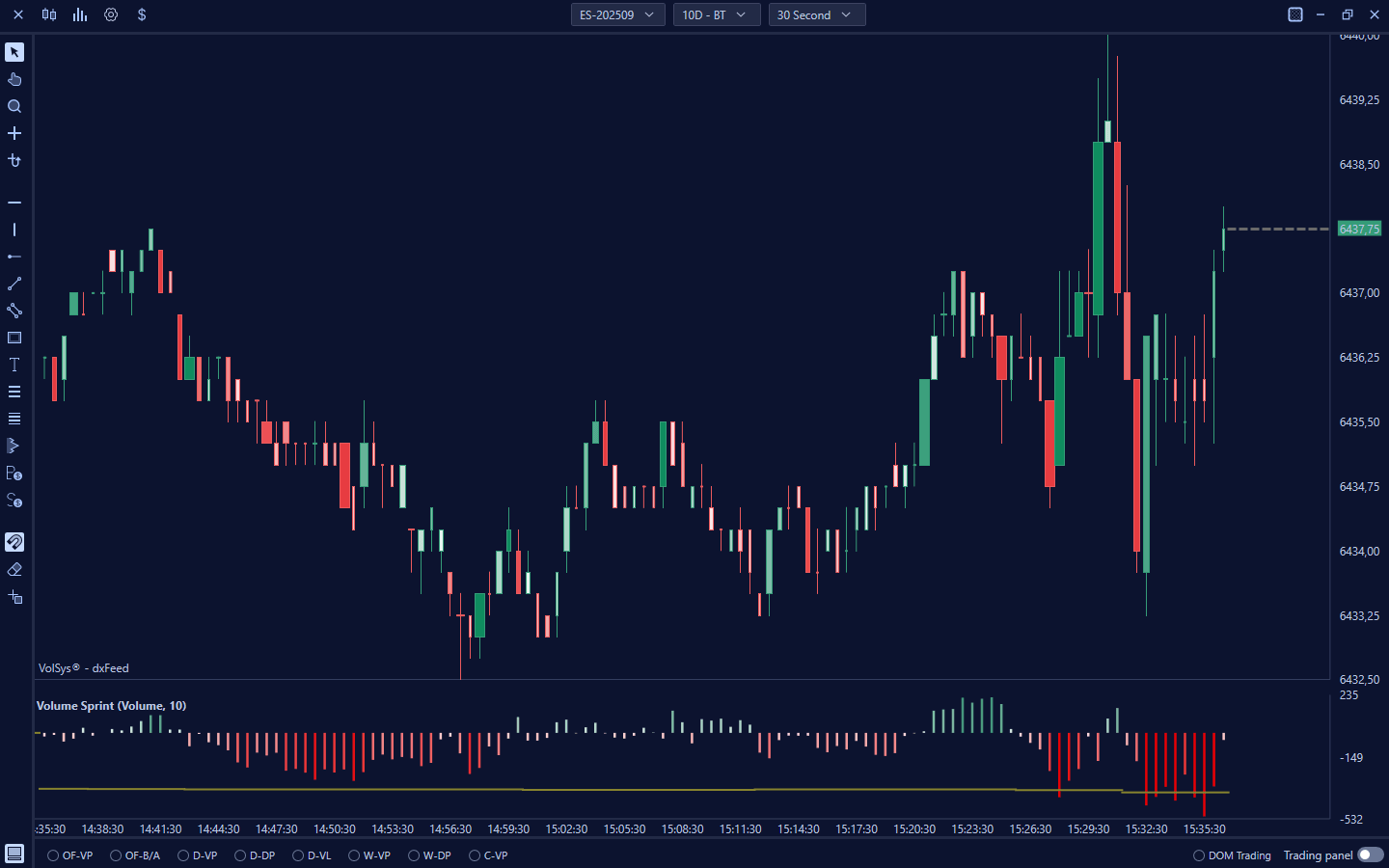

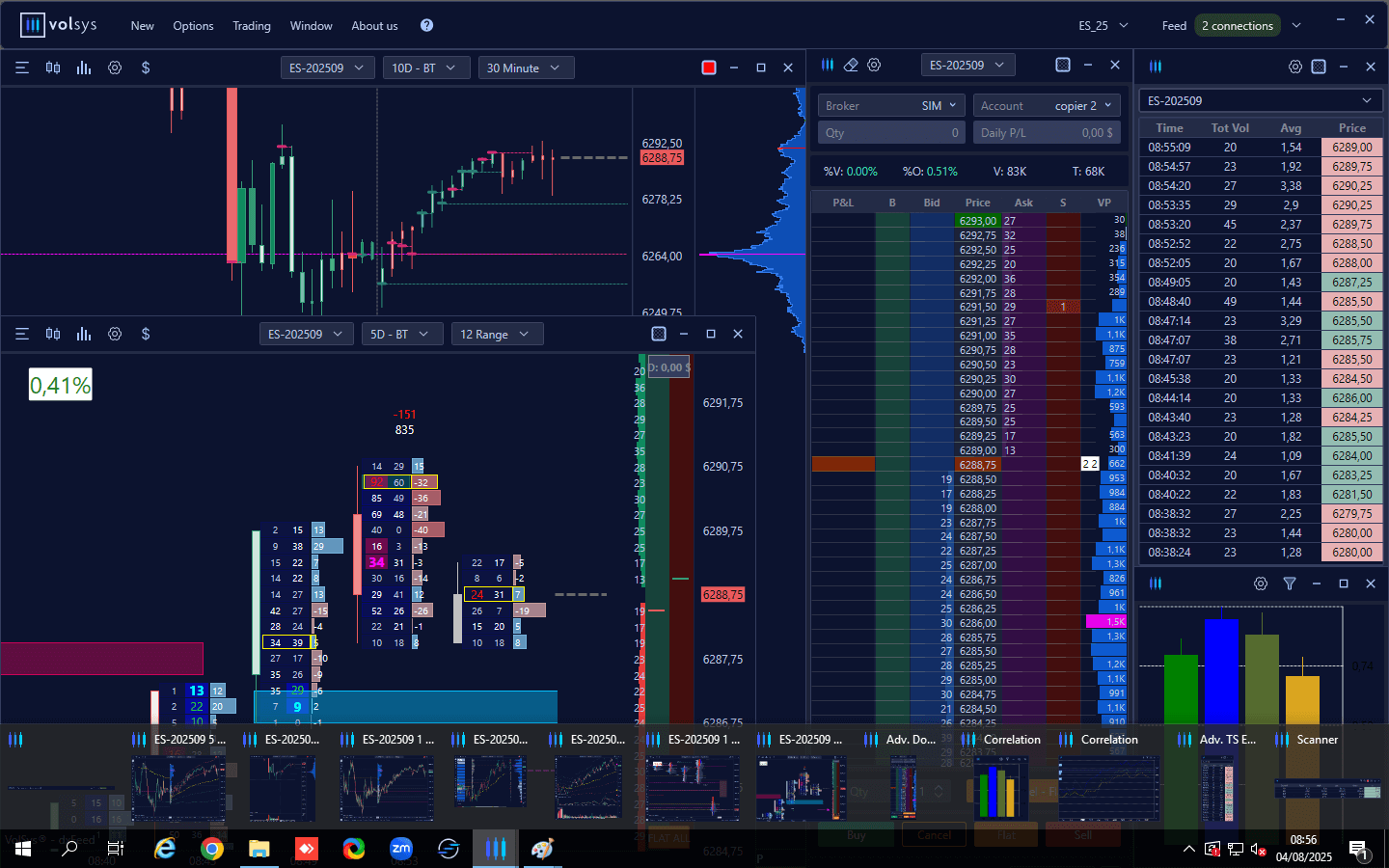

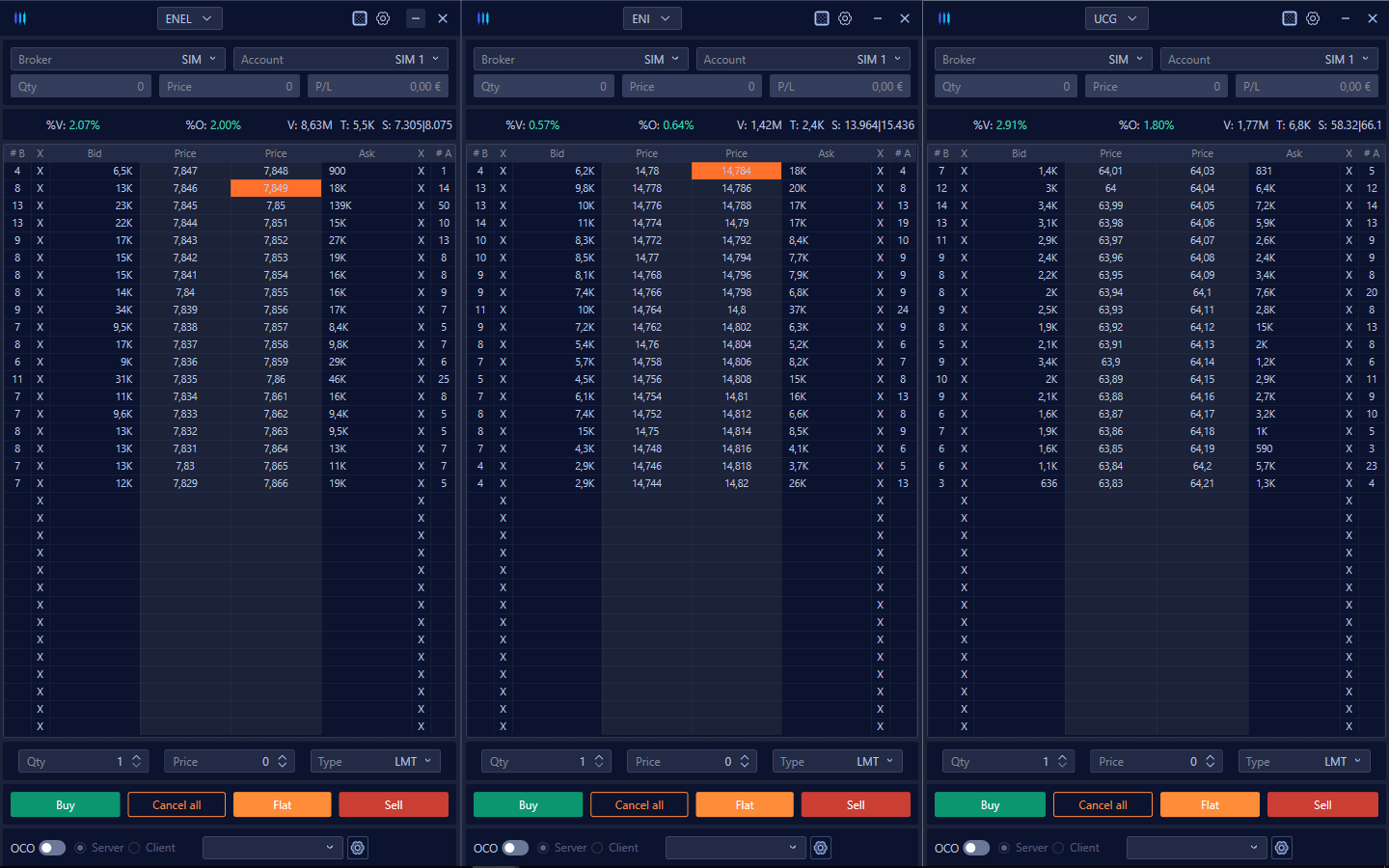

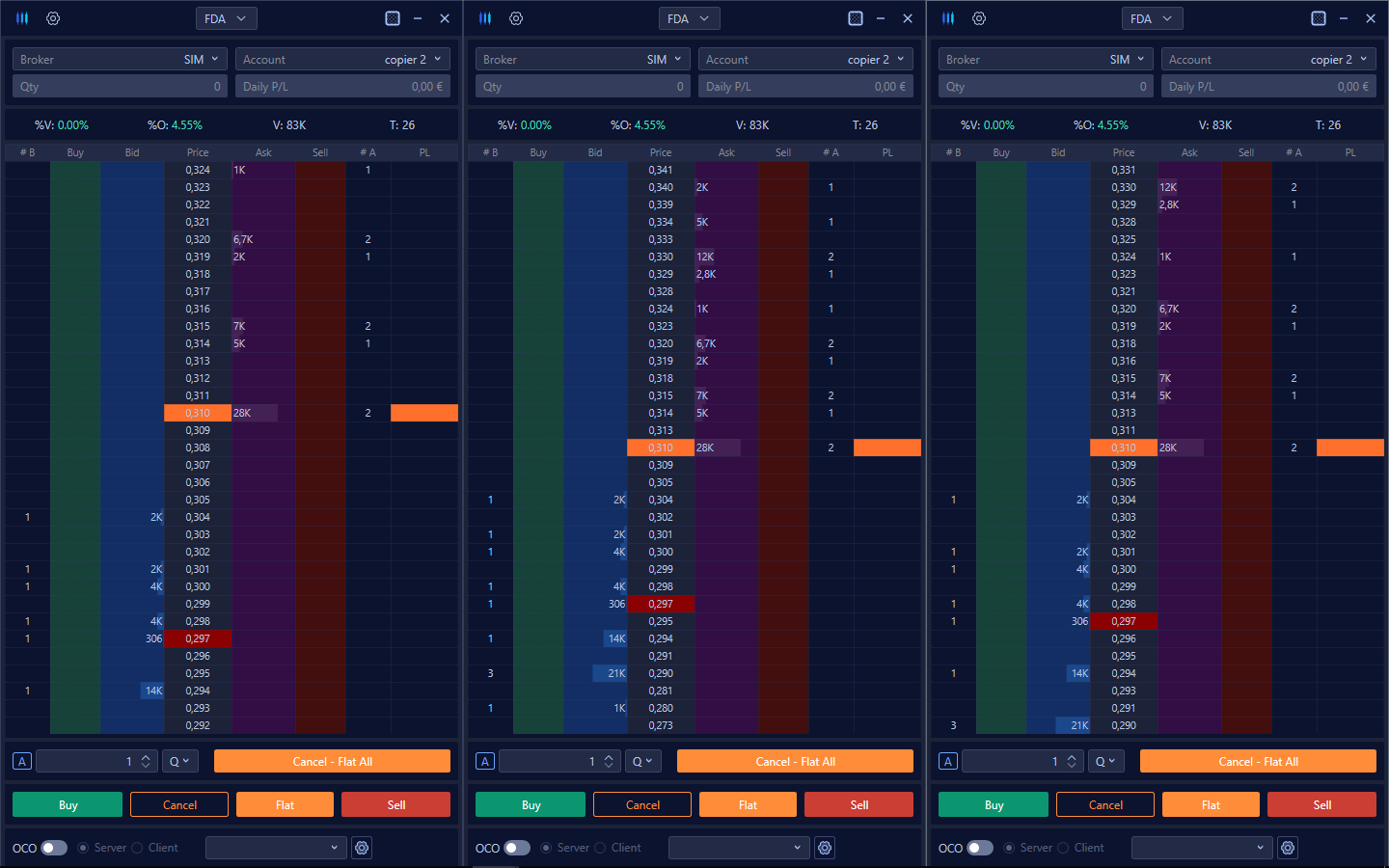

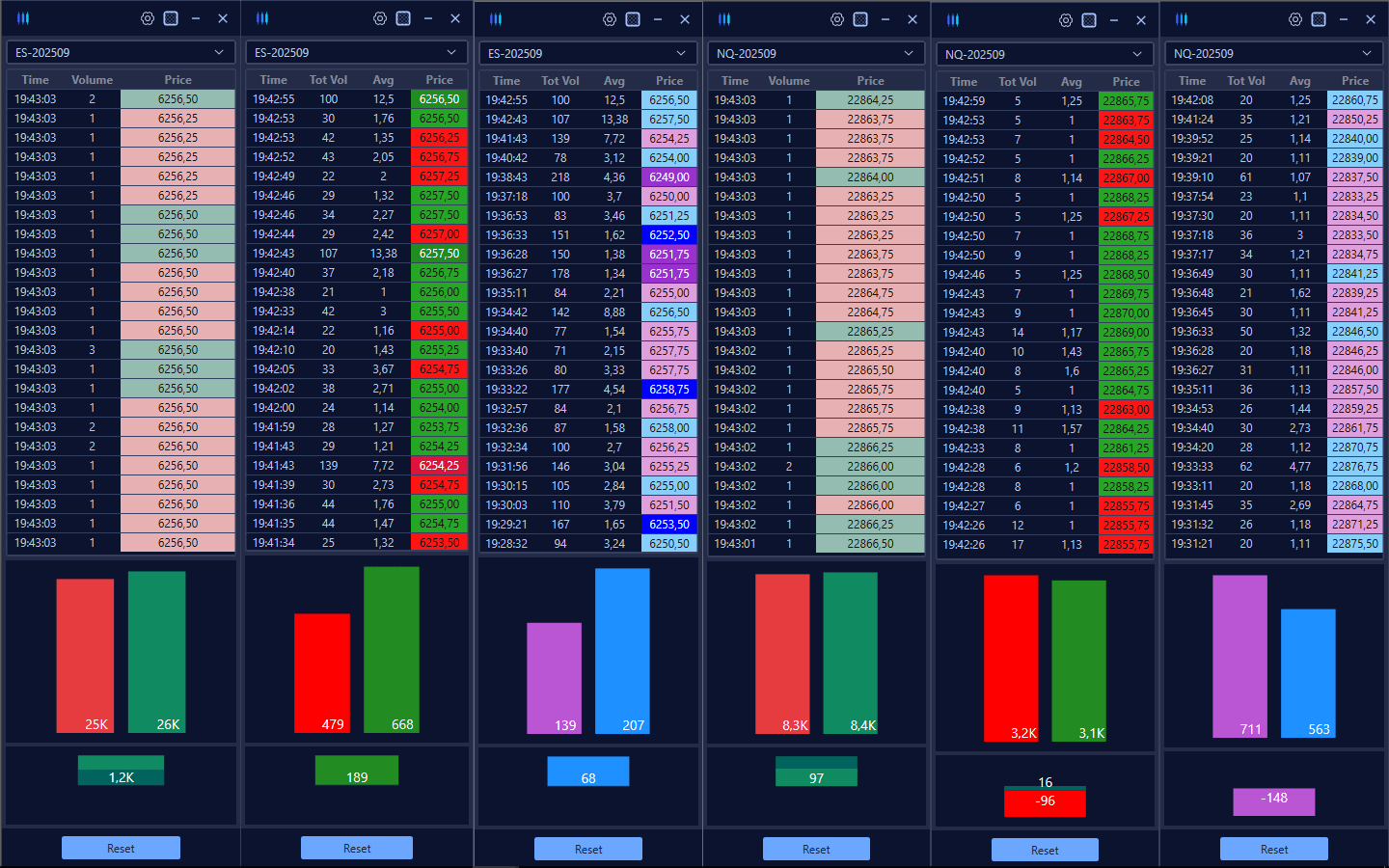

Advanced Time & Sales

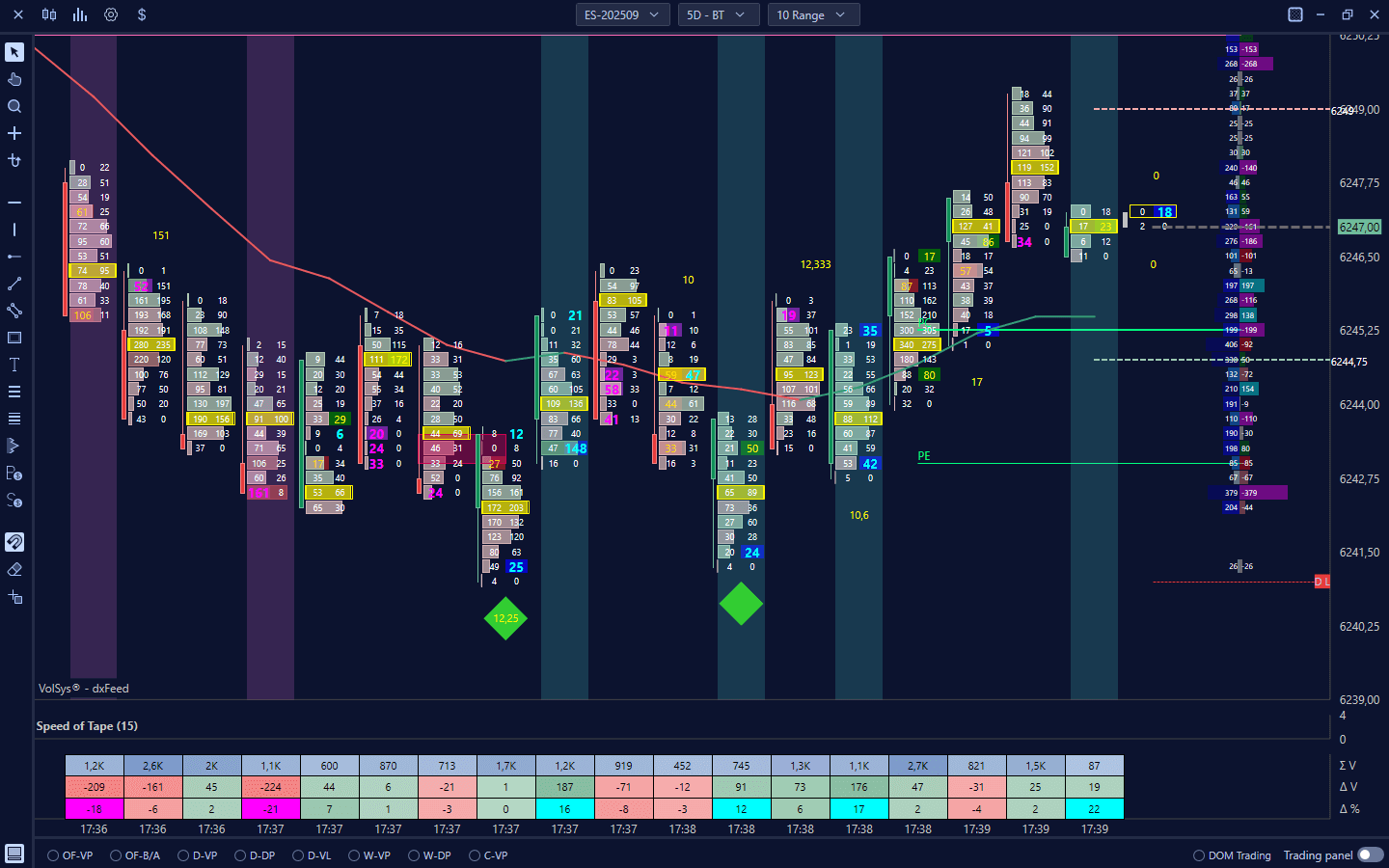

Volbook's Advanced Time & Sales (T&S), also known as Ticker Tape, is a key tool for monitoring real-time execution of market orders. It lists each transaction with timestamp, volume, and execution price.

Color coding is a key aspect:

Red indicates a market sell order that has hit a buy limit order (on the Bid), signaling selling pressure.

Green indicates a market buy order that has hit a sell limit order (on the Ask), highlighting buying pressure.

The Advanced T&S allows you to customize the analysis by filtering out the most relevant orders and triggering sound alerts, improving the interpretation of order flow.

Start now

Color coding is a key aspect:

Red indicates a market sell order that has hit a buy limit order (on the Bid), signaling selling pressure.

Green indicates a market buy order that has hit a sell limit order (on the Ask), highlighting buying pressure.

The Advanced T&S allows you to customize the analysis by filtering out the most relevant orders and triggering sound alerts, improving the interpretation of order flow.

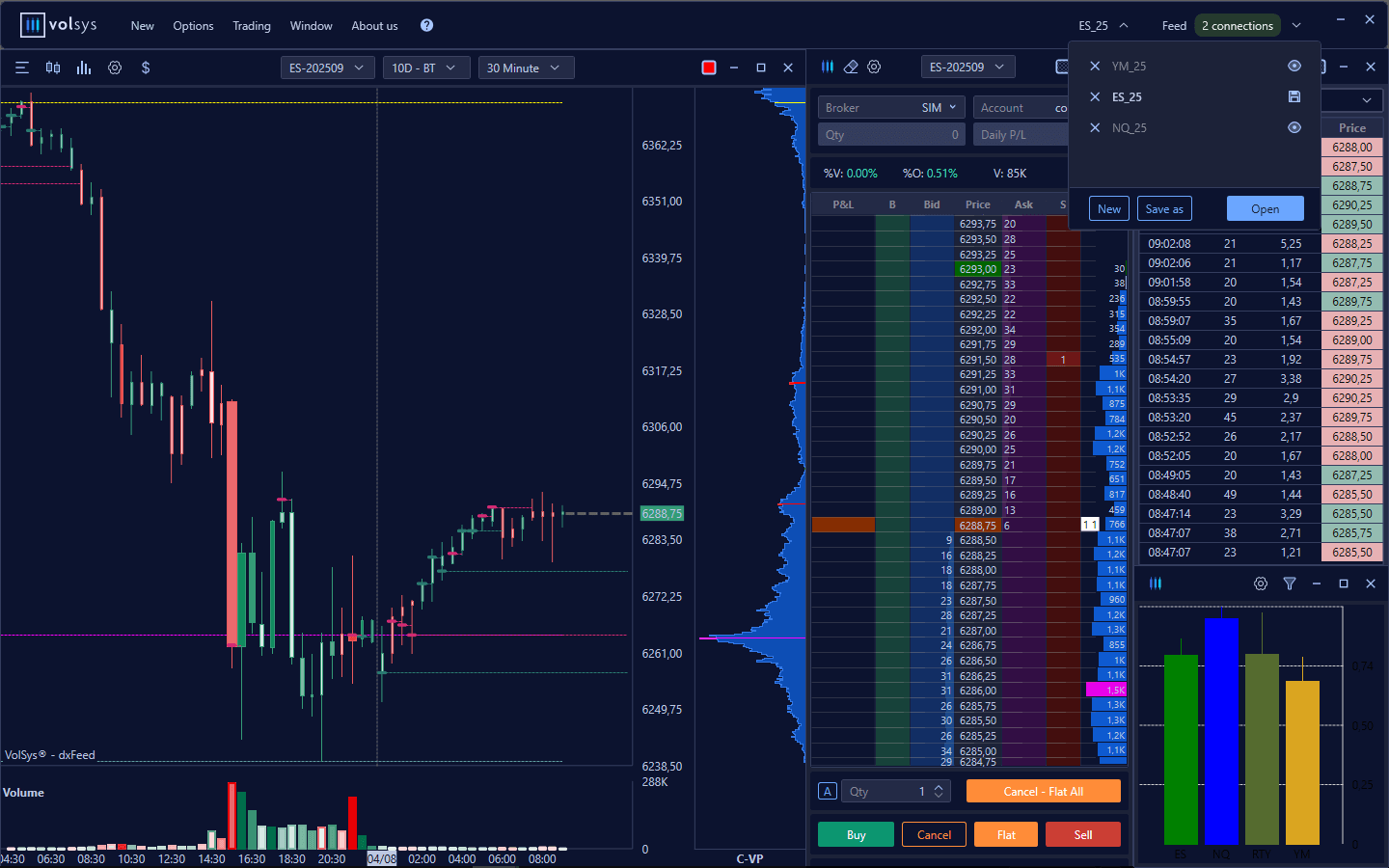

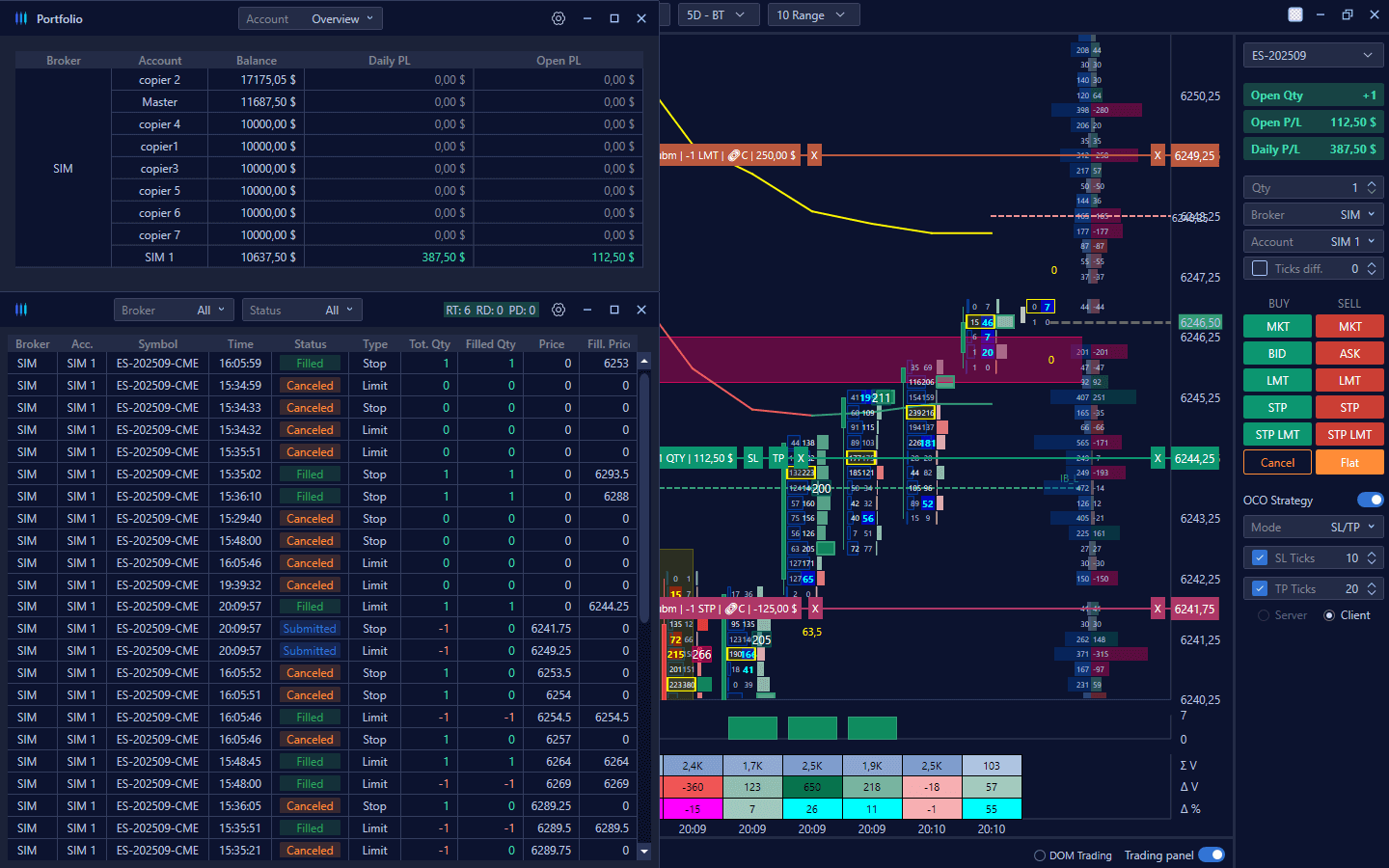

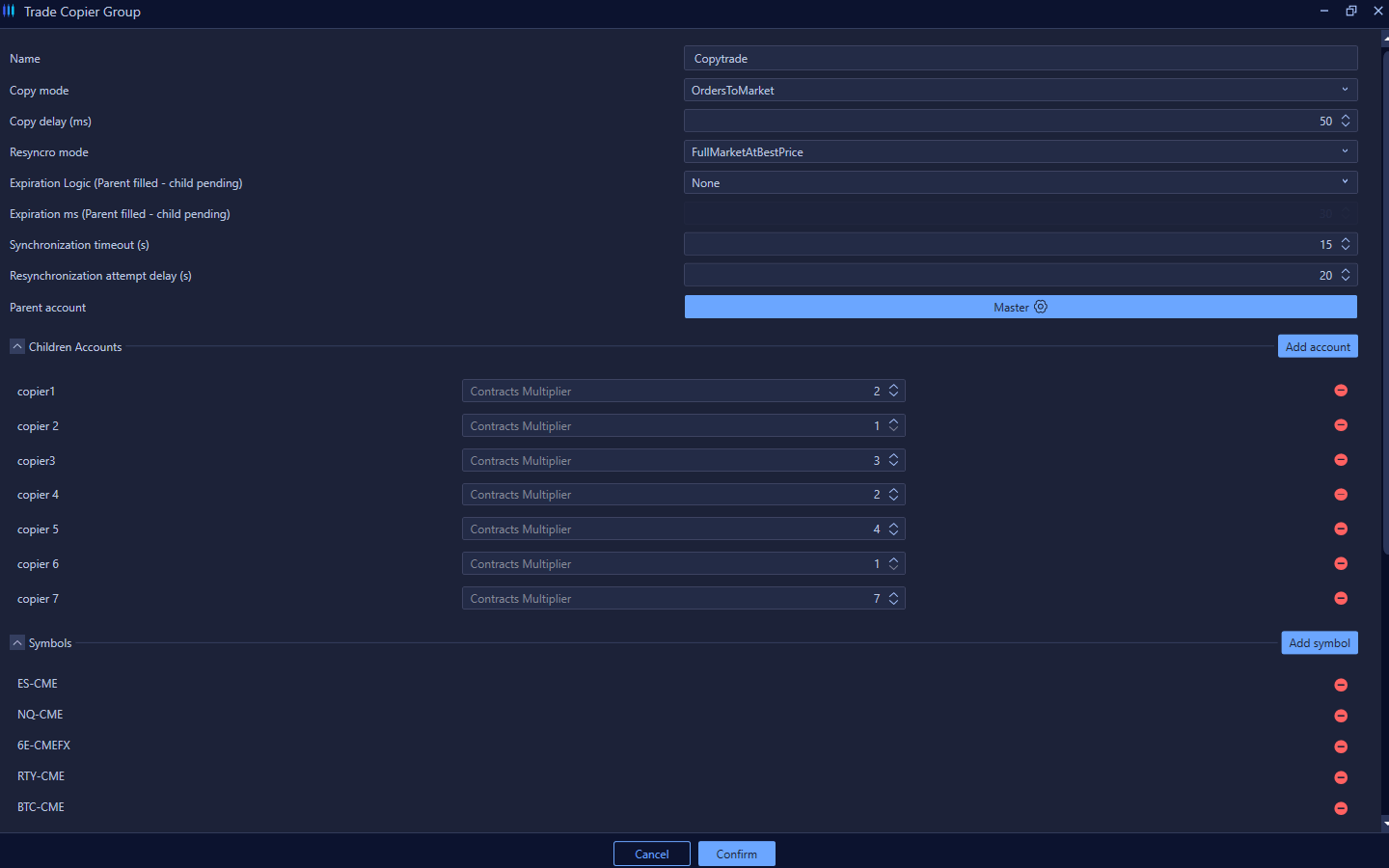

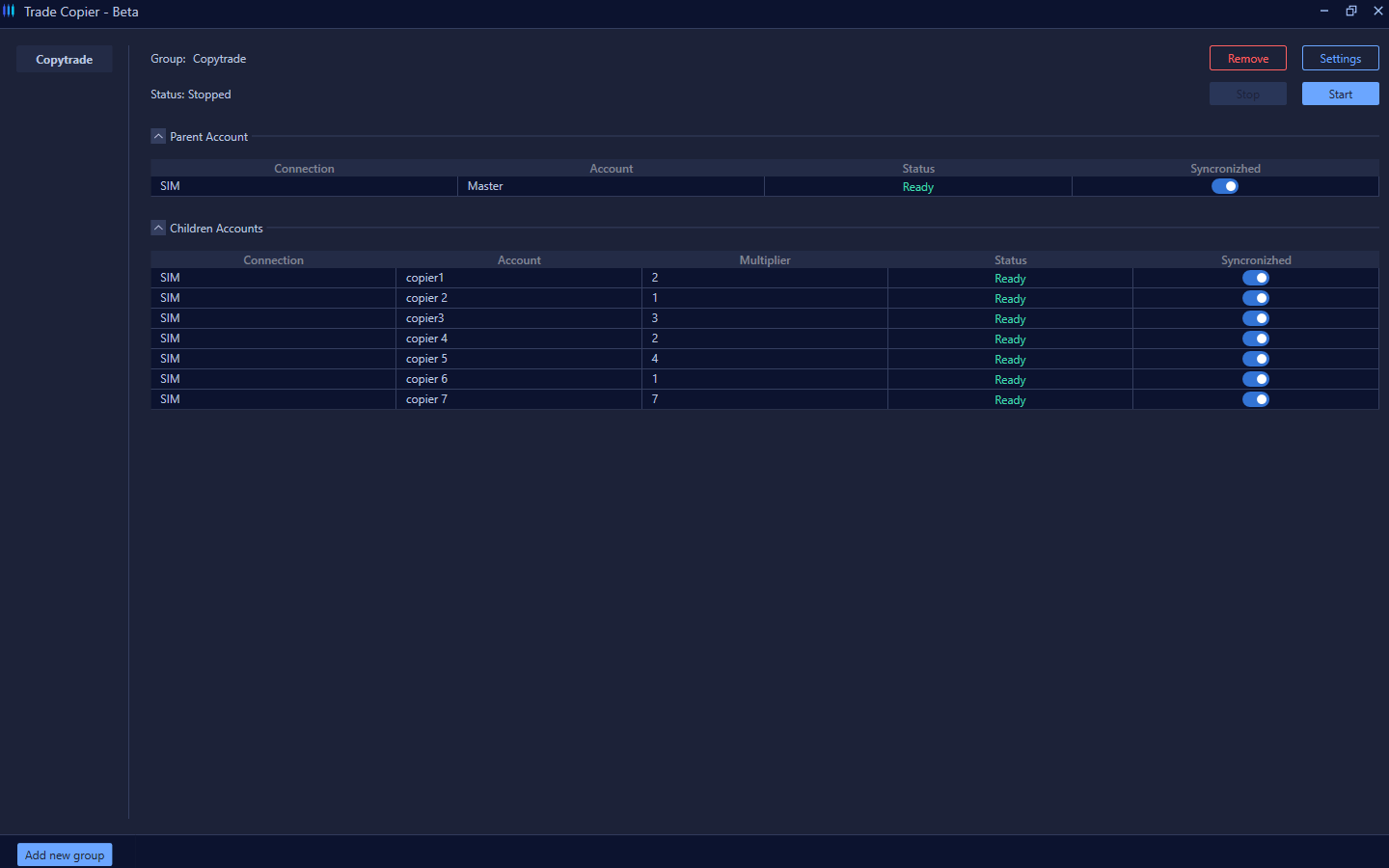

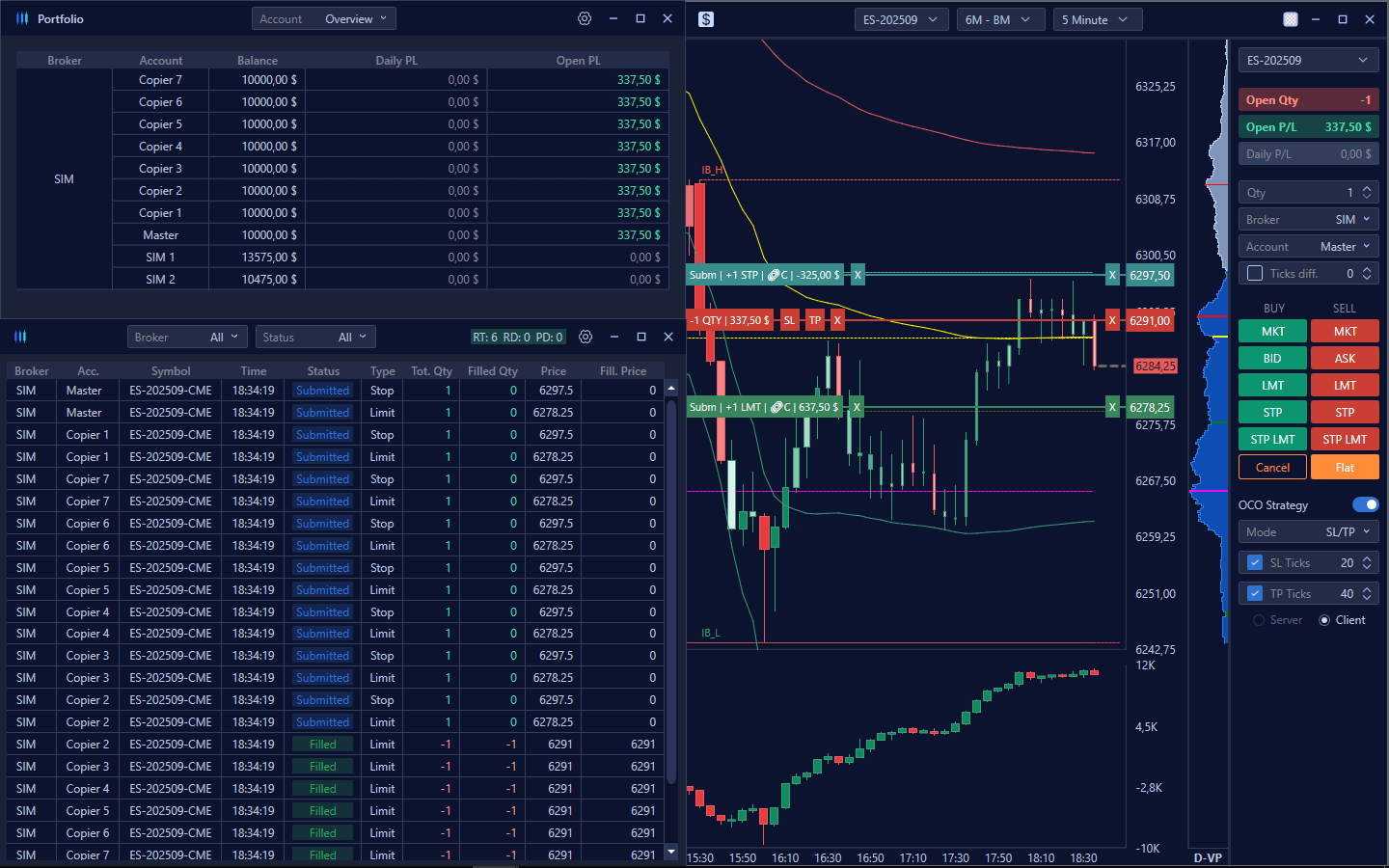

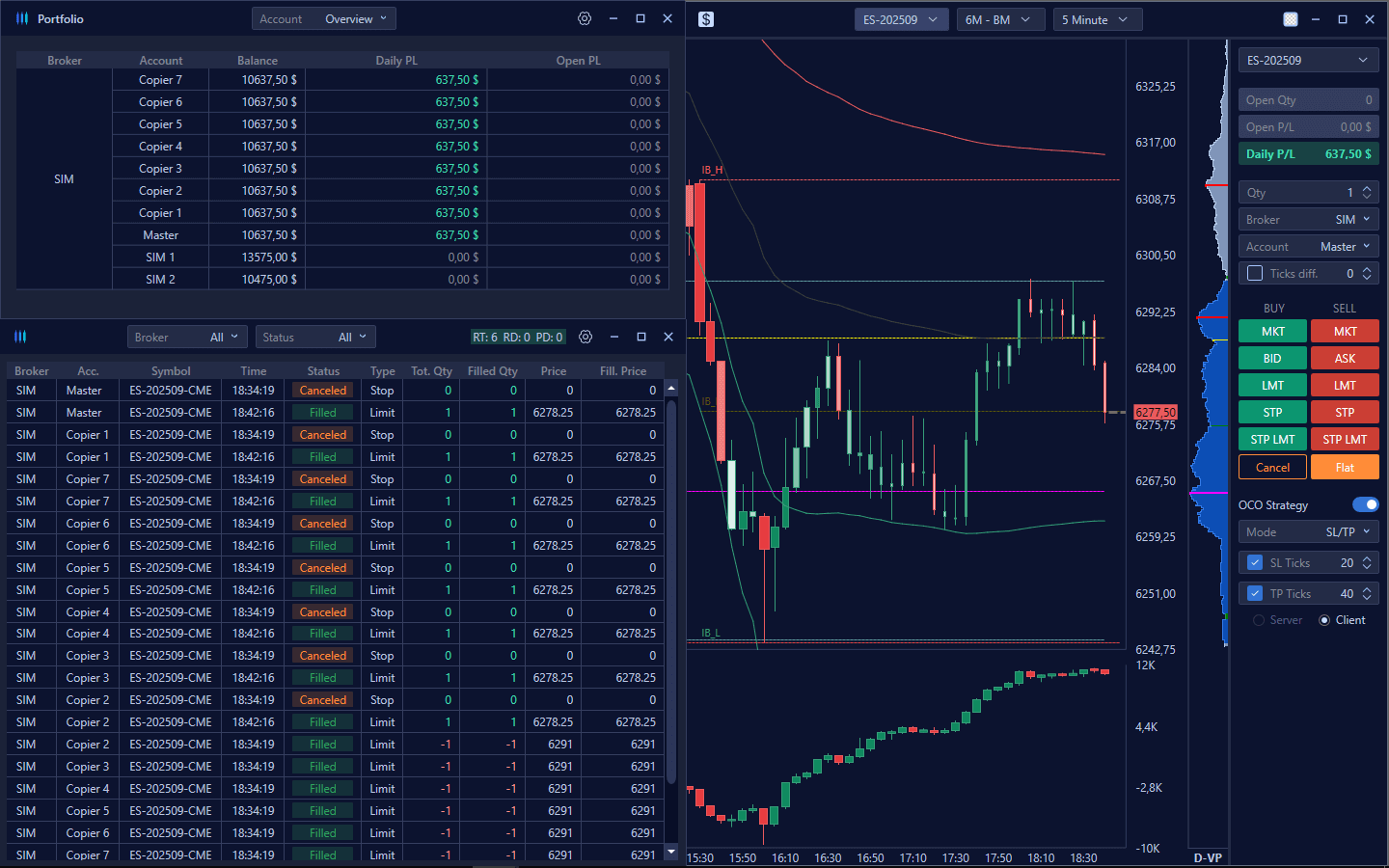

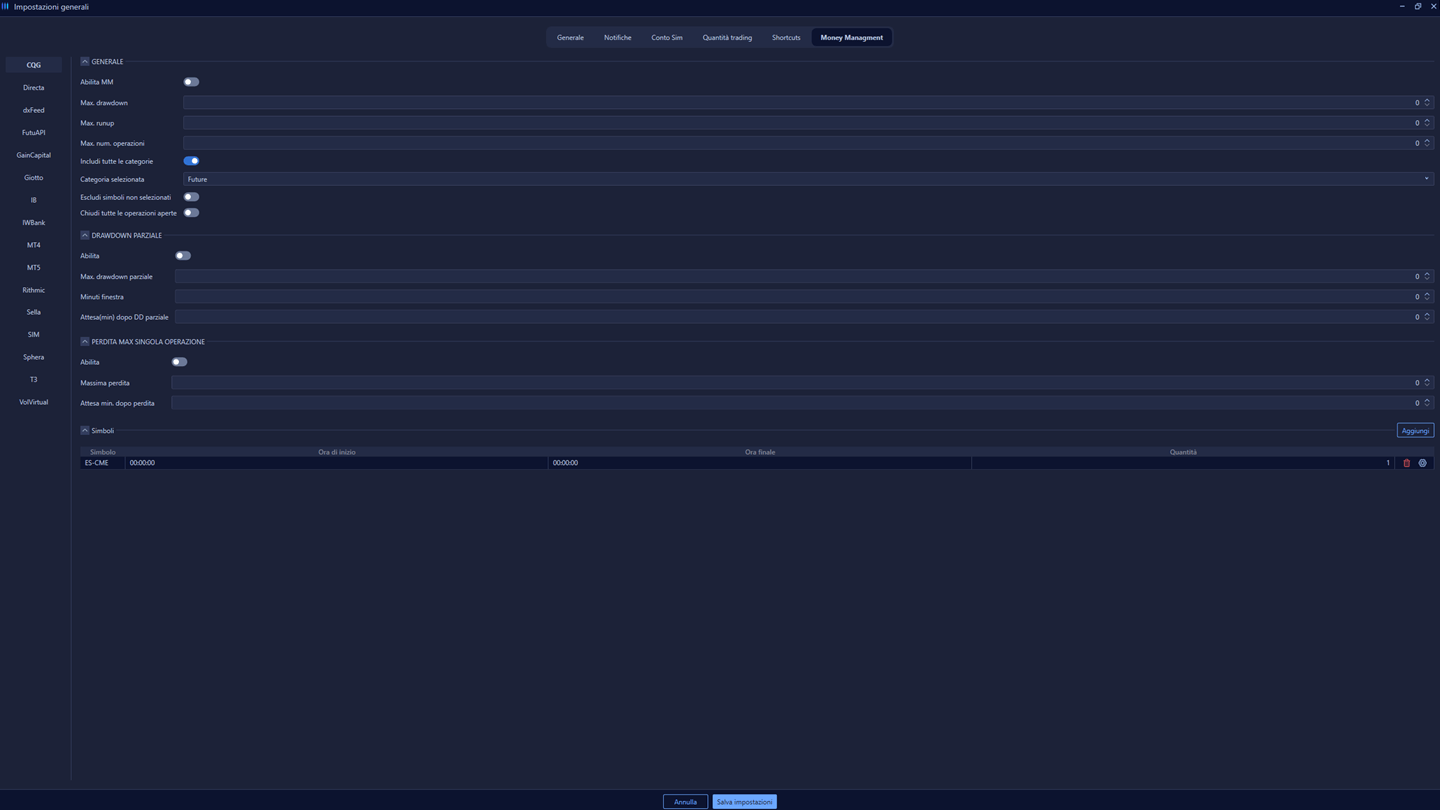

Trade Copier

The Copy Trade feature of our platform allows you to automatically replicate trades made on a main (parent) account to one or more secondary (children) accounts. In this way, one account's trading strategies can be tracked in real time and applied synchronously to other accounts, maintaining operational consistency and saving time in management. One of the most advanced features of the system is the ability to set a multiplier, i.e., a volume multiplier: this allows, for example, to enter the parent account with 1 contract and replicate the same trade in the children accounts with 2, 3 or more contracts, depending on one's desired exposure. In this way, each account can adjust the position size according to its own capital, while still maintaining alignment with the strategy of the parent account.

Start now

Money management and strategy report

Plans

Add Addon

VolAnalyzer

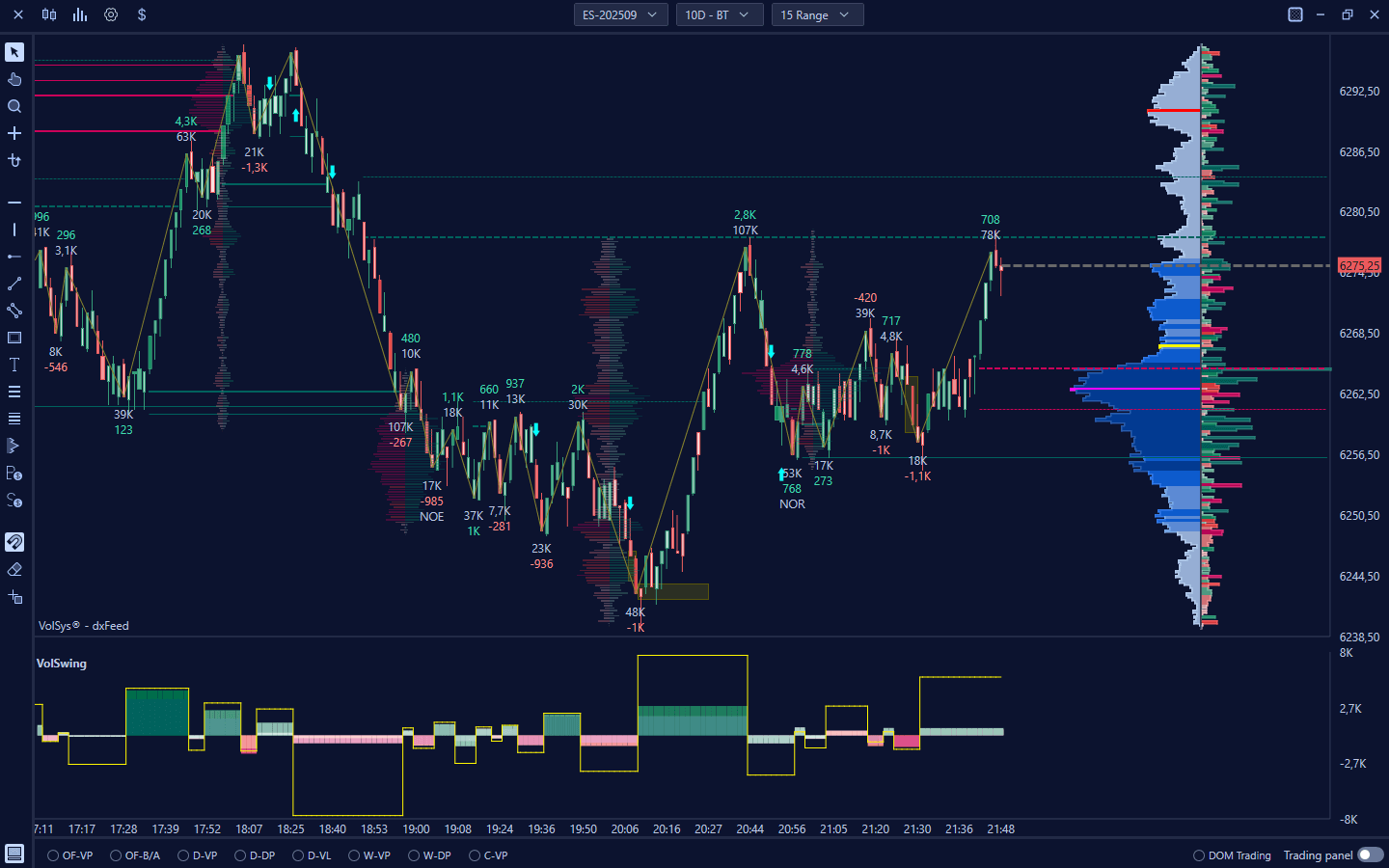

The VolAnalyzer is the ideal suite of proprietary indicators for those new to volume analysis. It simplifies the understanding of market dynamics by providing key information on fundamental volume actions such as Pressures, Absorptions, Accelerations and Exhaustions. A powerful tool for less experienced users, it opens the door to a deeper and more informed reading of the market.

- VolSwing

- VolSignal

- Volume Profile Swing

Frequently asked questions

We understand the desire to try the platform, one of the most frequently asked questions. Our policy of not offering a free trial is based on a desire to protect your training and operational journey. In fact, we provide comprehensive support from the very first installation and configuration, ensuring a smooth and frustration-free start.

The main reason is that volumetric analysis is not a simple crossing of surface indicators, but a discipline that requires in-depth study and solid training. It is a path that begins with the basics, with specific courses, and requires months of dedication and constant practice to form a competent trader. We see trading as a serious profession, where commitment is essential to achieve excellent results, and it is unrealistic to expect quick success without the right dedication.

Although it is different for those already using other platforms or familiar with volume analysis, for consistency we do not split the user-by-user treatment. However, to meet this requirement, we offer the option of taking out a one-month subscription to test our services. In addition, to allow you to familiarize yourself with VolSys, a basic version of VolSys Web is available, allowing you to explore the core functionality and begin to understand our approach to the marketplace. This is complemented by our dedicated support and two V Live sessions per week to give you ongoing help and valuable insights into the market.

The main reason is that volumetric analysis is not a simple crossing of surface indicators, but a discipline that requires in-depth study and solid training. It is a path that begins with the basics, with specific courses, and requires months of dedication and constant practice to form a competent trader. We see trading as a serious profession, where commitment is essential to achieve excellent results, and it is unrealistic to expect quick success without the right dedication.

Although it is different for those already using other platforms or familiar with volume analysis, for consistency we do not split the user-by-user treatment. However, to meet this requirement, we offer the option of taking out a one-month subscription to test our services. In addition, to allow you to familiarize yourself with VolSys, a basic version of VolSys Web is available, allowing you to explore the core functionality and begin to understand our approach to the marketplace. This is complemented by our dedicated support and two V Live sessions per week to give you ongoing help and valuable insights into the market.

At Volumetrica, the choice of data feed is left to your freedom, recognizing that each trader has specific needs and preferences. For this reason, the data feed is not included directly in the platform. However, we have integrated a wide range of native data feeds to give you maximum flexibility. Among them, you have the convenience of purchasing DxFeed and Rithmic directly from your personal area on our site, making the process simple and straightforward.

Our platform also supports connections with other high-quality data providers such as CQG, IQFeed ensuring you access to robust and reliable data feeds. Importantly, you also have the option of using a data feed already provided by your trusted broker, as long as it is compatible with those supported by our platform. This ensures that you can continue to operate with your preferred configurations while maintaining business continuity. For all the specific details on compatibility and how to connect, please consult the dedicated page on our website, where you will find all the information you need to best configure your trading environment.

Our platform also supports connections with other high-quality data providers such as CQG, IQFeed ensuring you access to robust and reliable data feeds. Importantly, you also have the option of using a data feed already provided by your trusted broker, as long as it is compatible with those supported by our platform. This ensures that you can continue to operate with your preferred configurations while maintaining business continuity. For all the specific details on compatibility and how to connect, please consult the dedicated page on our website, where you will find all the information you need to best configure your trading environment.

Your training is the focus of our attention! About 8 hours of video tutorials, designed to guide you step by step in the technical use of the platform, await you within the personal area. From the simple act of opening a chart, to inserting and customizing an indicator, every aspect is clearly explained to get you up and running right away. You no longer have to feel lost when faced with new features: every step is illustrated to ensure a quick and effective learning curve.

But the support doesn't end there! On our site there is a detailed Wiki section, a veritable encyclopedia of technical guides. Here you will find comprehensive explanations, enhanced by texts available in multiple languages and explanatory images, regarding all the functions of our platforms. Whether you prefer to learn by watching a video or consulting a written guide, we have the right resource for you. Our goal is to provide you with all the tools and knowledge you need to make the most of every potential of our platforms, supporting you at every stage of your trading journey.

But the support doesn't end there! On our site there is a detailed Wiki section, a veritable encyclopedia of technical guides. Here you will find comprehensive explanations, enhanced by texts available in multiple languages and explanatory images, regarding all the functions of our platforms. Whether you prefer to learn by watching a video or consulting a written guide, we have the right resource for you. Our goal is to provide you with all the tools and knowledge you need to make the most of every potential of our platforms, supporting you at every stage of your trading journey.

For maximum convenience and flexibility, Volumetrica supports a variety of payment methods, making the process simple and secure for all our customers. You can make your purchases using all major credit cards, ensuring fast and secure transactions. If you prefer the speed and convenience of digital solutions, you can also pay via PayPal, a method widely recognized for its ease of use and security. In addition, for those who prefer traditional methods or need more control over transactions, we also accept bank transfers. This wide choice allows you to select the payment method that best suits your needs and preferences, ensuring a smooth and seamless shopping experience, in full compliance with the highest security standards.

For all our clients, we guarantee a comprehensive and easily accessible technical support service, available via email and chat, including popular platforms such as WhatsApp and Telegram. We are operational from Monday to Friday, with dedicated hours to cover different time zone needs: in the morning from 8:30 a.m. to 12:30 p.m. CEST (which corresponds to 02:30 a.m. to 06:30 a.m. EST) and in the afternoon from 2 p.m. to 6 p.m. CEST (i.e. 8 a.m. to 12 p.m. EST).

In addition to chat support, for more complex issues or those requiring direct intervention, we offer the possibility of support via remote connection with Anydesk, allowing us to intervene directly on your system in a safe and efficient manner. This mode is particularly useful for troubleshooting technical faults or detailed configurations. For even more specific needs or customized in-depth sessions, calls can also be arranged on Zoom, ensuring you receive support tailored to your needs. Our goal is to ensure that you always have the help you need to operate our platforms at their best, minimizing disruptions and maximizing your uptime.

In addition to chat support, for more complex issues or those requiring direct intervention, we offer the possibility of support via remote connection with Anydesk, allowing us to intervene directly on your system in a safe and efficient manner. This mode is particularly useful for troubleshooting technical faults or detailed configurations. For even more specific needs or customized in-depth sessions, calls can also be arranged on Zoom, ensuring you receive support tailored to your needs. Our goal is to ensure that you always have the help you need to operate our platforms at their best, minimizing disruptions and maximizing your uptime.

The Vol Analyzer represents a suite of proprietary indicators specifically developed to make volume analysis accessible to even the most inexperienced users, providing a clear and intuitive understanding of the key volumetric actions that move the market. This powerful tool will guide you in deciphering fundamental concepts such as Pressures (indicating the dominant aggressiveness of buyers or sellers), Absorptions (when one side absorbs the aggressiveness of the other, preventing price from moving), Accelerations (rapid price movements accompanied by increasing volumes), and Exhaustions (signs of weakening of an ongoing trend).

Thanks to the Vol Analyzer, you can begin to read the market not just in terms of price, but by understanding the underlying forces that influence it, gaining crucial awareness to make more informed trading decisions. It is the ideal tool for building your foundation in volumetric analysis, turning complex data into clear, actionable information. To delve further into the features and discover how Vol Analyzer can revolutionize your approach to trading, please visit the dedicated section on our website, where you will find all the information you need to take full advantage of its potential.

Thanks to the Vol Analyzer, you can begin to read the market not just in terms of price, but by understanding the underlying forces that influence it, gaining crucial awareness to make more informed trading decisions. It is the ideal tool for building your foundation in volumetric analysis, turning complex data into clear, actionable information. To delve further into the features and discover how Vol Analyzer can revolutionize your approach to trading, please visit the dedicated section on our website, where you will find all the information you need to take full advantage of its potential.

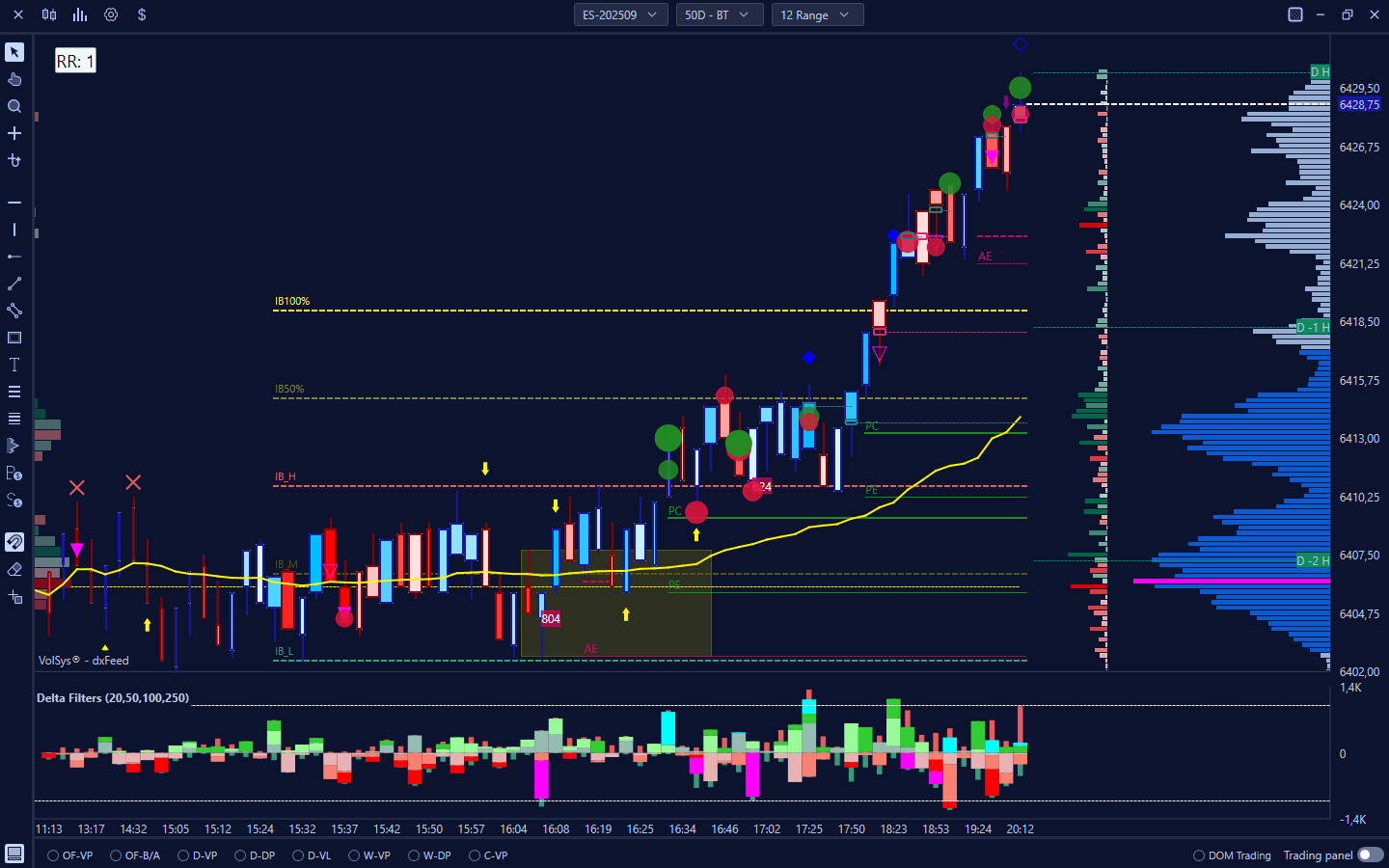

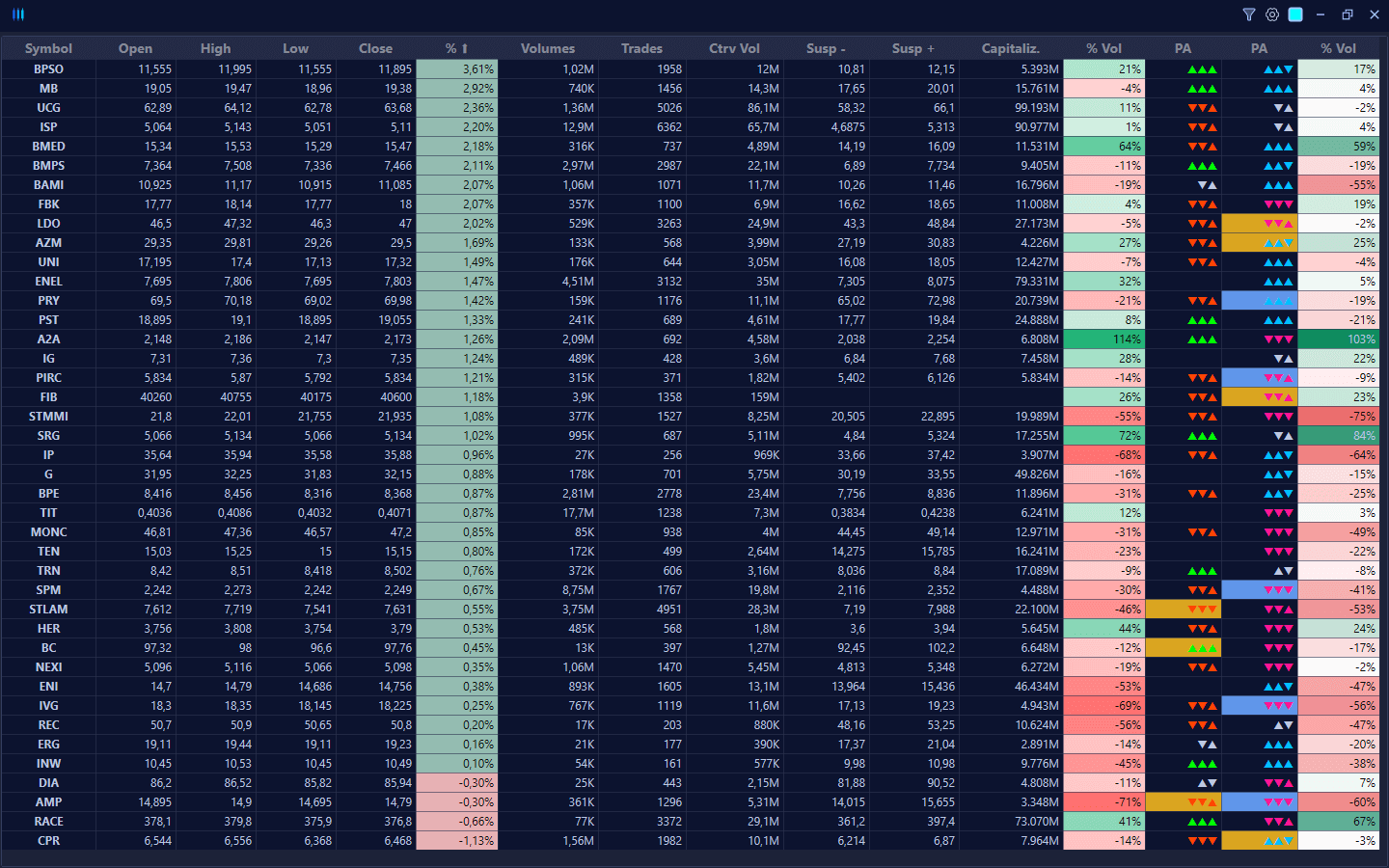

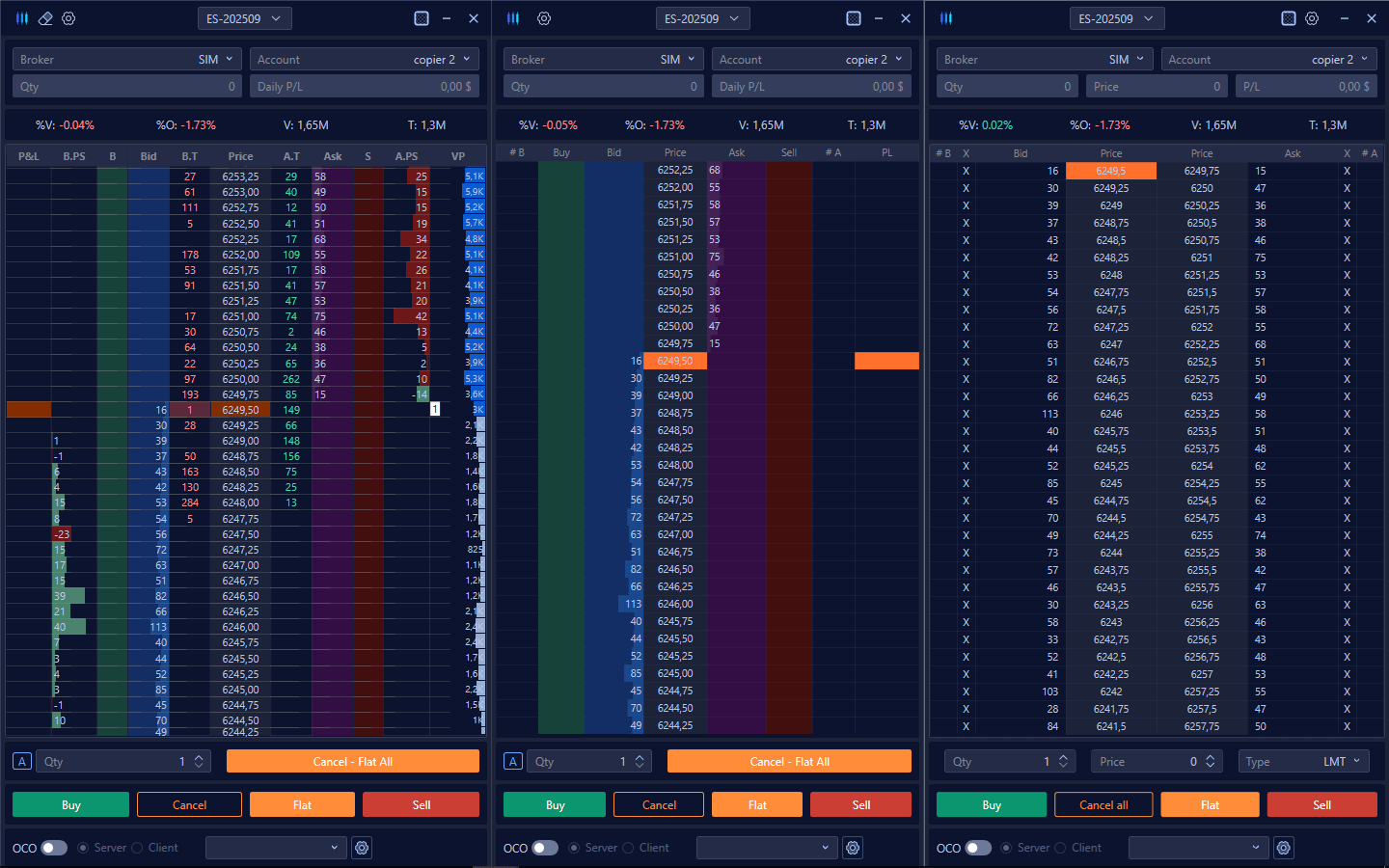

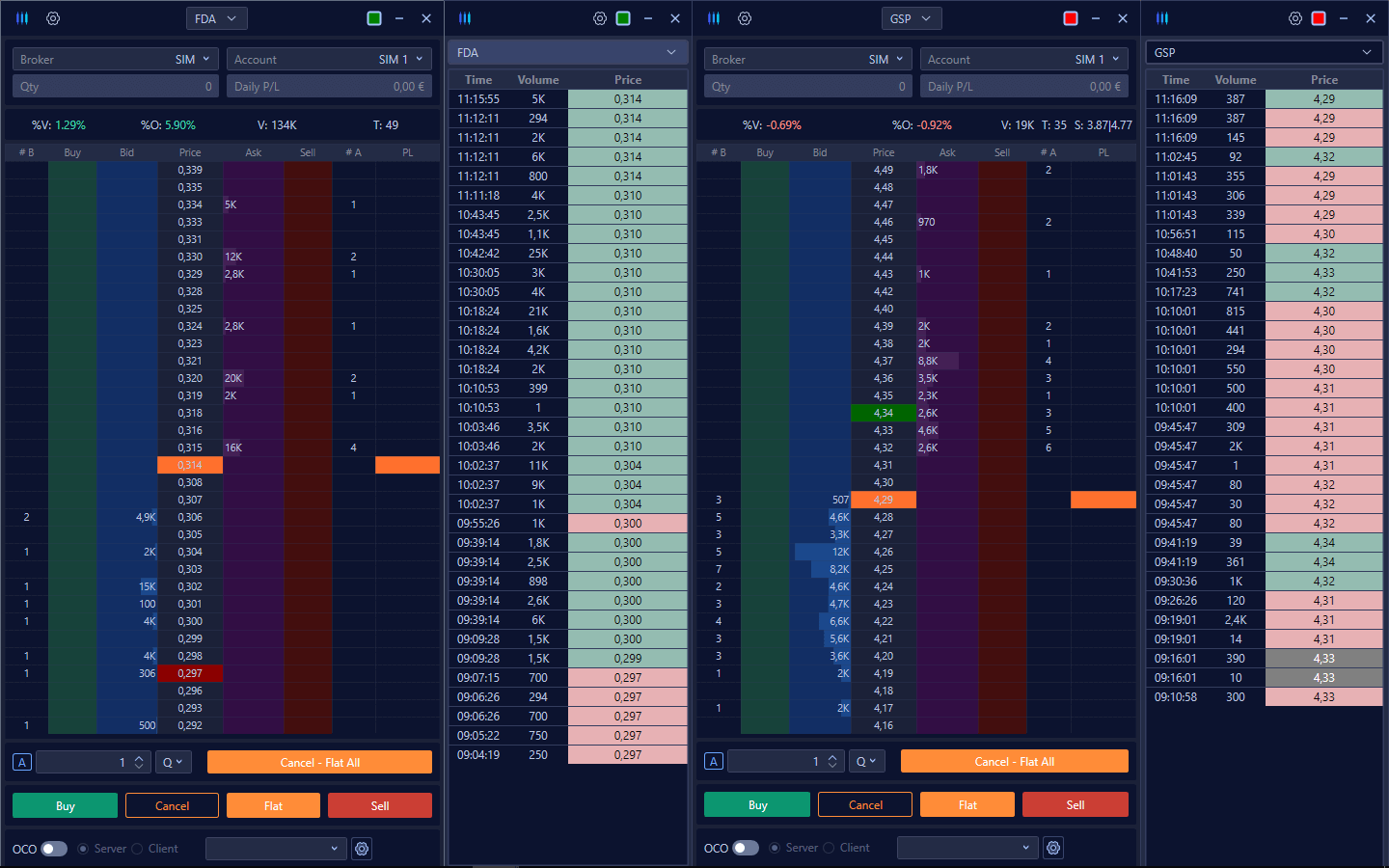

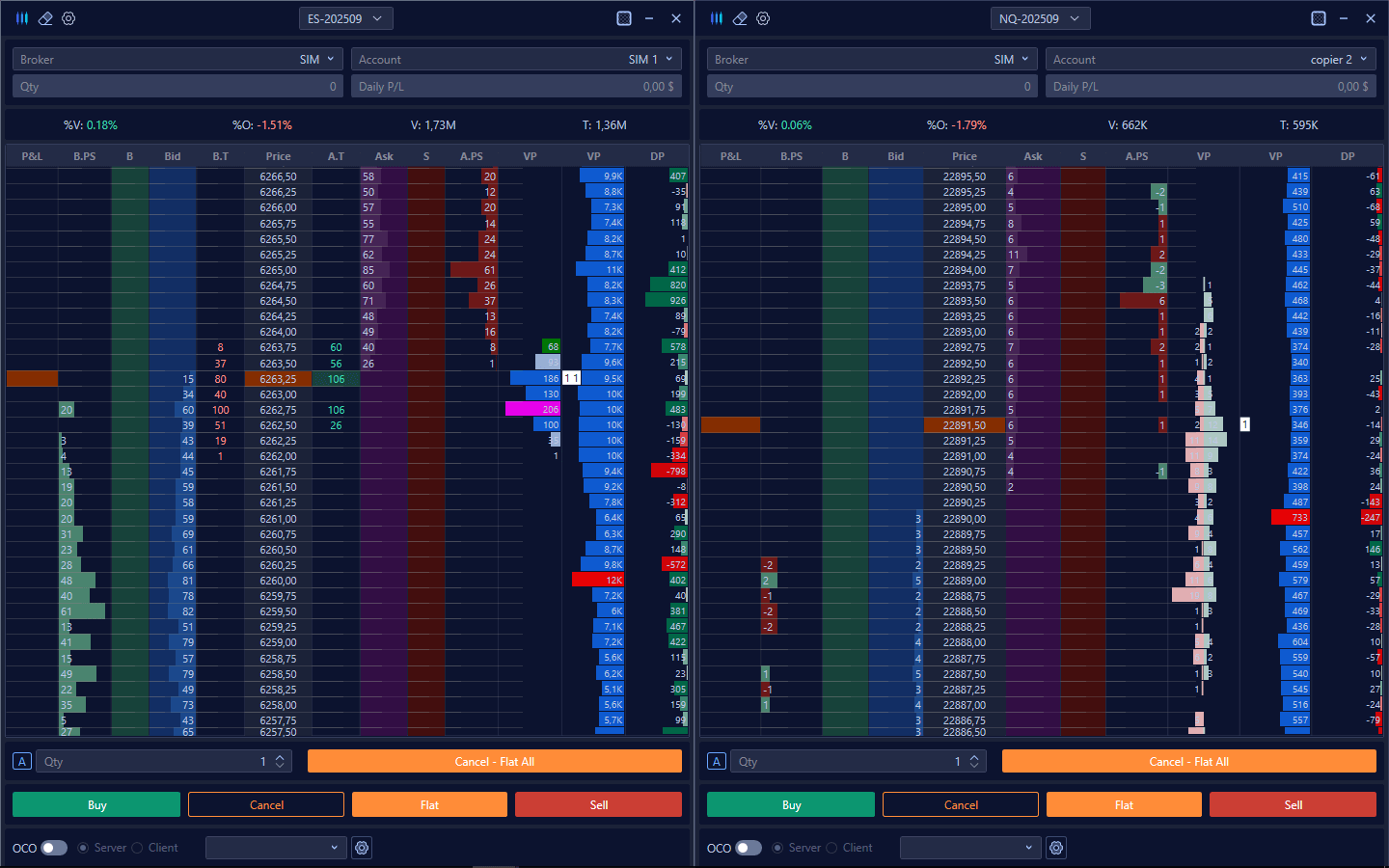

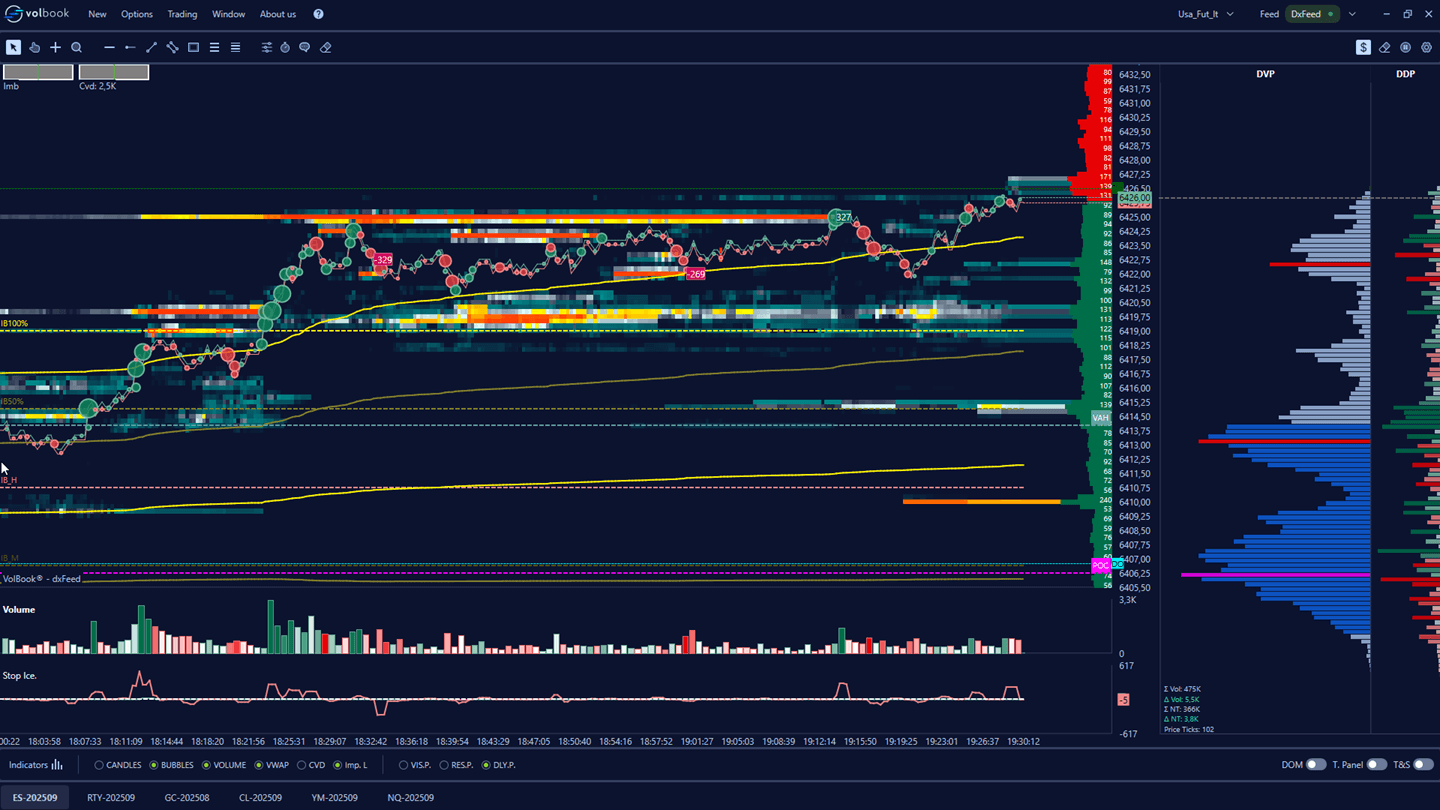

VolBook: The platform that reveals the hidden secrets of the market to you!

VolBook® is a professional volumetric trading platform and offers an innovative way to visualize and analyze market depth, level 2, without neglecting the study of level 1.we made a tremendous effort to build a lightweight, clear and functional proprietary heatmap.

Discover VolBook

Do you want to know more?

If you would like more information about our services, please write to us leaving your email or phone number. We will be happy to contact you as soon as possible.

Contact us